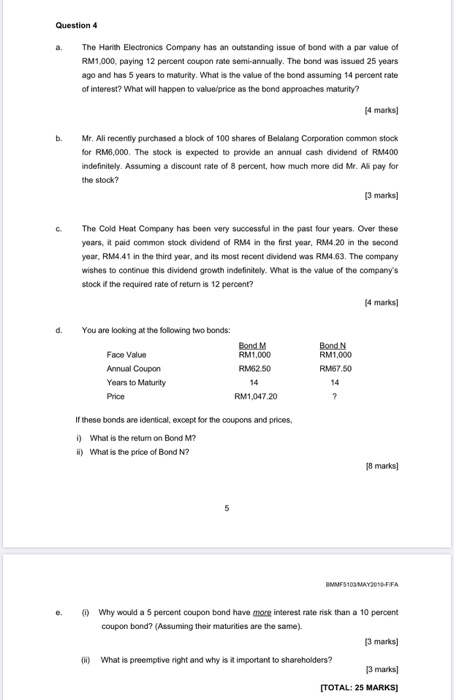

Question 4 The Harith Electronics Company has an outstanding issue of bond with a par value of a. RM1,000, paying 12 percent coupon rate semi-annually. The bond was issued 25 years ago and has 5 years to maturity. What is the value of the bond assuming 14 percent rate of interest? What will happen to value/price as the bond approaches maturity? (4 marks) b. Mr. Ali recently purchased a block of 100 shares of Belalang Corporation common stock for RM6,000. The stock is expected to provide an annual cash dividend of RM400 indefinitely. Assuming a discount rate of 8 percent, how much more did Mr. Ali pay for the stock? (3 marks) The Cold Heat Company has been very successful in the past four years. Over these C. years, it paid common stock dividend of RM4 in the first year, RM4.20 in the second year, RM4.41 in the third year, and its most recent dividend was RM4.63. The company wishes to continue this dividend growth indefinitely. What is the value of the company's stock if the required rate of return is 12 percent? (4 marks) d. You are looking at the following two bonds: Bond N RM1,000 Bond M RM1.000 Face Value Annual Coupon RM62.50 RM67.50 Years to Maturity 14 14 Price RM1,047.20 If these bonds are identical, except for the coupons and prices, i) What is the return on Bond M? What is the price of Bond N? i) 18 marks) BMMFS103MAY2010-FIFA (i) Why would a 5 percent coupon bond have more interest rate risk than a 10 percent e. coupon bond? (Assuming their maturities are the same). (3 marks) What is preemptive right and why is it important to shareholders? (i) (3 marks) [TOTAL: 25 MARKS) Question 4 The Harith Electronics Company has an outstanding issue of bond with a par value of a. RM1,000, paying 12 percent coupon rate semi-annually. The bond was issued 25 years ago and has 5 years to maturity. What is the value of the bond assuming 14 percent rate of interest? What will happen to value/price as the bond approaches maturity? (4 marks) b. Mr. Ali recently purchased a block of 100 shares of Belalang Corporation common stock for RM6,000. The stock is expected to provide an annual cash dividend of RM400 indefinitely. Assuming a discount rate of 8 percent, how much more did Mr. Ali pay for the stock? (3 marks) The Cold Heat Company has been very successful in the past four years. Over these C. years, it paid common stock dividend of RM4 in the first year, RM4.20 in the second year, RM4.41 in the third year, and its most recent dividend was RM4.63. The company wishes to continue this dividend growth indefinitely. What is the value of the company's stock if the required rate of return is 12 percent? (4 marks) d. You are looking at the following two bonds: Bond N RM1,000 Bond M RM1.000 Face Value Annual Coupon RM62.50 RM67.50 Years to Maturity 14 14 Price RM1,047.20 If these bonds are identical, except for the coupons and prices, i) What is the return on Bond M? What is the price of Bond N? i) 18 marks) BMMFS103MAY2010-FIFA (i) Why would a 5 percent coupon bond have more interest rate risk than a 10 percent e. coupon bond? (Assuming their maturities are the same). (3 marks) What is preemptive right and why is it important to shareholders? (i) (3 marks) [TOTAL: 25 MARKS)