Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 The firm Green is entirely funded by equity and has 65 million shares in issue with a current share price of 8 each.

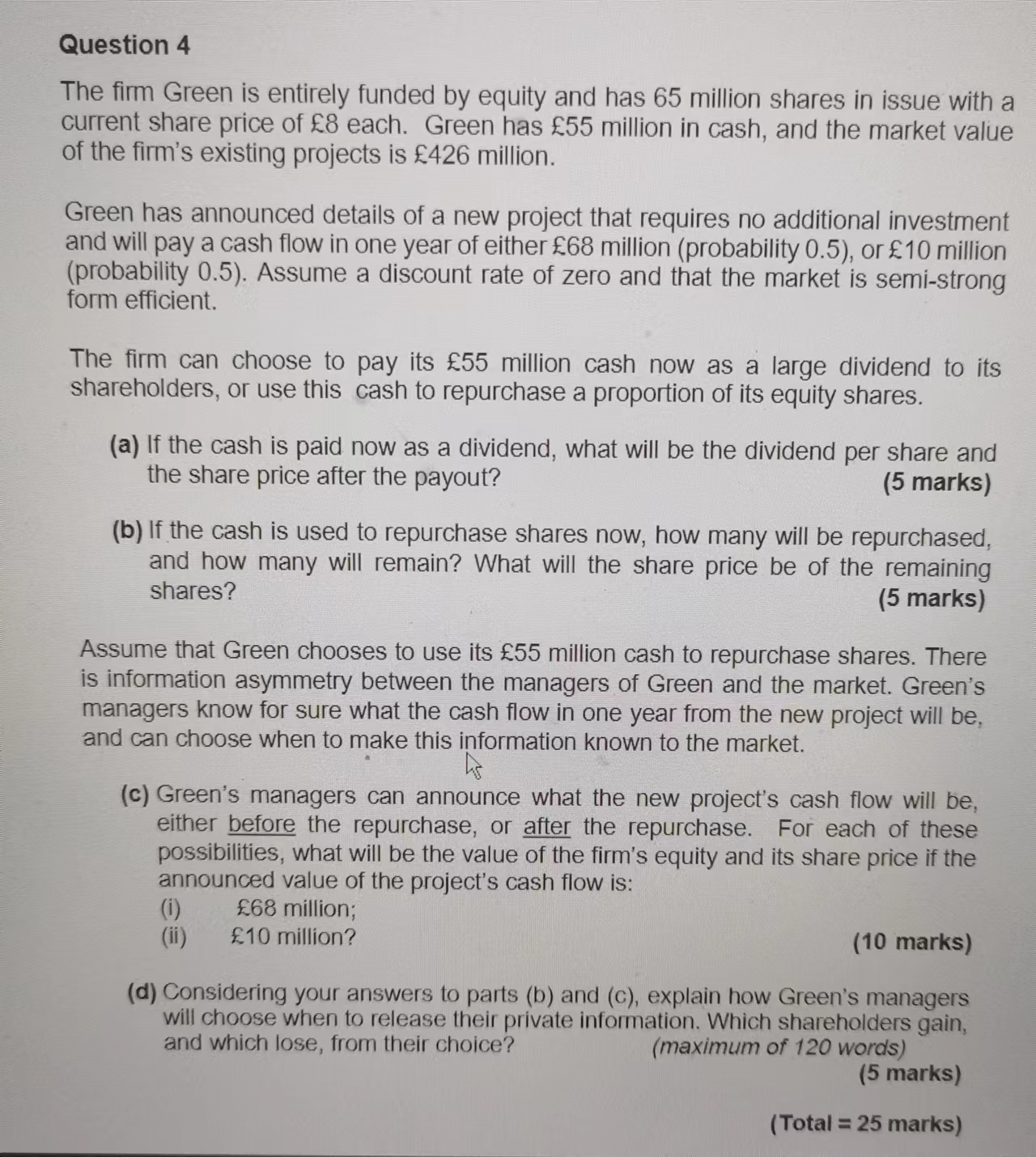

Question 4 The firm Green is entirely funded by equity and has 65 million shares in issue with a current share price of 8 each. Green has 55 million in cash, and the market value of the firm's existing projects is 426 million. Green has announced details of a new project that requires no additional investment and will pay a cash flow in one year of either 68 million (probability 0.5 ), or 10 million (probability 0.5). Assume a discount rate of zero and that the market is semi-strong form efficient. The firm can choose to pay its 55 million cash now as a large dividend to its shareholders, or use this cash to repurchase a proportion of its equity shares. (a) If the cash is paid now as a dividend, what will be the dividend per share and the share price after the payout? (5 marks) (b) If the cash is used to repurchase shares now, how many will be repurchased, and how many will remain? What will the share price be of the remaining shares? (5 marks) Assume that Green chooses to use its 55 million cash to repurchase shares. There is information asymmetry between the managers of Green and the market. Green's managers know for sure what the cash flow in one year from the new project will be, and can choose when to make this information known to the market. (c) Green's managers can announce what the new project's cash flow will be, either before the repurchase, or after the repurchase. For each of these possibilities, what will be the value of the firm's equity and its share price if the announced value of the project's cash flow is: (i) 68 million; (ii) 10 million? (10 marks) (d) Considering your answers to parts (b) and (c), explain how Green's managers will choose when to release their private information. Which shareholders gain, and which lose, from their choice? (maximum of 120 words) (5 marks) ( Total =25 marks)

Question 4 The firm Green is entirely funded by equity and has 65 million shares in issue with a current share price of 8 each. Green has 55 million in cash, and the market value of the firm's existing projects is 426 million. Green has announced details of a new project that requires no additional investment and will pay a cash flow in one year of either 68 million (probability 0.5 ), or 10 million (probability 0.5). Assume a discount rate of zero and that the market is semi-strong form efficient. The firm can choose to pay its 55 million cash now as a large dividend to its shareholders, or use this cash to repurchase a proportion of its equity shares. (a) If the cash is paid now as a dividend, what will be the dividend per share and the share price after the payout? (5 marks) (b) If the cash is used to repurchase shares now, how many will be repurchased, and how many will remain? What will the share price be of the remaining shares? (5 marks) Assume that Green chooses to use its 55 million cash to repurchase shares. There is information asymmetry between the managers of Green and the market. Green's managers know for sure what the cash flow in one year from the new project will be, and can choose when to make this information known to the market. (c) Green's managers can announce what the new project's cash flow will be, either before the repurchase, or after the repurchase. For each of these possibilities, what will be the value of the firm's equity and its share price if the announced value of the project's cash flow is: (i) 68 million; (ii) 10 million? (10 marks) (d) Considering your answers to parts (b) and (c), explain how Green's managers will choose when to release their private information. Which shareholders gain, and which lose, from their choice? (maximum of 120 words) (5 marks) ( Total =25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started