Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial year of T Boon ended on 31 December 2020. The following transactions have been extracted from the company's ledger. (i) Maintenance expenses:

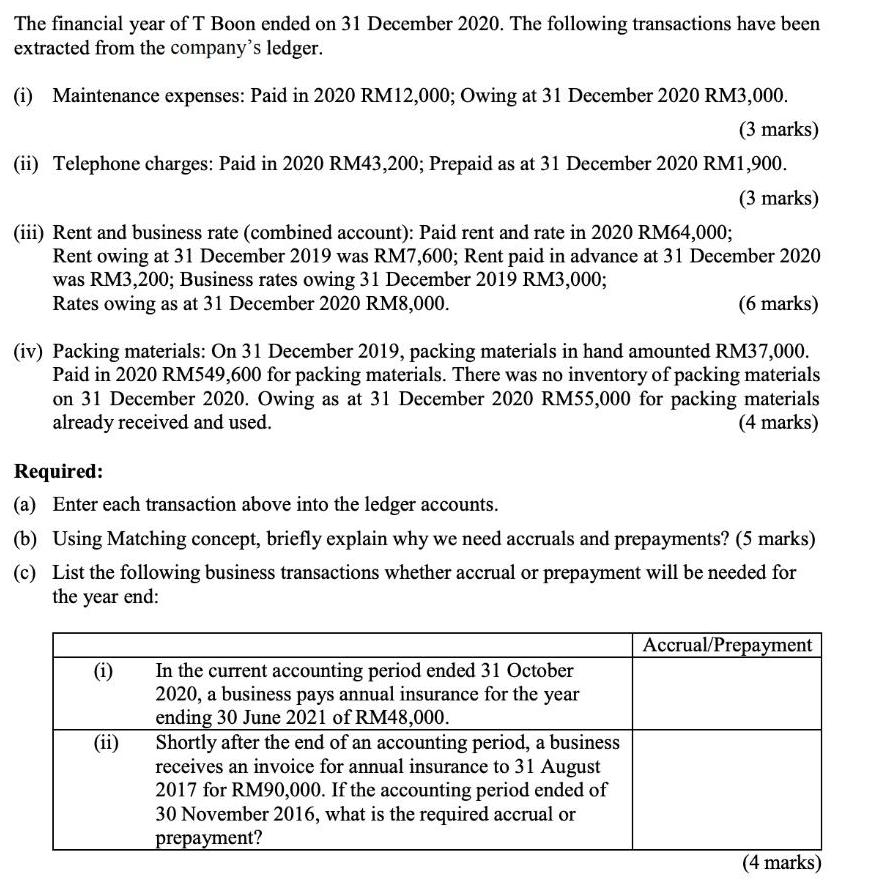

The financial year of T Boon ended on 31 December 2020. The following transactions have been extracted from the company's ledger. (i) Maintenance expenses: Paid in 2020 RM12,000; Owing at 31 December 2020 RM3,000. (3 marks) (ii) Telephone charges: Paid in 2020 RM43,200; Prepaid as at 31 December 2020 RM1,900. (3 marks) (iii) Rent and business rate (combined account): Paid rent and rate in 2020 RM64,000; Rent owing at 31 December 2019 was RM7,600; Rent paid in advance at 31 December 2020 was RM3,200; Business rates owing 31 December 2019 RM3,0003; Rates owing as at 31 December 2020 RM8,000. (6 marks) (iv) Packing materials: On 31 December 2019, packing materials in hand amounted RM37,000. Paid in 2020 RM549,600 for packing materials. There was no inventory of packing materials on 31 December 2020. Owing as at 31 December 2020 RM55,000 for packing materials already received and used. (4 marks) Required: (a) Enter each transaction above into the ledger accounts. (b) Using Matching concept, briefly explain why we need accruals and prepayments? (5 marks) (c) List the following business transactions whether accrual or prepayment will be needed for the year end: Accrual/Prepayment In the current accounting period ended 31 October 2020, a business pays annual insurance for the year ending 30 June 2021 of RM48,000. Shortly after the end of an accounting period, a business receives an invoice for annual insurance to 31 August 2017 for RM90,000. If the accounting period ended of 30 November 2016, what is the required accrual or prepayment? (i) (ii) (4 marks)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A IMaintenance Expenses Dr 3000 to Outstanding Expenses Liability 3000 will be transferred to outsta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started