Answered step by step

Verified Expert Solution

Question

1 Approved Answer

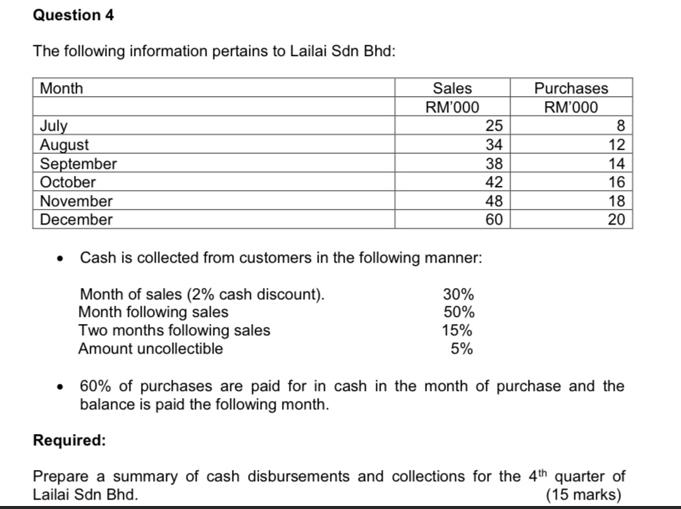

Question 4 The following information pertains to Lailai Sdn Bhd: Month July August September October November December Sales Purchases RM'000 RM'000 25 8 34

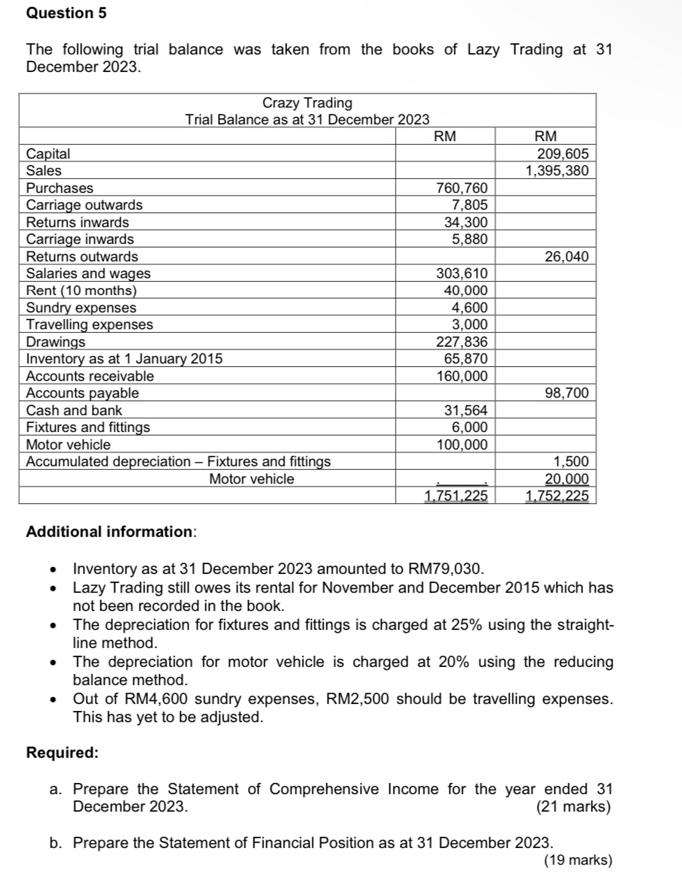

Question 4 The following information pertains to Lailai Sdn Bhd: Month July August September October November December Sales Purchases RM'000 RM'000 25 8 34 12 38 14 42 16 48 18 60 20 Cash is collected from customers in the following manner: Month of sales (2% cash discount). Month following sales Two months following sales 30% 50% 15% 5% Amount uncollectible 60% of purchases are paid for in cash in the month of purchase and the balance is paid the following month. Required: Prepare a summary of cash disbursements and collections for the 4th quarter of Lailai Sdn Bhd. (15 marks) Question 5 The following trial balance was taken from the books of Lazy Trading at 31 December 2023. Crazy Trading Trial Balance as at 31 December 2023 RM RM Capital Sales Purchases Carriage outwards Returns inwards 209,605 1,395,380 760,760 7,805 34,300 Carriage inwards Returns outwards Salaries and wages Rent (10 months) Sundry expenses 5,880 26,040 303,610 40,000 4,600 Travelling expenses Drawings Inventory as at 1 January 2015 Accounts receivable 3,000 227,836 65,870 160,000 Accounts payable 98,700 Cash and bank 31,564 Fixtures and fittings 6,000 Motor vehicle 100,000 Accumulated depreciation - Fixtures and fittings 1,500 Motor vehicle 20,000 1,751,225 1,752,225 Additional information: Inventory as at 31 December 2023 amounted to RM79,030. Lazy Trading still owes its rental for November and December 2015 which has not been recorded in the book. The depreciation for fixtures and fittings is charged at 25% using the straight- line method. The depreciation for motor vehicle is charged at 20% using the reducing balance method. Out of RM4,600 sundry expenses, RM2,500 should be travelling expenses. This has yet to be adjusted. Required: a. Prepare the Statement of Comprehensive Income for the year ended 31 December 2023. (21 marks) (19 marks) b. Prepare the Statement of Financial Position as at 31 December 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started