Answered step by step

Verified Expert Solution

Question

1 Approved Answer

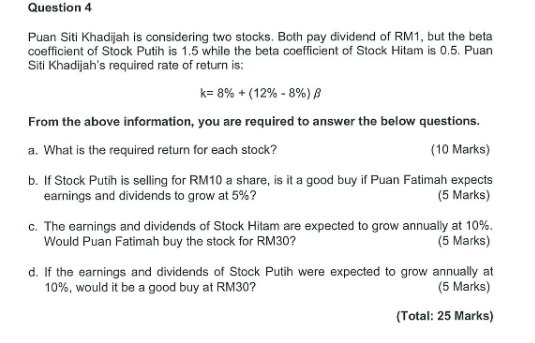

Question 4 Puan Siti Khadijah is considering two stocks. Both pay dividend of RM1, but the beta coefficient of Stock Putih is 1.5 while

Question 4 Puan Siti Khadijah is considering two stocks. Both pay dividend of RM1, but the beta coefficient of Stock Putih is 1.5 while the beta coefficient of Stock Hitam is 0.5. Puan Siti Khadijah's required rate of return is: k=8% +(12%-8%) B From the above information, you are required to answer the below questions. a. What is the required return for each stock? (10 Marks) b. If Stock Putih is selling for RM10 a share, is it a good buy if Puan Fatimah expects earnings and dividends to grow at 5%? (5 Marks) c. The earnings and dividends of Stock Hitam are expected to grow annually at 10%. Would Puan Fatimah buy the stock for RM30? (5 Marks) d. If the earnings and dividends of Stock Putih were expected to grow annually at 10%, would it be a good buy at RM30? (5 Marks) (Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions well follow the provided formula for required rate of return k 8 12 8beta a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started