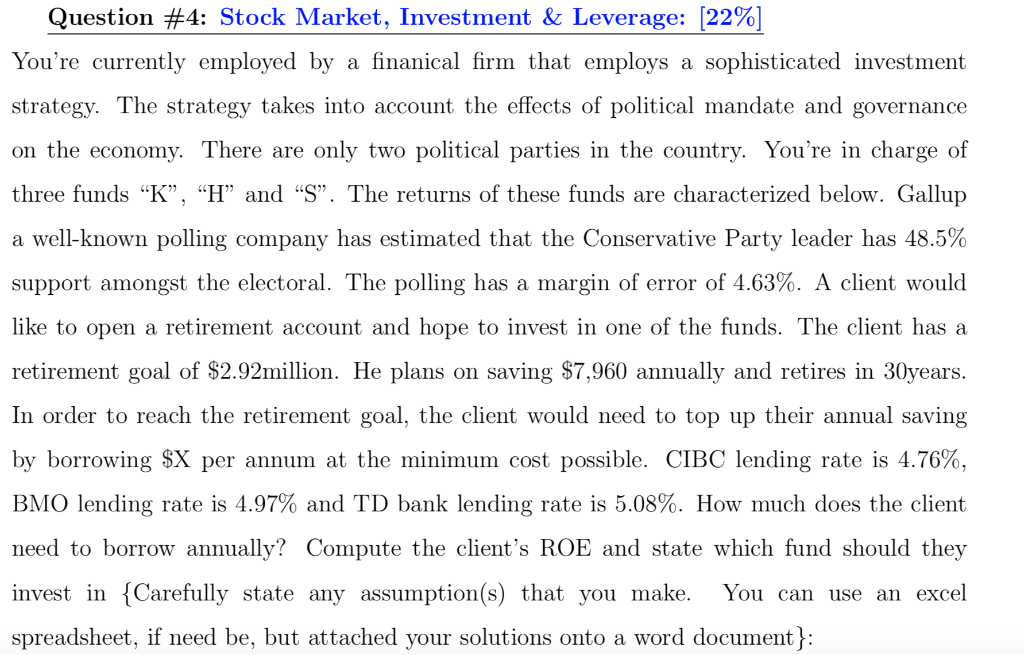

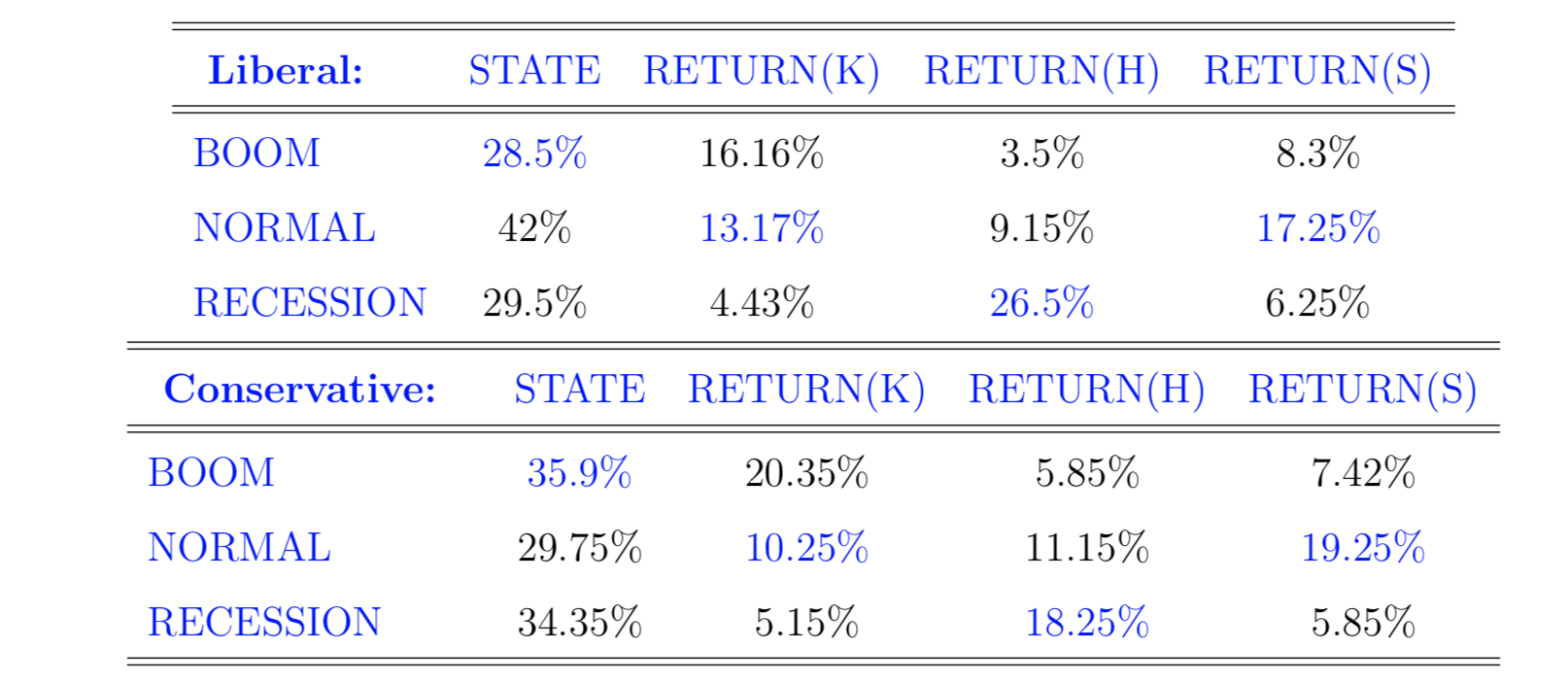

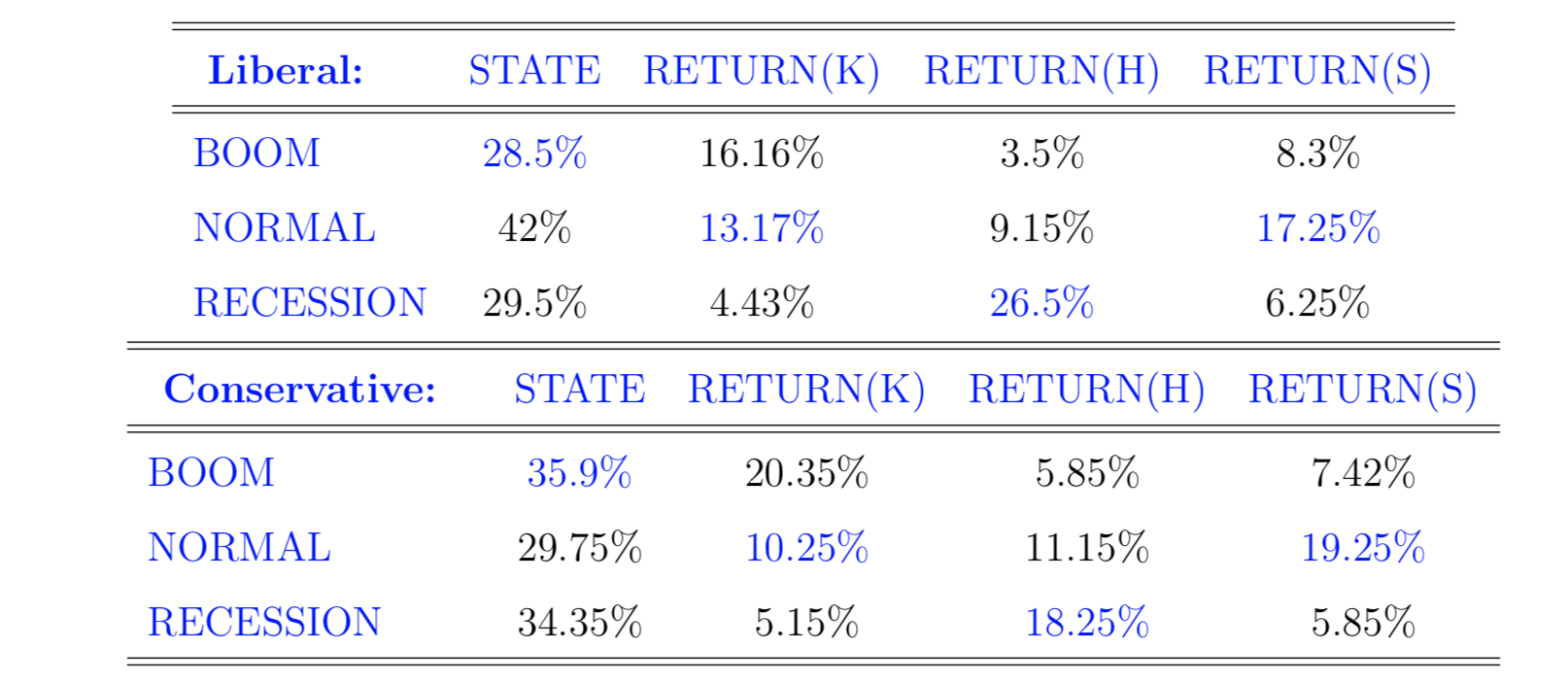

Question #4: Stock Market, Investment & Leverage: [22%] You're currently employed by a finanical firm that employs a sophisticated investment strategy. The strategy takes into account the effects of political mandate and governance on the economy. There are only two political parties in the country. Youre in charge of three funds "K, H and S. The returns of these funds are characterized below. Gallup a well-known polling company has estimated that the Conservative Party leader has 48.5% support amongst the electoral. The polling has a margin of error of 4.63%. A client would like to open a retirement account and hope to invest in one of the funds. The client has a retirement goal of $2.92million. He plans on saving $7,960 annually and retires in 30years. In order to reach the retirement goal, the client would need to top up their annual saving by borrowing $X per annum at the minimum cost possible. CIBC lending rate is 4.76%, BMO lending rate is 4.97% and TD bank lending rate is 5.08%. How much does the client need to borrow annually? Compute the client's ROE and state which fund should they invest in {Carefully state any assumption(s) that you make. You can use an excel spreadsheet, if need be, but attached your solutions onto a word document): Liberal: STATE RETURN(K) RETURN(H) RETURN(S) BOOM 28.5% 16.16% 3.5% 8.3% NORMAL 42% 13.17% 9.15% 17.25% RECESSION 29.5% 4.43% 26.5% 6.25% Conservative: STATE RETURN(K) RETURN(H) RETURN(S) BOOM 35.9% 20.35% 5.85% 7.42% NORMAL 29.75% 10.25% 11.15% 19.25% RECESSION 34.35% 5.15% 18.25% 5.85% Question #4: Stock Market, Investment & Leverage: [22%] You're currently employed by a finanical firm that employs a sophisticated investment strategy. The strategy takes into account the effects of political mandate and governance on the economy. There are only two political parties in the country. Youre in charge of three funds "K, H and S. The returns of these funds are characterized below. Gallup a well-known polling company has estimated that the Conservative Party leader has 48.5% support amongst the electoral. The polling has a margin of error of 4.63%. A client would like to open a retirement account and hope to invest in one of the funds. The client has a retirement goal of $2.92million. He plans on saving $7,960 annually and retires in 30years. In order to reach the retirement goal, the client would need to top up their annual saving by borrowing $X per annum at the minimum cost possible. CIBC lending rate is 4.76%, BMO lending rate is 4.97% and TD bank lending rate is 5.08%. How much does the client need to borrow annually? Compute the client's ROE and state which fund should they invest in {Carefully state any assumption(s) that you make. You can use an excel spreadsheet, if need be, but attached your solutions onto a word document): Liberal: STATE RETURN(K) RETURN(H) RETURN(S) BOOM 28.5% 16.16% 3.5% 8.3% NORMAL 42% 13.17% 9.15% 17.25% RECESSION 29.5% 4.43% 26.5% 6.25% Conservative: STATE RETURN(K) RETURN(H) RETURN(S) BOOM 35.9% 20.35% 5.85% 7.42% NORMAL 29.75% 10.25% 11.15% 19.25% RECESSION 34.35% 5.15% 18.25% 5.85%