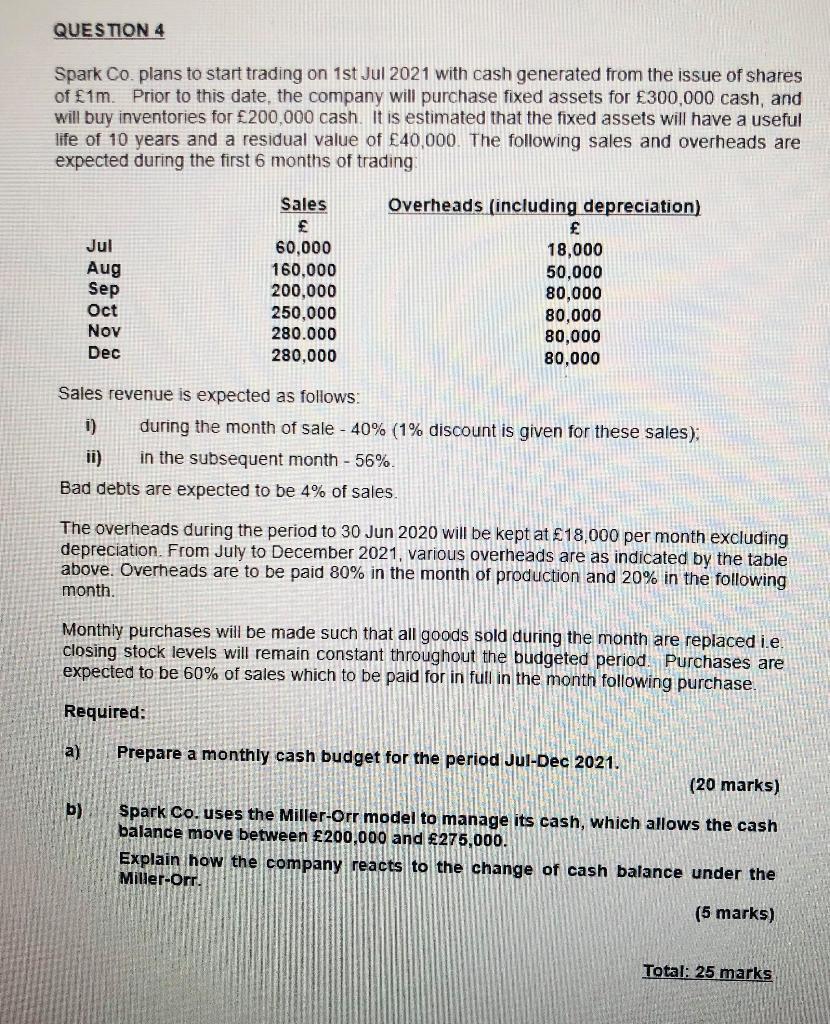

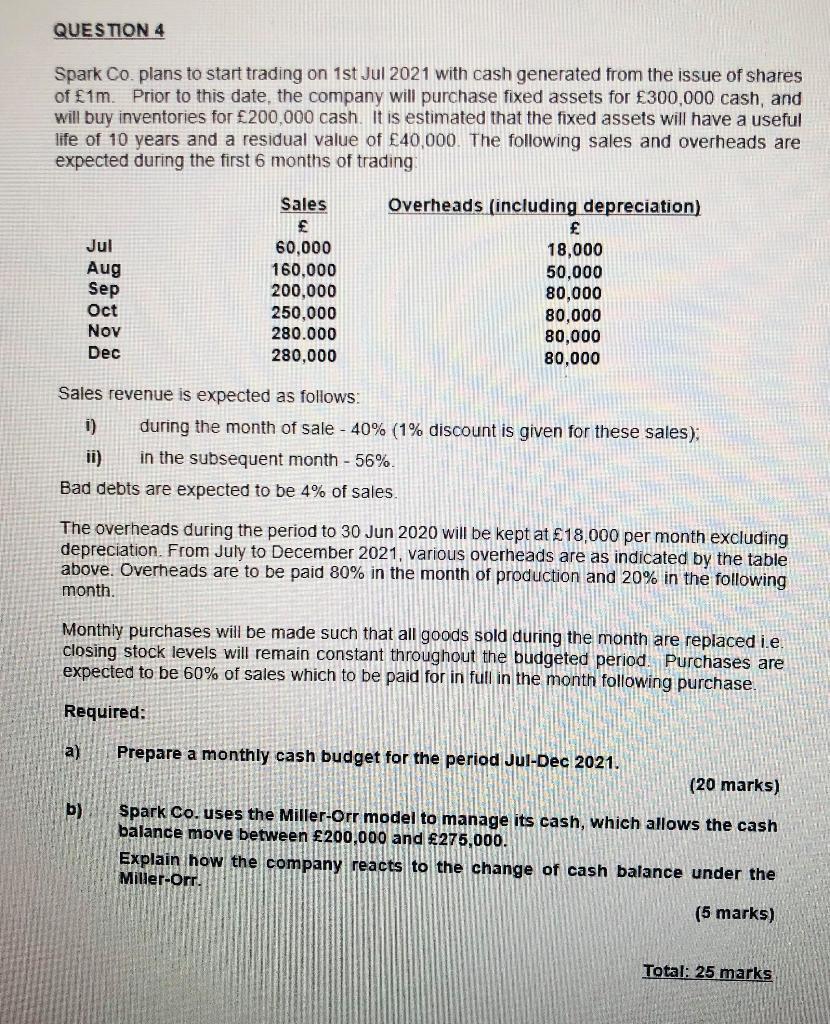

QUESTION 4 Spark Co. plans to start trading on 1st Jul 2021 with cash generated from the issue of shares of 1m. Prior to this date, the company will purchase fixed assets for 300,000 cash, and will buy inventories for 200,000 cash. It is estimated that the fixed assets will have a useful life of 10 years and a residual value of 40,000. The following sales and overheads are expected during the first 6 months of trading Jul Aug Sep Oct Nov Sales 60,000 160,000 200,000 250,000 280.000 280,000 Overheads (including depreciation) f 18,000 50,000 80,000 80,000 80,000 80,000 Dec Sales revenue is expected as follows: 1) during the month of sale - 40% (1% discount is given for these sales); i) in the subsequent month - 56%. Bad debts are expected to be 4% of sales. The overheads during the period to 30 Jun 2020 will be kept at 18,000 per month excluding depreciation. From July to December 2021, various overheads are as indicated by the table above. Overheads are to be paid 80% in the month of production and 20% in the following month. Monthly purchases will be made such that all goods sold during the month are replaced i.e. closing stock levels will remain constant throughout the budgeted period. Purchases are expected to be 60% of sales which to be paid for in full in the month following purchase Required: Prepare a monthly cash budget for the period Jul-Dec 2021. (20 marks) b) Spark Co. uses the Miller-Orr model to manage its cash, which allows the cash balance move between 200,000 and 275,000. Explain how the company reacts to the change of cash balance under the Miller-Orr. (5 marks) Total: 25 marks QUESTION 4 Spark Co. plans to start trading on 1st Jul 2021 with cash generated from the issue of shares of 1m. Prior to this date, the company will purchase fixed assets for 300,000 cash, and will buy inventories for 200,000 cash. It is estimated that the fixed assets will have a useful life of 10 years and a residual value of 40,000. The following sales and overheads are expected during the first 6 months of trading Jul Aug Sep Oct Nov Sales 60,000 160,000 200,000 250,000 280.000 280,000 Overheads (including depreciation) f 18,000 50,000 80,000 80,000 80,000 80,000 Dec Sales revenue is expected as follows: 1) during the month of sale - 40% (1% discount is given for these sales); i) in the subsequent month - 56%. Bad debts are expected to be 4% of sales. The overheads during the period to 30 Jun 2020 will be kept at 18,000 per month excluding depreciation. From July to December 2021, various overheads are as indicated by the table above. Overheads are to be paid 80% in the month of production and 20% in the following month. Monthly purchases will be made such that all goods sold during the month are replaced i.e. closing stock levels will remain constant throughout the budgeted period. Purchases are expected to be 60% of sales which to be paid for in full in the month following purchase Required: Prepare a monthly cash budget for the period Jul-Dec 2021. (20 marks) b) Spark Co. uses the Miller-Orr model to manage its cash, which allows the cash balance move between 200,000 and 275,000. Explain how the company reacts to the change of cash balance under the Miller-Orr. (5 marks) Total: 25 marks