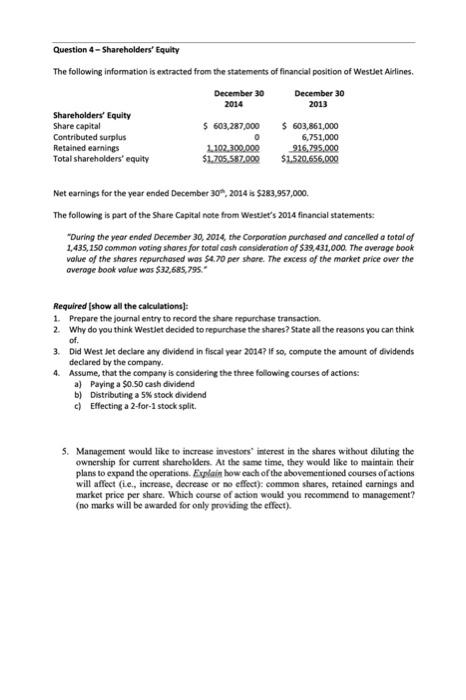

Question 4 - Shareholders' Equity The following information is extracted from the statements of financial position of Westlet Allines. Net earnings for the year ended December 30,,2014 is $283,957,000. The following is part of the Share Capital note from Westlet's 2014 financial statements: "During the yeor ended December 30, 2014, the Corporation purchased and cancelled a totof of 1,435,150 common voting shares for total cash consideration of $39,431,000. The averege book volue of the shares repurchased was 54.70 per share. The excess of the market price over the overage book value was $32,685,795." Required [show all the calculations] 1. Prepare the journal entry to record the share repurchase transaction. 2. Why do you think Westjet decided to repurchase the shares? State all the reasons you can think of. 3. Did West let declare any dividend in fiscal year 2014 ? if so, compute the amount of dividends declared by the company. 4. Assume, that the company is considering the three following courses of actions: a) Paying a $0.50 cash dividend b) Distributing a 5% stock dividend c) Eflecting a 2-for-1 stock split. 5. Management would like to increase investoes" interest in the shares without diluting the ownership for current shareholders. At the same time, they would like to maintain their plans to expand the operations. Expilain how each of the abovementioned courses of actions will affect (ie,, increase, decrease or no effect): common shares, retained carnings and market price per share. Which course of action would you recommend to management? (no marks will be awarded for only providing the effect). Question 4 - Shareholders' Equity The following information is extracted from the statements of financial position of Westlet Allines. Net earnings for the year ended December 30,,2014 is $283,957,000. The following is part of the Share Capital note from Westlet's 2014 financial statements: "During the yeor ended December 30, 2014, the Corporation purchased and cancelled a totof of 1,435,150 common voting shares for total cash consideration of $39,431,000. The averege book volue of the shares repurchased was 54.70 per share. The excess of the market price over the overage book value was $32,685,795." Required [show all the calculations] 1. Prepare the journal entry to record the share repurchase transaction. 2. Why do you think Westjet decided to repurchase the shares? State all the reasons you can think of. 3. Did West let declare any dividend in fiscal year 2014 ? if so, compute the amount of dividends declared by the company. 4. Assume, that the company is considering the three following courses of actions: a) Paying a $0.50 cash dividend b) Distributing a 5% stock dividend c) Eflecting a 2-for-1 stock split. 5. Management would like to increase investoes" interest in the shares without diluting the ownership for current shareholders. At the same time, they would like to maintain their plans to expand the operations. Expilain how each of the abovementioned courses of actions will affect (ie,, increase, decrease or no effect): common shares, retained carnings and market price per share. Which course of action would you recommend to management? (no marks will be awarded for only providing the effect)