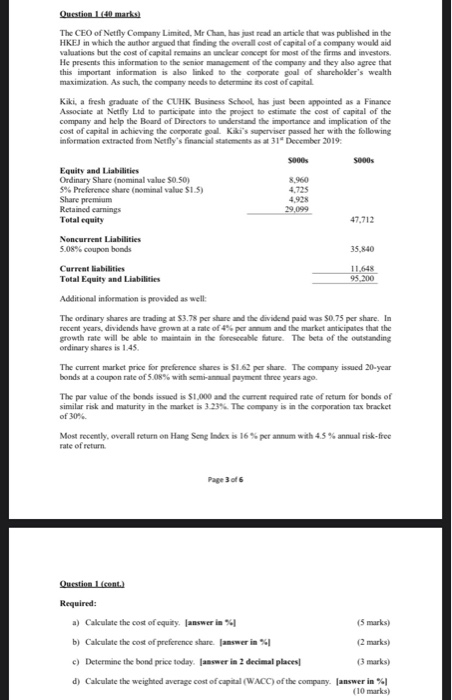

Question (40 marks) The CEO of Netfly Company Limited, Mr Chan, has just read an article that was published in the HKEJ in which the author argued that finding the overall cost of capital of a company would aid valuations but the cost of capital remains an unclear concept for most of the firms and investors. He presents this information to the senior management of the company and they also agree that this important information is also linked to the corporate goal of shareholder's wealth maximization. As such, the company needs to determine its cost of capital Kiki, a fresh graduate of the CUHK Business School has just been appointed as a Finance Associate at Netfly Ltd to participate into the project to estimate the cost of capital of the company and help the Board of Directors to understand the importance and implication of the cost of capital in achieving the corporate goal. Kiki's superviser passed her with the following information extracted from Netfly's financial statements as at 31 December 2019 soos Soos Equity and Liabilities Ordinary Share (nominal value $0.50) 8.960 5% Preference share (nominal value $1.5) 4.725 Share premium 4.928 Retained camnings 29.099 Total equity 47,712 Noncurrent Liabilities 5.08% coupon bonds 35.840 Current liabilities 11.648 Total Equity and Liabilities 95,200 Additional information is provided as well: The ordinary shares are trading at $3.78 per share and the dividend paid was $0.75 per share. In recent years, dividends have grown at a rate of 2% per annum and the market anticipates that the growth rate will be able to maintain in the foreseeable future. The beta of the outstanding ordinary shares is 145. The current market price for preference shares is $1.62 per share. The company issued 20-year bonds at a coupon rate of 5.08% with semi-annual payment three years ago. The par value of the bonds issued is $1,000 and the current required rate of return for bonds of similar risk and maturity in the market is 3.23%. The company is in the corporation tax bracket of 30% Most recently, overall return on Hang Seng Index is 16% per annum with 4.5% annual risk-free rate of return Page 3 of 6 Question Licenta) Required: a) Calculate the cost of cquity. (answer in % (5 marks) b) Cakulate the cost of preference share. Janswerin (2 marks) c) Determine the bond price today. (answer in 2 decimal places (3 marks) d) Calculate the weighted average cost of capial (WACC) of the company. (answer in (10 marks)