Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 : Suppose last year you bought 4 0 0 shares of ABC at 1 5 0 SAR per share and bought 2 0

Question :

Suppose last year you bought shares of ABC at SAR per share and bought shares of XYZ at SAR per share. This year, the prices of ABC's stock rose to I SAR per share and XYZs stock fell to SAR per share, and neither stock paid dividends. When you invested in those stocks, you knew that the standard deviation for ABC was standard deviation for was and correlation between them was Answer following questions:

a What were the weights for ABC and in your investment portfolio when you just invested in these stocks?

mark

b What was the realized retum of ABC and

mark

c What was the returm of the entire portfolio?

mark

d What is the volatility of the portfolio?

mark

c What happened to the total risk as measured by the standard deviation of the portfolio according to portfolio theory? Briefly explain why.

mark

Question :

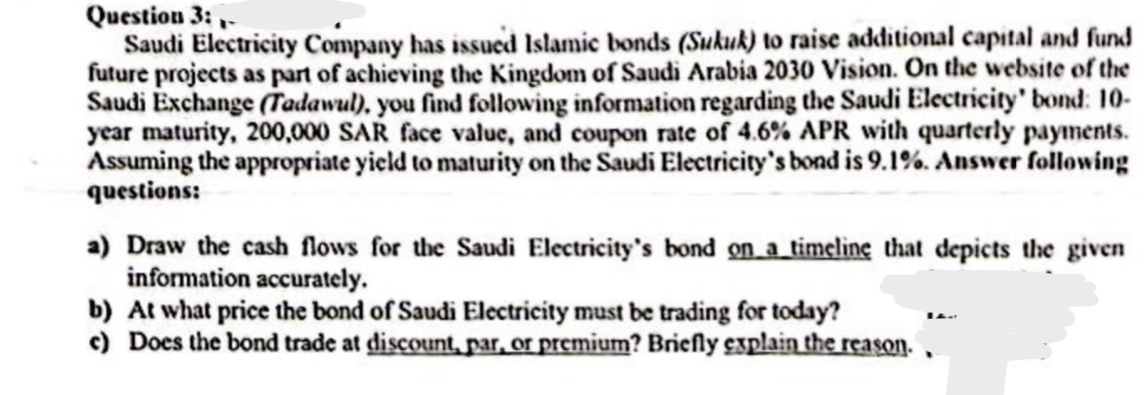

Saudi Electricity Company has issued Islamic bonds Sukuk to raise additional capital and fund future projects as part of achieving the Kingdom of Saudi Arabia Vision. On the website of the Saudi Exchange Tadawul you find following information regarding the Saudi Electricity' bond: year maturity, SAR face value, and coupon rate of APR with quarterly payments. Assuming the appropriate yield to maturity on the Saudi Electricity's bond is Answer following questions:

a Draw the cash flows for the Saudi Electricity's bond on a timeline that depicts the given information accurately.

b At what price the bond of Saudi Electricity must be trading for today?

c Does the bond trade at discount, par, or premium? Briefly explain the reasen.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started