Answered step by step

Verified Expert Solution

Question

1 Approved Answer

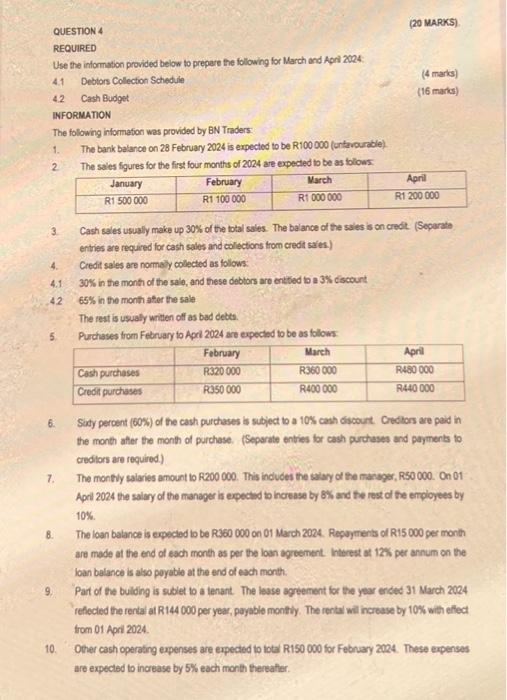

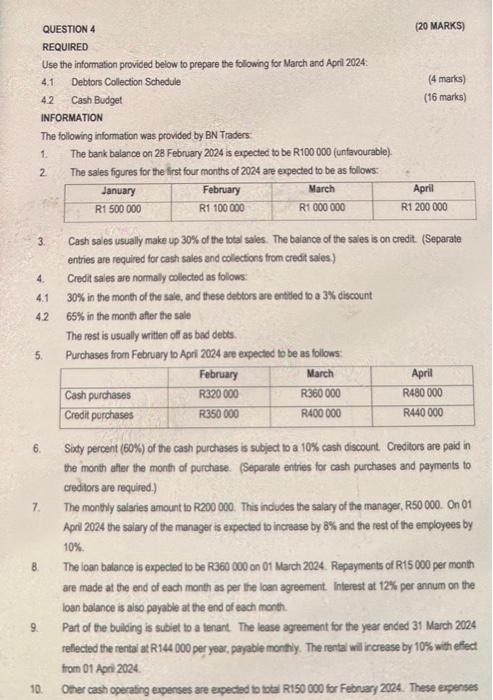

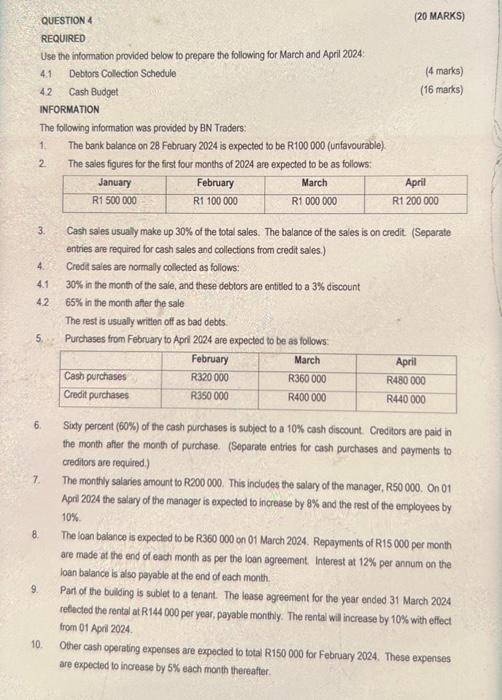

QUESTION 4 REQUIRED Use the information provided below to prepare the following for March and April 2024: 4.1 Debtors Collection Schedule 4.2 Cash Budget INFORMATION

QUESTION 4 REQUIRED Use the information provided below to prepare the following for March and April 2024: 4.1 Debtors Collection Schedule 4.2 Cash Budget INFORMATION The following information was provided by BN Traders: 1. The bank balance on 28 February 2024 is expected to be R100 000 (unfavourable). The sales figures for the first four months of 2024 are expected to be as follows: March R1 000 000 2 3. 4. 4.1 4.2 5. 6. 7. 8. 9. 10. January R1 500 000 February R1 100 000 Cash purchases Credit purchases (20 MARKS) R360 000 R400 000 (4 marks) (16 marks) Cash sales usually make up 30% of the total sales. The balance of the sales is on credit. (Separate entries are required for cash sales and collections from credit sales.) Credit sales are normally collected as follows: 30% in the month of the sale, and these debtors are entitled to a 3% discount 65% in the month after the sale The rest is usually written off as bad debts. Purchases from February to April 2024 are expected to be as follows: February March R320 000 R350 000 April R1 200 000 April R480 000 R440 000 Sixty percent (60%) of the cash purchases is subject to a 10% cash discount. Creditors are paid in the month after the month of purchase. (Separate entries for cash purchases and payments to creditors are required.) The monthly salaries amount to R200 000. This includes the salary of the manager, R50 000. On 01 April 2024 the salary of the manager is expected to increase by 8% and the rest of the employees by 10%. The loan balance is expected to be R360 000 on 01 March 2024. Repayments of R15 000 per month are made at the end of each month as per the loan agreement. Interest at 12% per annum on the loan balance is also payable at the end of each month. Part of the building is sublet to a tenant. The lease agreement for the year ended 31 March 2024 reflected the rental at R144 000 per year, payable monthly. The rental will increase by 10% with effect from 01 April 2024. Other cash operating expenses are expected to total R150 000 for February 2024. These expenses are expected to increase by 5% each month thereafter.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started