Answered step by step

Verified Expert Solution

Question

1 Approved Answer

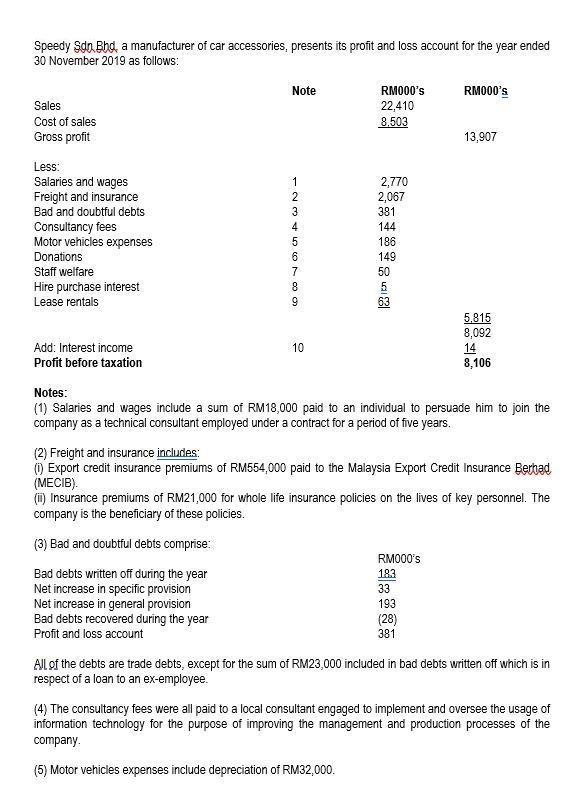

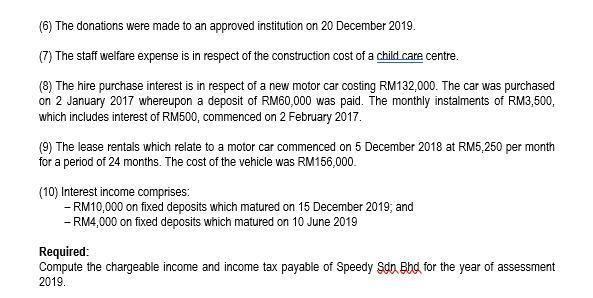

Speedy Sdn Bhd, a manufacturer of car accessories, presents its profit and loss account for the year ended 30 November 2019 as follows: Note

Speedy Sdn Bhd, a manufacturer of car accessories, presents its profit and loss account for the year ended 30 November 2019 as follows: Note RM000's RM000's Sales 22,410 Cost of sales Gross profit 8,503 13,907 Less: Salaries and wages Freight and insurance Bad and doubtful debts 1 2,770 2,067 381 3 Consultancy fees Motor vehicles expenses 4 144 186 Donations 6 149 Staff welfare 7 50 Hire purchase interest Lease rentals 5 63 5.815 8,092 14 8,106 Add: Interest income 10 Profit before taxation Notes: (1) Salaries and wages include a sum of RM18,000 paid to an individual to persuade him to join the company as a technical consultant employed under a contract for a period of five years. (2) Freight and insurance includes: ) Export credit insurance premiums of RM554,000 paid to the Malaysia Export Credit Insurance Bertad (MECIB). (m) Insurance premiums of RM21,000 for whole life insurance policies on the lives of key personnel. The company is the beneficiary of these policies. (3) Bad and doubtful debts comprise: RM000's Bad debts written off during the year Net increase in specific provision Net increase in general provision Bad debts recovered during the year Profit and loss account 183 33 193 (28) 381 AIl of the debts are trade debts, except for the sum of RM23,000 included in bad debts written off which is in respect of a loan to an ex-employee. (4) The consultancy fees were all paid to a local consultant engaged to implement and oversee the usage of information technology for the purpose of improving the management and production processes of the company. (5) Motor vehicles expenses include depreciation of RM32,000. (6) The donations were made to an approved institution on 20 December 2019. (7) The staff welfare expense is in respect of the construction cost of a child care centre. (8) The hire purchase interest is in respect of a new motor car costing RM132,000. The car was purchased on 2 January 2017 whereupon a deposit of RM60,000 was paid. The monthly instalments of RM3,500, which includes interest of RM500, commenced on 2 February 2017. (9) The lease rentals which relate to a motor car commenced on 5 December 2018 at RM5,250 per month for a period of 24 months. The cost of the vehicle was RM156,000. (10) Interest income comprises: - RM10,000 on fixed deposits which matured on 15 December 2019; and - RM4,000 on fixed deposits which matured on 10 June 2019 Required: Compute the chargeable income and income tax payable of Speedy Sdn Bhd for the year of assessment 2019.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started