Answered step by step

Verified Expert Solution

Question

1 Approved Answer

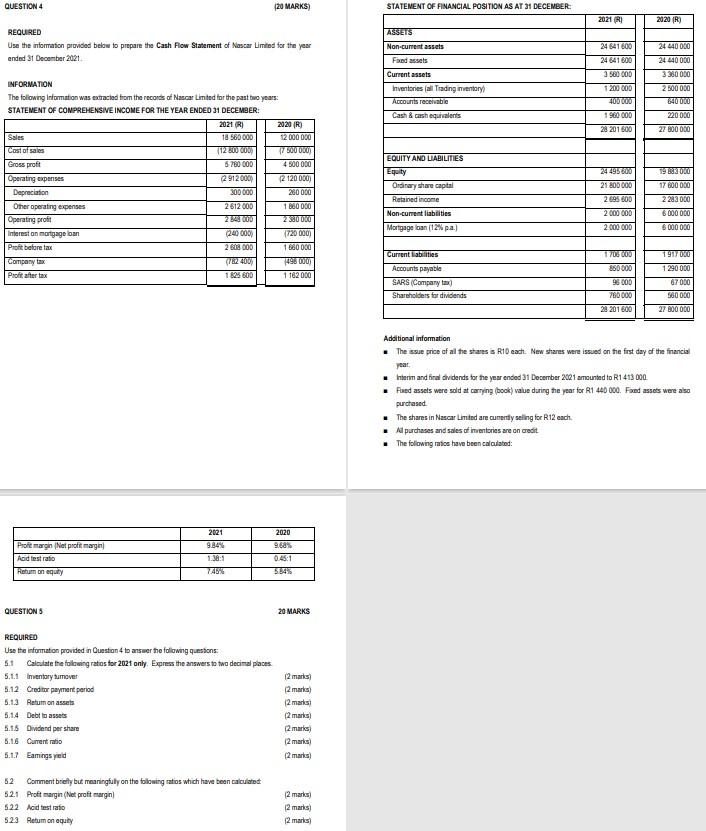

QUESTION 4 REQUIRED (20 MARKS) Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31

QUESTION 4 REQUIRED (20 MARKS) Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following Information was extracted from the records of Nascar Limited for the past two years: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER: Sales Cost of sales Gross profit STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: 2021 (R 2020 (R) ASSETS Non-current assets 24 641600 24 440 000 Fixed assets Current assets 24 641 600 24 440 000 3 580 000 Inventories (all Trading inventory) Accounts receivable Cash & cash equivalents 2021 (R) 18 560 000 (12 800 000) 2020 (R) 12 000 000 (7 500 000) 28 201600 1200000 400 000 1960 000 3360 000 2 500 000 640 000 220000 27 800 000 EQUITY AND LIABILITIES 4 500 000 2912000) 5 760 000 300 000 (2 120 000) 260 000 1860 000 2 350 000 (720000) Mortgage loan (12% p.a.) Equity 24 495600 19 833 000 Ordinary share capital 21 800 000 17 600 000 Retained income 2695 600 Non-current liabilities 2 000 000 2283 000 6 000 000 2.000.000 $ 000 000 Operating expenses Depreciation Other operating expenses 2612 000 Operating profit 2848 000 Interest on mortgage loan (240 000) Profit before tax 2 608 000 1660 000 Company tax Proft after tax (782 400) 1825600 (498 000) 1162 000 2021 2020 Profit margin (Net profit margin 9.84% 9.68% 1:38:1 0.45:1 Acid testratio Return on equity 7.45% 5.84% QUESTION 5 20 MARKS REQUIRED Use the information provided in Question 4 to answer the following questions: 5.1 Calculate the following ratios for 2021 only. Express the answers to two decimal places 5.1.1 Inventory turnover 5.12 Creditor payment period (2 marks) (2 marks) 5.1.3 Retum on assets 5.1.4 Debt to assets (2 marks) (2 marks) 5.1.5 Dividend per share (2 marks) 5.1.6 Cument ratio (2 marks) 5.1.7 Eamings yield (2 marks) 52 Comment briefly but meaningfully on the following ratios which have been calculated 5.2.1 Proft margin (Net profit margin) (2 marks) 5.2.2 Acid test rafo (2 marks) 5.2.3 Return on equity (2 marks) Current liabilities Accounts payable SARS (Company tax) Shareholders for dividends 1706000 850000 1917.000 1290 000 96 000 67 000 760 000 560 000 28 201600 27 800 000 Additional information The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. Interim and final dividends for the year ended 31 December 2021 amounted to R1413 000 Fixed assets were sold at carrying (book) value during the year for R1 440 000. Faxed assets were also purchased The shares in Nascar Limited are curently selling for R12 each. All purchases and sales of inventories are on credit The following ratios have been calculated:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started