Answered step by step

Verified Expert Solution

Question

1 Approved Answer

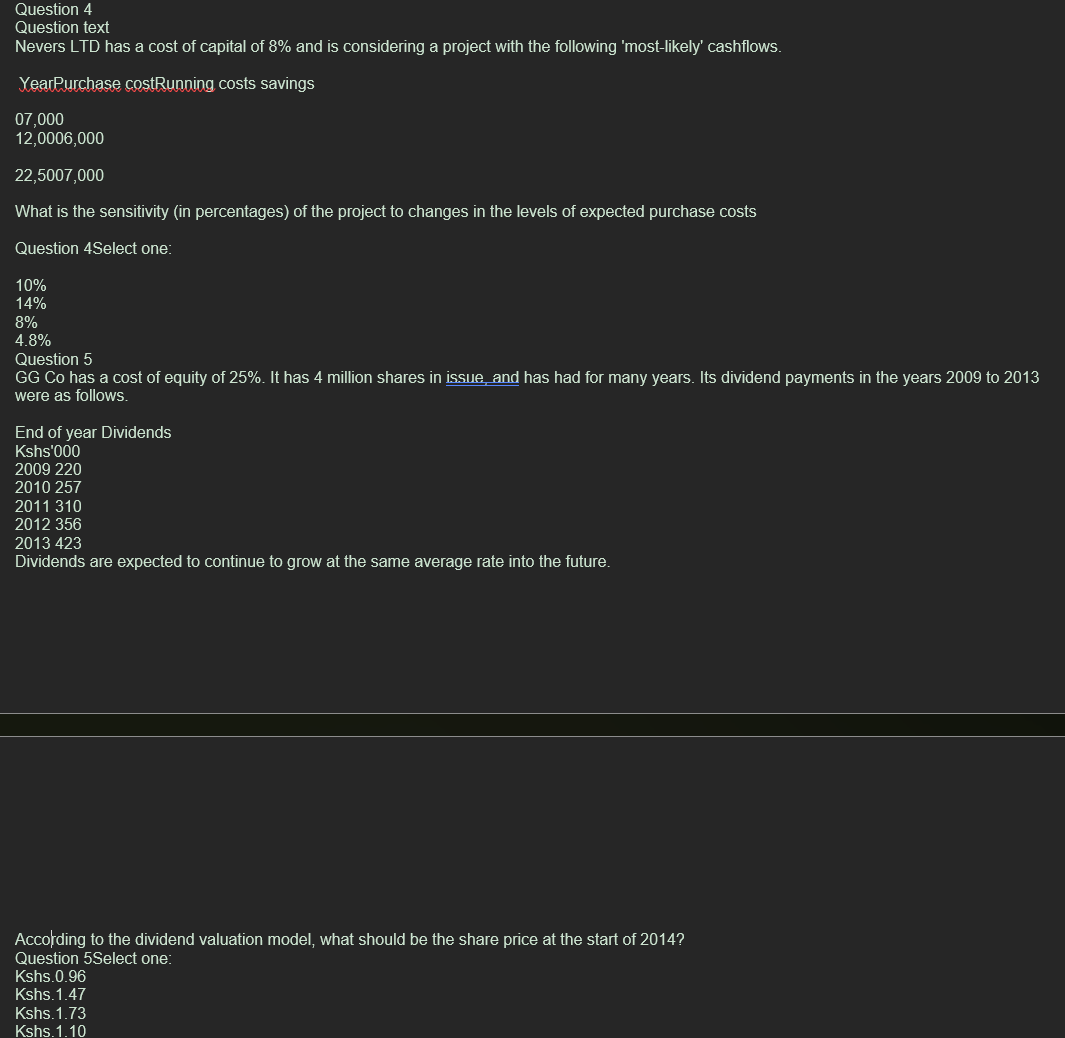

Question 4 Question text Nevers LTD has a cost of capital of 8 % and is considering a project with the following 'most - likely'

Question

Question text

Nevers LTD has a cost of capital of and is considering a project with the following 'mostlikely' cashflows.

YearPurchase costRunning costs savings

What is the sensitivity in percentages of the project to changes in the levels of expected purchase costs

Question Select one:

Question

GG Co has a cost of equity of It has million shares in issue, and has had for many years. Its dividend payments in the years to

were as follows.

End of year Dividends

Kshs

Dividends are expected to continue to grow at the same average rate into the future.

According to the dividend valuation model, what should be the share price at the start of

Question Select one:

Kshs

Kshs

Kshs

Kshs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started