Answered step by step

Verified Expert Solution

Question

1 Approved Answer

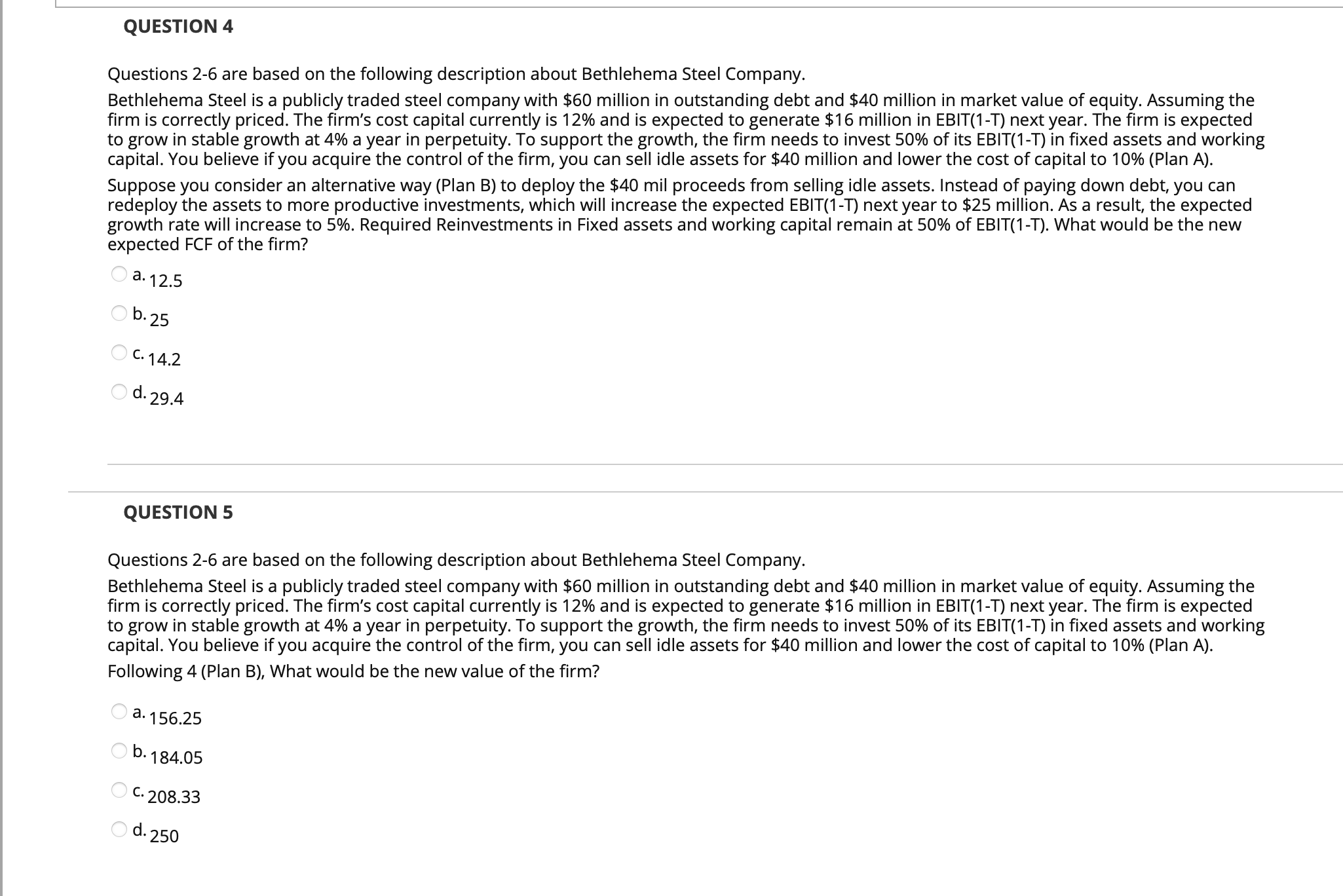

QUESTION 4 Questions 2 - 6 are based on the following description about Bethlehema Steel Company. Bethlehema Steel is a publicly traded steel company with

QUESTION

Questions are based on the following description about Bethlehema Steel Company.

Bethlehema Steel is a publicly traded steel company with $ million in outstanding debt and $ million in market value of equity. Assuming the

firm is correctly priced. The firm's cost capital currently is and is expected to generate $ million in EBITT next year. The firm is expected

to grow in stable growth at a year in perpetuity. To support the growth, the firm needs to invest of its EBITT in fixed assets and working

capital. You believe if you acquire the control of the firm, you can sell idle assets for $ million and lower the cost of capital to Plan

Suppose you consider an alternative way Plan B to deploy the $ mil proceeds from selling idle assets. Instead of paying down debt, you can

redeploy the assets to more productive investments, which will increase the expected EBITT next year to $ million. As a result, the expected

growth rate will increase to Required Reinvestments in Fixed assets and working capital remain at of EBITT What would be the new

expected FCF of the firm?

a

b

C

d

QUESTION

Questions are based on the following description about Bethlehema Steel Company.

Bethlehema Steel is a publicly traded steel company with $ million in outstanding debt and $ million in market value of equity. Assuming the

firm is correctly priced. The firm's cost capital currently is and is expected to generate $ million in EBITT next year. The firm is expected

to grow in stable growth at a year in perpetuity. To support the growth, the firm needs to invest of its EBITT in fixed assets and working

capital. You believe if you acquire the control of the firm, you can sell idle assets for $ million and lower the cost of capital to Plan A

Following Plan B What would be the new value of the firm?

a

b

C

d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started