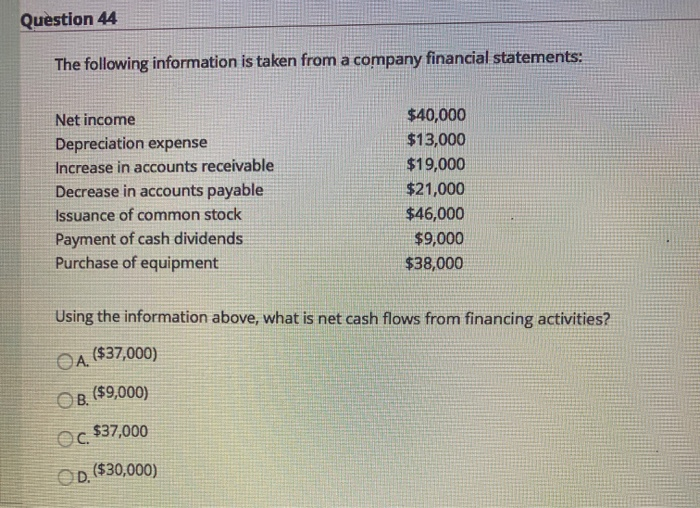

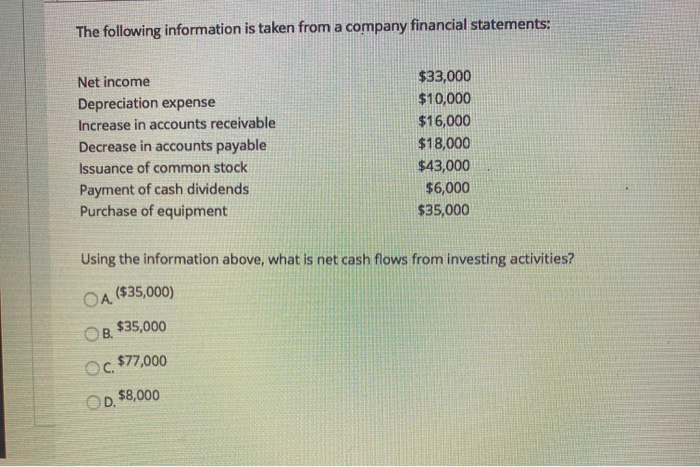

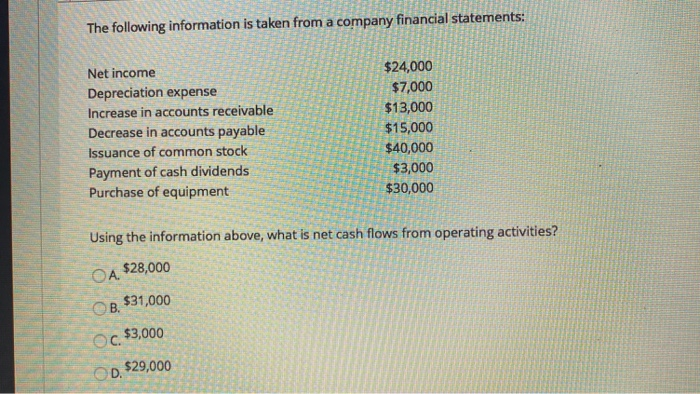

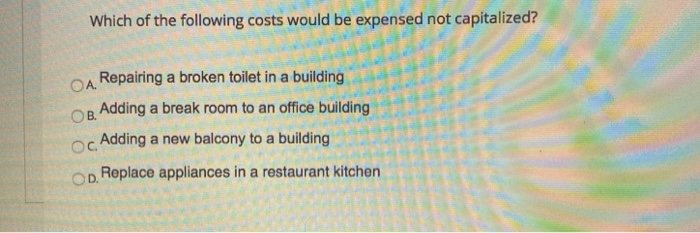

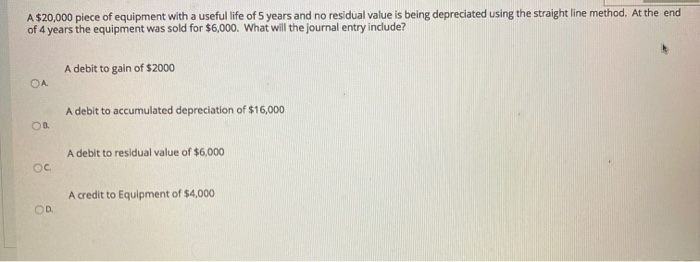

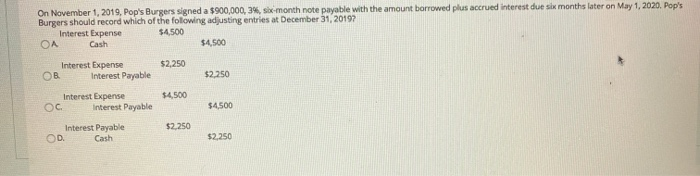

Question 44 The following information is taken from a company financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of common stock Payment of cash dividends Purchase of equipment $40,000 $13,000 $19,000 $21,000 $46,000 $9,000 $38,000 Using the information above, what is net cash flows from financing activities? . ($37,000) . ($9,000) c. $37,000 D. ($30,000) The following information is taken from a company financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of common stock Payment of cash dividends Purchase of equipment $33,000 $10,000 $16,000 $18,000 $43,000 $6,000 $35,000 Using the information above, what is net cash flows from investing activities? OA ($35,000) . $35,000 Oc. $77,000 D. $8,000 The following information is taken from a company financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of common stock Payment of cash dividends Purchase of equipment $24,000 $7,000 $13,000 $15,000 $40,000 $3,000 $30,000 Using the information above, what is net cash flows from operating activities? A. $28,000 . $31,000 c. $3,000 D. $29,000 Which of the following costs would be expensed not capitalized? . Repairing a broken toilet in a building OB. Adding a break room to an office building oc Adding a new balcony to a building Op. Replace appliances in a restaurant kitchen A $20,000 piece of equipment with a useful life of 5 years and no residual value is being depreciated using the straight line method. At the end of 4 years the equipment was sold for $6,000. What will the journal entry include? A debit to gain of $2000 A debit to accumulated depreciation of $16,000 On A debit to residual value of $6,000 A credit to Equipment of $4,000 OD On November 1, 2019, Pop's Burgers signed a $900,000, 3%, six-month note payable with the amount borrowed plus accrued interest due six months later on May 1, 2020. Pop's Burgers should record which of the following adjusting entries at December 31, 2019? Interest Expense $4,500 $4,500 Interest Expense $2,250 OB Interest Payable $2.250 Cash $4.500 Interest Expense . Interest Payable $4.500 $2.250 Interest Payable OD Cash $2.250