Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 44 Jarrett is buying all the assets and assuming all the liabilities of Suzie Corporation. The following information is available for Suzie's at the

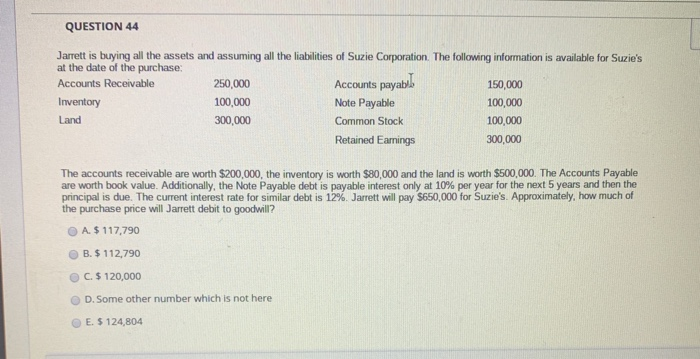

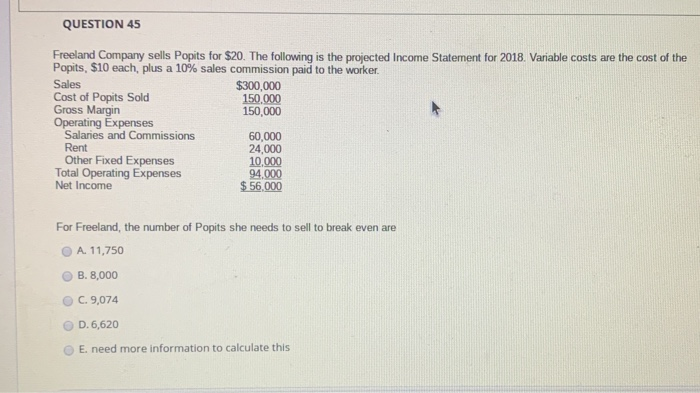

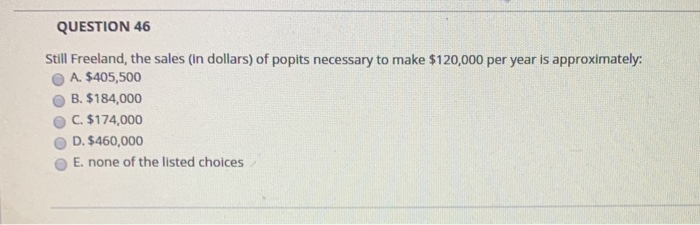

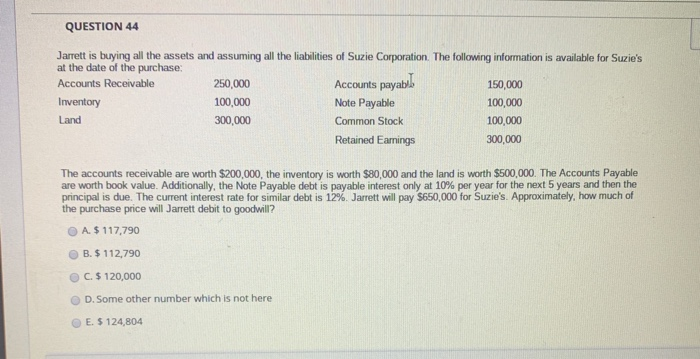

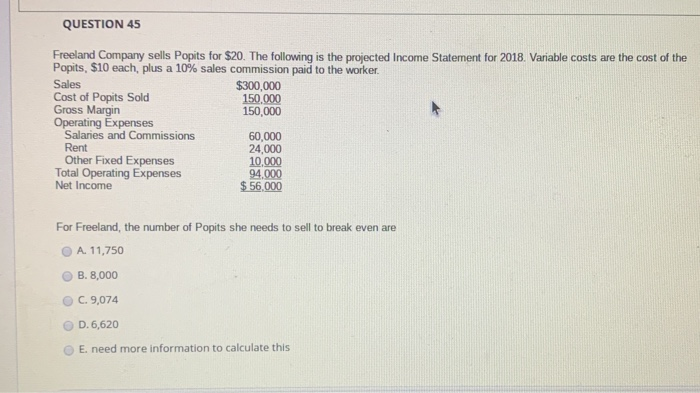

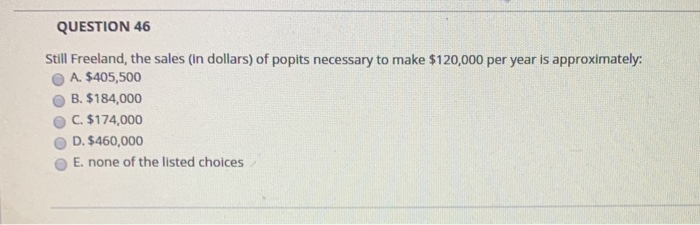

QUESTION 44 Jarrett is buying all the assets and assuming all the liabilities of Suzie Corporation. The following information is available for Suzie's at the date of the purchase: Accounts Receivable 250,000 Accounts payable 150,000 Inventory 100,000 Note Payable 100,000 Land 300,000 Common Stock 100,000 Retained Earnings 300,000 The accounts receivable are worth $200,000, the inventory is worth $80,000 and the land is worth $500,000. The Accounts Payable are worth book value. Additionally, the Note Payable debt is payable interest only at 10% per year for the next 5 years and then the principal is due. The current interest rate for similar debt is 12% Jarrett will pay $650,000 for Suzie's. Approximately, how much of the purchase price will Jarrett debit to goodwill? A. $ 117,790 B. $ 112,790 C. $ 120,000 D. Some other number which is not here E. $ 124,804 QUESTION 45 Freeland Company sells Popits for $20. The following is the projected Income Statement for 2018. Variable costs are the cost of the Popits, $10 each, plus a 10% sales commission paid to the worker. Sales $300,000 Cost of Popits Sold 150.000 Gross Margin 150,000 Operating Expenses Salaries and Commissions 60,000 Rent 24,000 Other Fixed Expenses 10,000 Total Operating Expenses 94.000 Net Income $ 56,000 For Freeland, the number of Popits she needs to sell to break even are A. 11,750 B. 8,000 C. 9,074 D. 6,620 E need more information to calculate this QUESTION 46 Still Freeland, the sales (in dollars) of popits necessary to make $120,000 per year is approximately: A. $405,500 B. $184,000 C. $174,000 D. $460,000 E. none of the listed choices

QUESTION 44 Jarrett is buying all the assets and assuming all the liabilities of Suzie Corporation. The following information is available for Suzie's at the date of the purchase: Accounts Receivable 250,000 Accounts payable 150,000 Inventory 100,000 Note Payable 100,000 Land 300,000 Common Stock 100,000 Retained Earnings 300,000 The accounts receivable are worth $200,000, the inventory is worth $80,000 and the land is worth $500,000. The Accounts Payable are worth book value. Additionally, the Note Payable debt is payable interest only at 10% per year for the next 5 years and then the principal is due. The current interest rate for similar debt is 12% Jarrett will pay $650,000 for Suzie's. Approximately, how much of the purchase price will Jarrett debit to goodwill? A. $ 117,790 B. $ 112,790 C. $ 120,000 D. Some other number which is not here E. $ 124,804 QUESTION 45 Freeland Company sells Popits for $20. The following is the projected Income Statement for 2018. Variable costs are the cost of the Popits, $10 each, plus a 10% sales commission paid to the worker. Sales $300,000 Cost of Popits Sold 150.000 Gross Margin 150,000 Operating Expenses Salaries and Commissions 60,000 Rent 24,000 Other Fixed Expenses 10,000 Total Operating Expenses 94.000 Net Income $ 56,000 For Freeland, the number of Popits she needs to sell to break even are A. 11,750 B. 8,000 C. 9,074 D. 6,620 E need more information to calculate this QUESTION 46 Still Freeland, the sales (in dollars) of popits necessary to make $120,000 per year is approximately: A. $405,500 B. $184,000 C. $174,000 D. $460,000 E. none of the listed choices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started