Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 requires an excel spreadsheet. thank you! 1. Company X receives its income in local currency (no dollars). The yearly income is $9,500. The

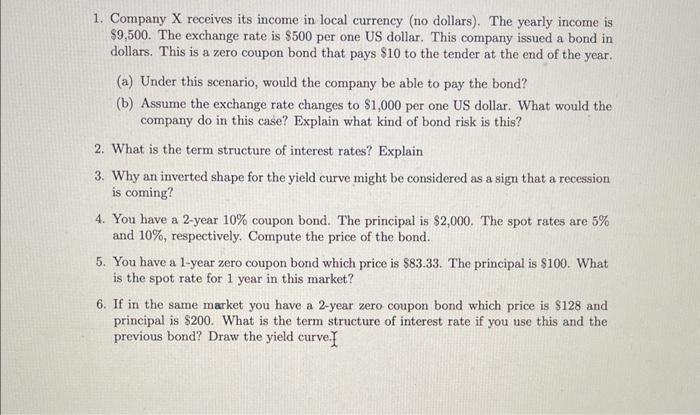

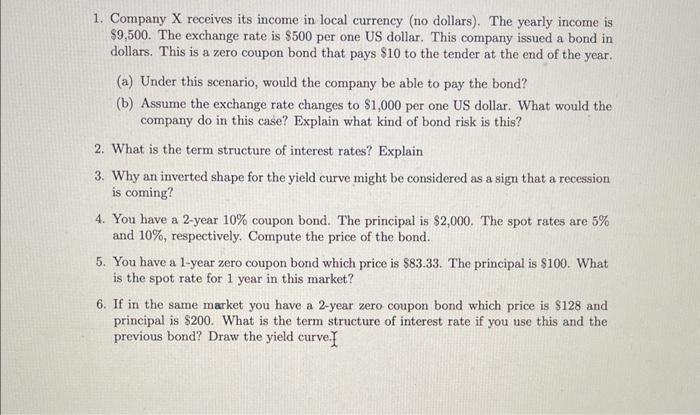

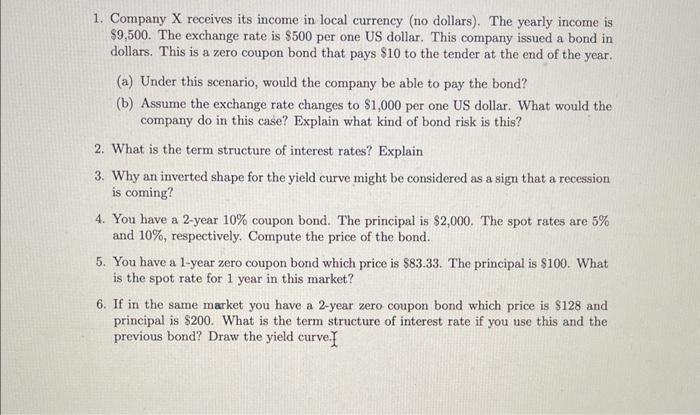

Question 4 requires an excel spreadsheet. thank you!  1. Company X receives its income in local currency (no dollars). The yearly income is $9,500. The exchange rate is $500 per one US dollar. This company issued a bond in dollars. This is a zero coupon bond that pays $10 to the tender at the end of the year. (a) Under this scenario, would the company be able to pay the bond? (b) Assume the exchange rate changes to $1,000 per one US dollar. What would the company do in this case? Explain what kind of bond risk is this? 2. What is the term structure of interest rates? Explain 3. Why an inverted shape for the yield curve might be considered as a sign that a recession is coming? 4. You have a 2-year 10% coupon bond. The principal is $2,000. The spot rates are 5% and 10%, respectively. Compute the price of the bond. 5. You have a 1-year zero coupon bond which price is $83.33. The principal is \$100. What is the spot rate for 1 year in this market? 6. If in the same market you have a 2-year zero coupon bond which price is $128 and principal is $200. What is the term structure of interest rate if you use this and the previous bond? Draw the yield curve

1. Company X receives its income in local currency (no dollars). The yearly income is $9,500. The exchange rate is $500 per one US dollar. This company issued a bond in dollars. This is a zero coupon bond that pays $10 to the tender at the end of the year. (a) Under this scenario, would the company be able to pay the bond? (b) Assume the exchange rate changes to $1,000 per one US dollar. What would the company do in this case? Explain what kind of bond risk is this? 2. What is the term structure of interest rates? Explain 3. Why an inverted shape for the yield curve might be considered as a sign that a recession is coming? 4. You have a 2-year 10% coupon bond. The principal is $2,000. The spot rates are 5% and 10%, respectively. Compute the price of the bond. 5. You have a 1-year zero coupon bond which price is $83.33. The principal is \$100. What is the spot rate for 1 year in this market? 6. If in the same market you have a 2-year zero coupon bond which price is $128 and principal is $200. What is the term structure of interest rate if you use this and the previous bond? Draw the yield curve

thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started