Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 40 Which of the following could result in a corporation having more than 100% of its income subject to state taxation? All of these

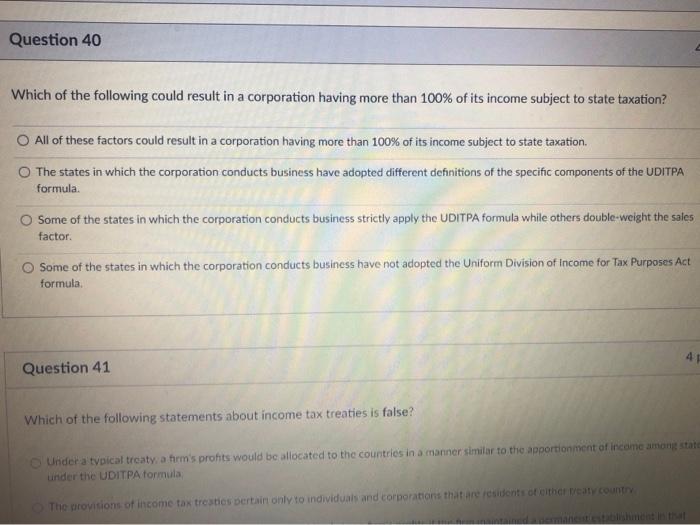

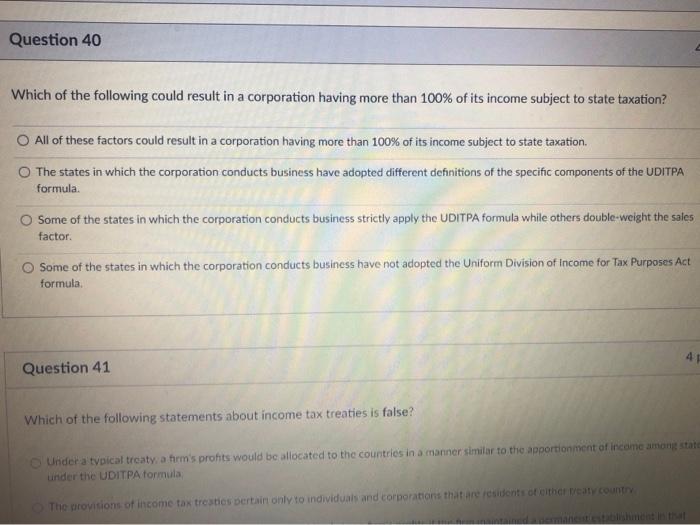

Question 40 Which of the following could result in a corporation having more than 100% of its income subject to state taxation? All of these factors could result in a corporation having more than 100% of its income subject to state taxation The states in which the corporation conducts business have adopted different definitions of the specific components of the UDITPA formula Some of the states in which the corporation conducts business strictly apply the UDITPA formula while others double-weight the sales factor Some of the states in which the corporation conducts business have not adopted the Uniform Division of income for Tax Purposes Act formula Question 41 Which of the following statements about income tax treaties is false? Under a typical treaty, a hrm's prohts would be allocated to the countries in a manner similar to the apportionment of income among state under the UDITPA formula The provisions of income tax treaties pertain only to individuals and corporations that are residents of the treaty country

Question 40 Which of the following could result in a corporation having more than 100% of its income subject to state taxation? All of these factors could result in a corporation having more than 100% of its income subject to state taxation The states in which the corporation conducts business have adopted different definitions of the specific components of the UDITPA formula Some of the states in which the corporation conducts business strictly apply the UDITPA formula while others double-weight the sales factor Some of the states in which the corporation conducts business have not adopted the Uniform Division of income for Tax Purposes Act formula Question 41 Which of the following statements about income tax treaties is false? Under a typical treaty, a hrm's prohts would be allocated to the countries in a manner similar to the apportionment of income among state under the UDITPA formula The provisions of income tax treaties pertain only to individuals and corporations that are residents of the treaty country

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started