Answered step by step

Verified Expert Solution

Question

1 Approved Answer

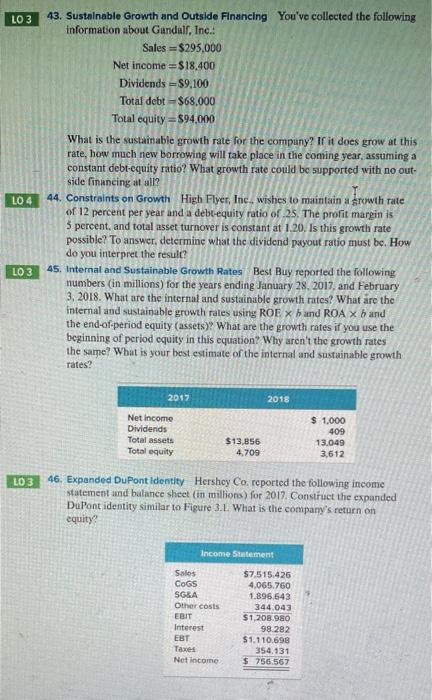

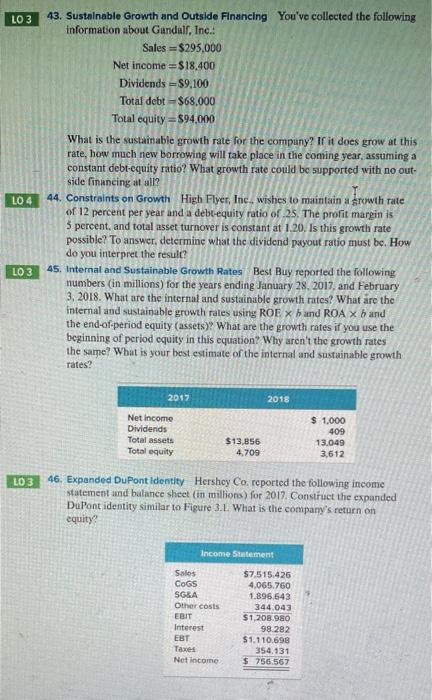

question 43 LO 3 43. Sustainable Growth and Outside Financing You've collected the following information about Gandalr, Inc.: Sales = $295,000 Net income $18.400 Dividends

question 43

LO 3 43. Sustainable Growth and Outside Financing You've collected the following information about Gandalr, Inc.: Sales = $295,000 Net income $18.400 Dividends $9,100 Total debt - $68,000 Total equity =$94.000 What is the sustainable growth rate for the company? If it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? What growth rate could be supported with no out- side financing at all? 44. Constraints on Growth High Flyer, Inc., wishes to maintain a growth rate of 12 percent per year and a debt-equity ratio of 25. The profit margin is 5 percent, and total asset turnover is constant at 1.20. Is this growth rate possible? To answer, determine what the dividend payout ratio must be. How do you interpret the result? 45. Internal and Sustainable Growth Rates Best Buy reported the following numbers (in millions) for the years ending January 28, 2017 and February 3, 2018. What are the internal and sustainable growth rates? What are the internal and sustainable growth rates using ROE X band ROA X b and the end-of-period equity (assets)? What are the growth rates if you use the beginning of period equity in this equation? Why aren't the growth rates the same? What is your best estimate of the internal and sustainable growth rates? LO 4 LO 3 2017 2018 Net Income Dividends Total assets Total equity $13.856 4.709 $ 1.000 409 13.049 3,612 LO 3 46. Expanded DuPont Identity Hershey Co. reported the following income statement and balance sheet (in millions) for 2017. Construct the expanded DuPont identity similar to Figure 3.L. What is the company's return on equity Income Statement Sales COGS SGRA Other costs EBIT Interest EBT Taxes Net Income $7,515,425 4,065.760 1.896.643 344.043 $1.208.980 98.282 $1.110.698 354.131 $ 756.567

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started