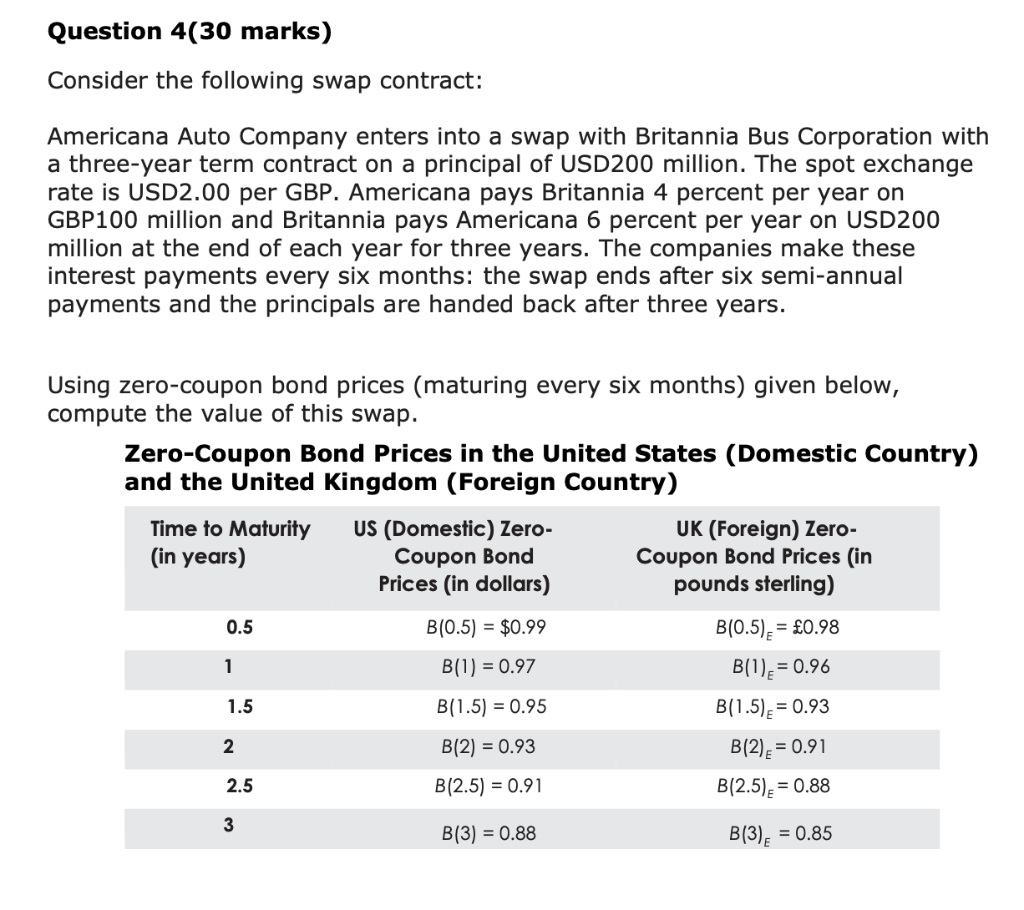

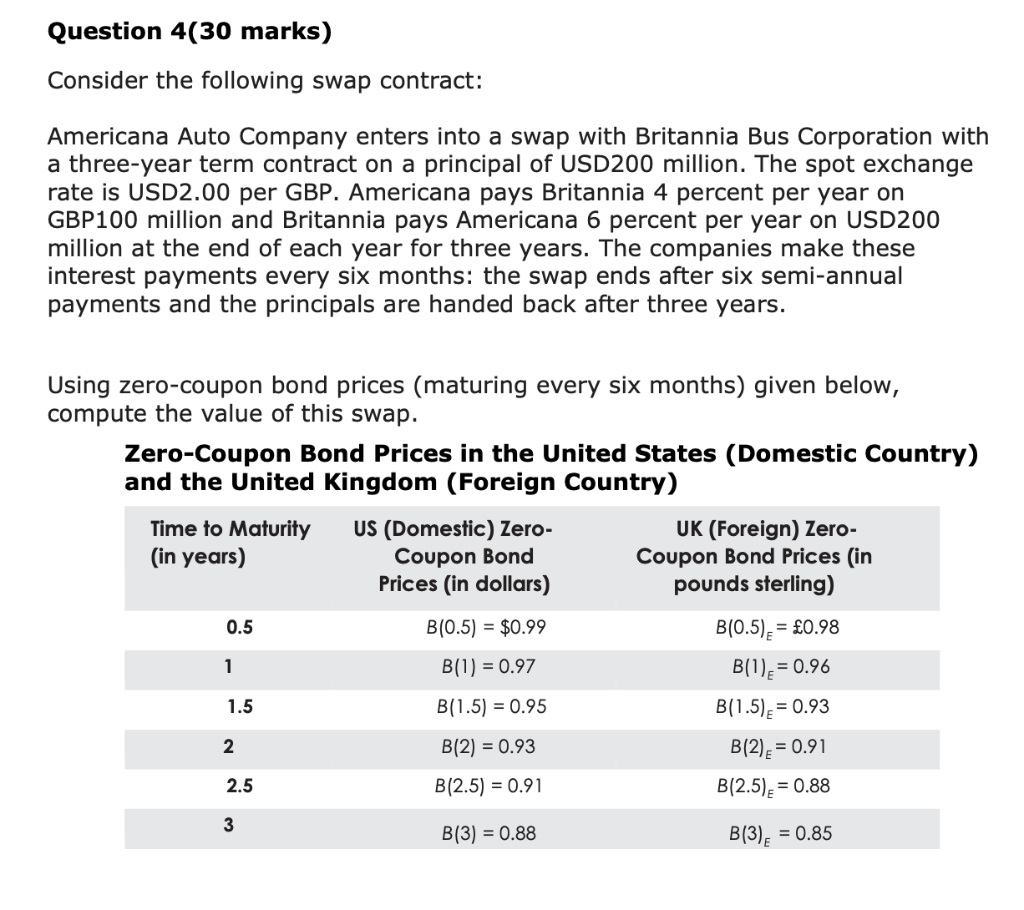

Question 4(30 marks) Consider the following swap contract: Americana Auto Company enters into a swap with Britannia Bus Corporation with a three-year term contract on a principal of USD 200 million. The spot exchange rate is USD2.00 per GBP. Americana pays Britannia 4 percent per year on GBP100 million and Britannia pays Americana 6 percent per year on USD200 million at the end of each year for three years. The companies make these interest payments every six months: the swap ends after six semi-annual payments and the principals are handed back after three years. Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap. Zero-Coupon Bond Prices in the United States (Domestic Country) and the United Kingdom (Foreign Country) Time to Maturity US (Domestic) Zero- UK (Foreign) Zero- (in years) Coupon Bond Coupon Bond Prices (in Prices (in dollars) pounds sterling) 0.5 B(0.5) = $0.99 B(0.5), = 0.98 B(1) = 0.97 B(1), = 0.96 1.5 B(1.5) = 0.95 B(1.5) = 0.93 B(2) = 0.93 B(2) = 0.91 2.5 B(2.5) = 0.91 B(2.5) = 0.88 1 2 3 B(3) = 0.88 B(3) = 0.85 Question 4(30 marks) Consider the following swap contract: Americana Auto Company enters into a swap with Britannia Bus Corporation with a three-year term contract on a principal of USD 200 million. The spot exchange rate is USD2.00 per GBP. Americana pays Britannia 4 percent per year on GBP100 million and Britannia pays Americana 6 percent per year on USD200 million at the end of each year for three years. The companies make these interest payments every six months: the swap ends after six semi-annual payments and the principals are handed back after three years. Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap. Zero-Coupon Bond Prices in the United States (Domestic Country) and the United Kingdom (Foreign Country) Time to Maturity US (Domestic) Zero- UK (Foreign) Zero- (in years) Coupon Bond Coupon Bond Prices (in Prices (in dollars) pounds sterling) 0.5 B(0.5) = $0.99 B(0.5), = 0.98 B(1) = 0.97 B(1), = 0.96 1.5 B(1.5) = 0.95 B(1.5) = 0.93 B(2) = 0.93 B(2) = 0.91 2.5 B(2.5) = 0.91 B(2.5) = 0.88 1 2 3 B(3) = 0.88 B(3) = 0.85