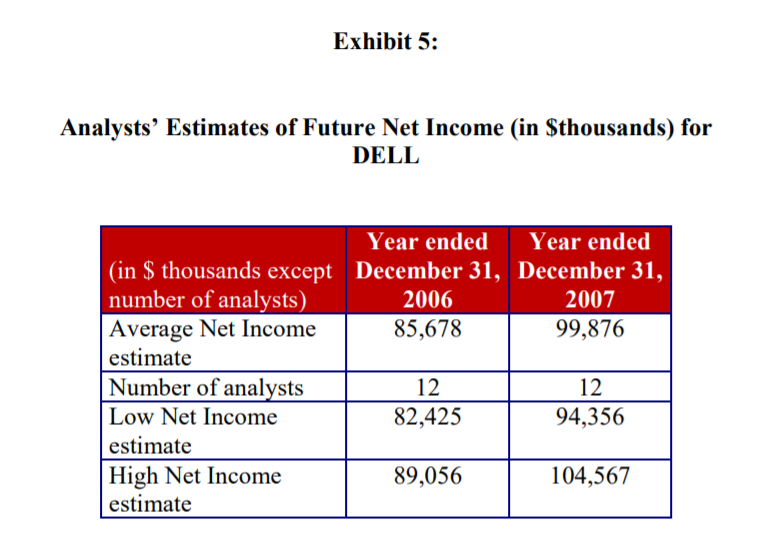

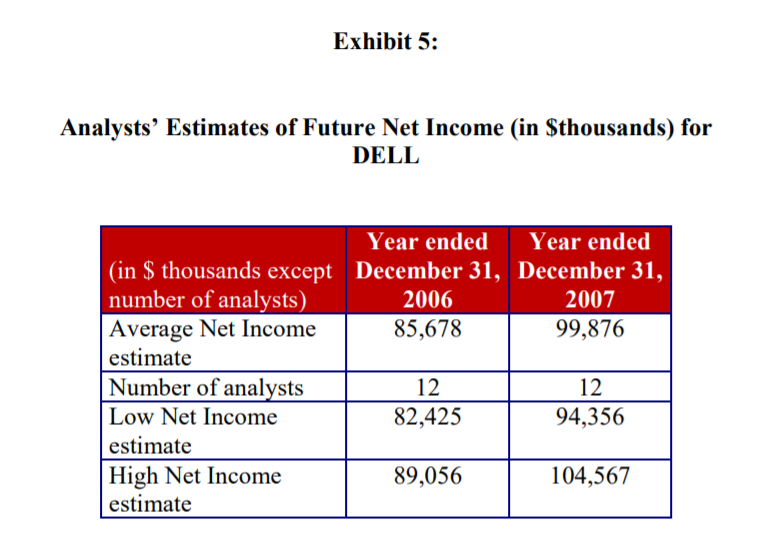

QUESTION 4: Q4a: Using the analysts' estimates of future average net income in Exhibit 5, calculate the intrinsic value of equity per share in DELL as at 1 January, 2006 using only the abnormal earnings (residual income) valuation method. Ignore any of the adjustments you have made in question 3 above. Use the following assumptions: 1. Net income rises by 25% in the year ended 31 December, 2008. 2. DELL plans to pay dividends of $22 million in the year ended 31 December, 2006 and $24 million in the year ended 31 December, 2007. No dividends are proposed in future years. 3. DELL plans to repurchase ordinary shares for $20 million in the year ended 31 December, 2006 and for $15 million in the year ended 31 December, 2007. No further repurchases are planned in future years. 4. Items 2 and 3 above and net income each year account for all changes in the book value of shareholders' equity each year. 5. Beyond 31 December, 2008, abnormal earnings are expected to grow at 3% per year indefinitely. 6. The equity beta for DELL on 1 January, 2006 is 0.84. 7. The market risk premium on 1 January, 2006 is 6% and the risk free rate is 2% on the same date. 8. Number of ordinary (common) shares in issue at 31 December, 2005 is 16,528,000 (note that this is the total figure - the figure in thousands is 16,528). Note Based only on the information in Q4a above, you are first expected to prepare a forecast of items needed for the abnormal earnings (residual income) valuation method, and then apply this method to estimate DELL's value. You should undertake your calculations in thousands of dollars as this is how the figures in Exhibits 2 to 5 are specified (i.e., in thousands of dollars). Show all the calculation steps. (39 marks) Q4b: One of the key assumptions underpinning the abnormal earnings (residual income) valuation method is that the 'clean-surplus relation' holds. (i) Explain what is meant by the 'clean surplus relation'. (4 marks) (ii) Does DELL's accounting violate the 'clean-surplus relation'? If it does, indicate where in Exhibits 3 to 4 this is evident. (3 marks) Exhibit 5: Analysts' Estimates of Future Net Income (in $thousands) for DELL Year ended Year ended December 31, 2006 December 31, 2007 (in $ thousands except number of analysts) Average Net Income estimate 85,678 99,876 Number of analysts 12 12 Low Net Income 82,425 94,356 estimate High Net Income 89,056 104,567 estimate QUESTION 4: Q4a: Using the analysts' estimates of future average net income in Exhibit 5, calculate the intrinsic value of equity per share in DELL as at 1 January, 2006 using only the abnormal earnings (residual income) valuation method. Ignore any of the adjustments you have made in question 3 above. Use the following assumptions: 1. Net income rises by 25% in the year ended 31 December, 2008. 2. DELL plans to pay dividends of $22 million in the year ended 31 December, 2006 and $24 million in the year ended 31 December, 2007. No dividends are proposed in future years. 3. DELL plans to repurchase ordinary shares for $20 million in the year ended 31 December, 2006 and for $15 million in the year ended 31 December, 2007. No further repurchases are planned in future years. 4. Items 2 and 3 above and net income each year account for all changes in the book value of shareholders' equity each year. 5. Beyond 31 December, 2008, abnormal earnings are expected to grow at 3% per year indefinitely. 6. The equity beta for DELL on 1 January, 2006 is 0.84. 7. The market risk premium on 1 January, 2006 is 6% and the risk free rate is 2% on the same date. 8. Number of ordinary (common) shares in issue at 31 December, 2005 is 16,528,000 (note that this is the total figure - the figure in thousands is 16,528). Note Based only on the information in Q4a above, you are first expected to prepare a forecast of items needed for the abnormal earnings (residual income) valuation method, and then apply this method to estimate DELL's value. You should undertake your calculations in thousands of dollars as this is how the figures in Exhibits 2 to 5 are specified (i.e., in thousands of dollars). Show all the calculation steps. (39 marks) Q4b: One of the key assumptions underpinning the abnormal earnings (residual income) valuation method is that the 'clean-surplus relation' holds. (i) Explain what is meant by the 'clean surplus relation'. (4 marks) (ii) Does DELL's accounting violate the 'clean-surplus relation'? If it does, indicate where in Exhibits 3 to 4 this is evident. (3 marks) Exhibit 5: Analysts' Estimates of Future Net Income (in $thousands) for DELL Year ended Year ended December 31, 2006 December 31, 2007 (in $ thousands except number of analysts) Average Net Income estimate 85,678 99,876 Number of analysts 12 12 Low Net Income 82,425 94,356 estimate High Net Income 89,056 104,567 estimate