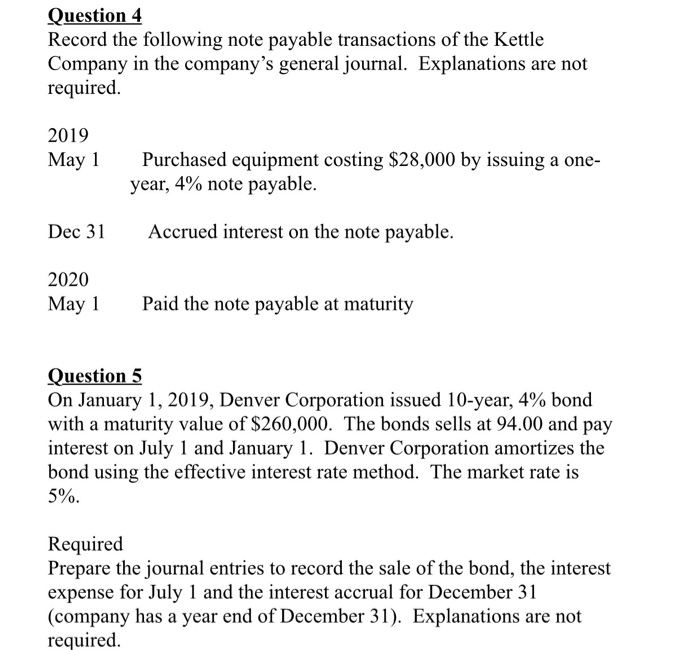

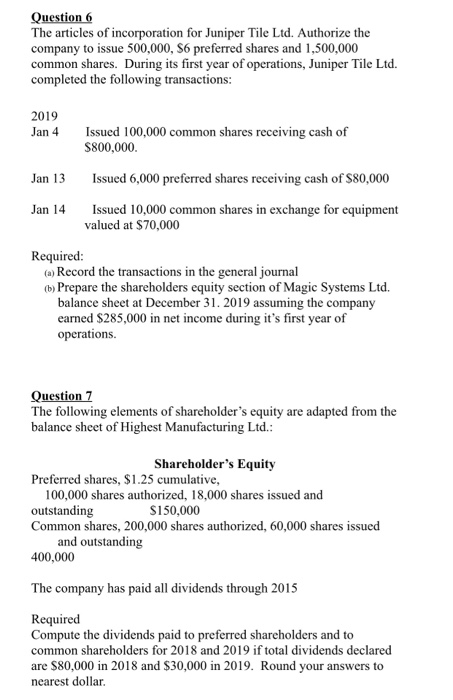

Question 4 Record the following note payable transactions of the Kettle Company in the company's general journal. Explanations are not required. 2019 May 1 Purchased equipment costing $28,000 by issuing a one- year, 4% note payable. Dec 31 Accrued interest on the note payable. 2020 May 1 Paid the note payable at maturity Question 5 On January 1, 2019, Denver Corporation issued 10-year, 4% bond with a maturity value of $260,000. The bonds sells at 94.00 and pay interest on July 1 and January 1. Denver Corporation amortizes the bond using the effective interest rate method. The market rate is 5%. Required Prepare the journal entries to record the sale of the bond, the interest expense for July 1 and the interest accrual for December 31 (company has a year end of December 31). Explanations are not required. Question 6 The articles of incorporation for Juniper Tile Ltd. Authorize the company to issue 500,000, S6 preferred shares and 1,500,000 common shares. During its first year of operations, Juniper Tile Ltd. completed the following transactions: 2019 Jan 4 Issued 100,000 common shares receiving cash of $800,000 Jan 13 Issued 6,000 preferred shares receiving cash of $80,000 Issued 10,000 common shares in exchange for equipment valued at $70,000 Jan 14 Required: (a) Record the transactions in the general journal (b) Prepare the shareholders equity section of Magic Systems Ltd. balance sheet at December 31, 2019 assuming the company earned $285,000 in net income during it's first year of operations. Question 7 The following elements of shareholder's equity are adapted from the balance sheet of Highest Manufacturing Ltd.: Shareholder's Equity Preferred shares, $1.25 cumulative, 100,000 shares authorized, 18,000 shares issued and outstanding S150,000 Common shares, 200,000 shares authorized, 60,000 shares issued and outstanding 400,000 The company has paid all dividends through 2015 Required Compute the dividends paid to preferred shareholders and to common shareholders for 2018 and 2019 if total dividends declared are $80,000 in 2018 and $30,000 in 2019. Round your answers to nearest dollar