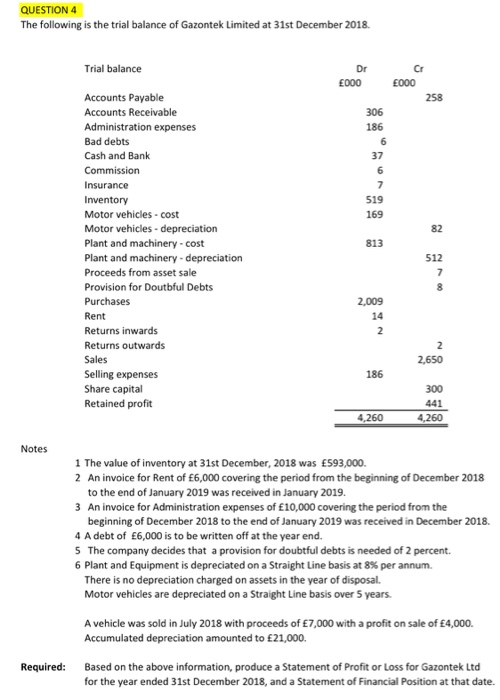

QUESTION 4 The following is the trial balance of Gazontek Limited at 31st December 2018 Trial balance Dr 000 000 258 Accounts Payable Accounts Receivable Administration expenses Bad debts Cash and Bank Commission Insurance Inventory Motor vehicles - cost Motor vehicles - depreciation Plant and machinery - cost Plant and machinery - depreciation Proceeds from asset sale Provision for Doutbful Debts Purchases Rent Returns inwards Returns outwards Sales Selling expenses Share capital Retained profit 4,260 4,260 Notes 1 The value of inventory at 31st December, 2018 was 593,000. 2 An invoice for Rent of 6,000 covering the period from the beginning of December 2018 to the end of January 2019 was received in January 2019. 3 An invoice for Administration expenses of 10,000 covering the period from the beginning of December 2018 to the end of January 2019 was received in December 2018 4 A debt of 6,000 is to be written off at the year end. 5 The company decides that a provision for doubtful debts is needed of 2 percent. 6 Plant and Equipment is depreciated on a Straight Line basis at 8% per annum. There is no depreciation charged on assets in the year of disposal. Motor vehicles are depreciated on a Straight Line basis over 5 years A vehicle was sold in July 2018 with proceeds of 7,000 with a profit on sale of 4,000. Accumulated depreciation amounted to 21,000. Required: Based on the above information, produce a Statement of Profit or Loss for Gazontek Ltd for the year ended 31st December 2018, and a statement of Financial Position at that date. QUESTION 4 The following is the trial balance of Gazontek Limited at 31st December 2018 Trial balance Dr 000 000 258 Accounts Payable Accounts Receivable Administration expenses Bad debts Cash and Bank Commission Insurance Inventory Motor vehicles - cost Motor vehicles - depreciation Plant and machinery - cost Plant and machinery - depreciation Proceeds from asset sale Provision for Doutbful Debts Purchases Rent Returns inwards Returns outwards Sales Selling expenses Share capital Retained profit 4,260 4,260 Notes 1 The value of inventory at 31st December, 2018 was 593,000. 2 An invoice for Rent of 6,000 covering the period from the beginning of December 2018 to the end of January 2019 was received in January 2019. 3 An invoice for Administration expenses of 10,000 covering the period from the beginning of December 2018 to the end of January 2019 was received in December 2018 4 A debt of 6,000 is to be written off at the year end. 5 The company decides that a provision for doubtful debts is needed of 2 percent. 6 Plant and Equipment is depreciated on a Straight Line basis at 8% per annum. There is no depreciation charged on assets in the year of disposal. Motor vehicles are depreciated on a Straight Line basis over 5 years A vehicle was sold in July 2018 with proceeds of 7,000 with a profit on sale of 4,000. Accumulated depreciation amounted to 21,000. Required: Based on the above information, produce a Statement of Profit or Loss for Gazontek Ltd for the year ended 31st December 2018, and a statement of Financial Position at that date