Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 46 Which of the following is true regarding life insurance policy dividends? Dividends represent a return of excess premium when mortality and expenses are

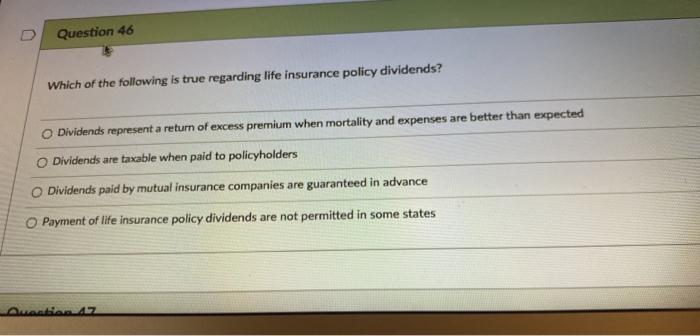

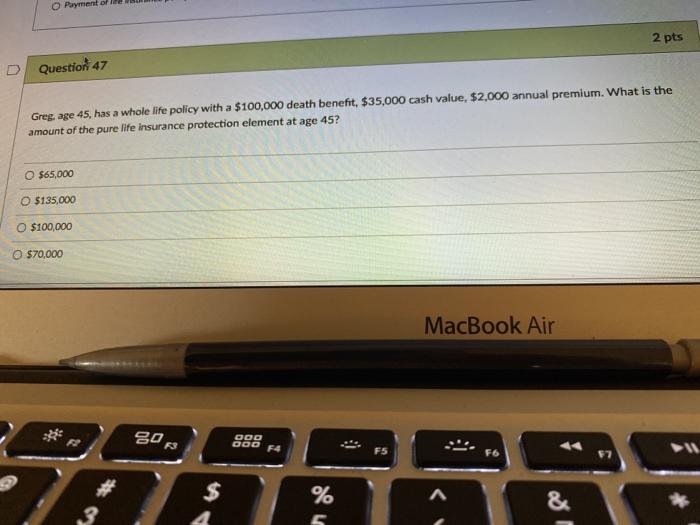

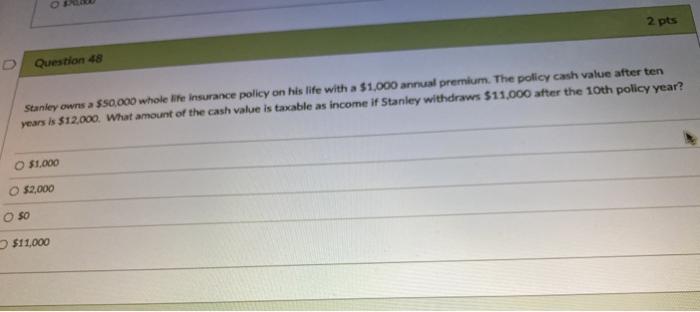

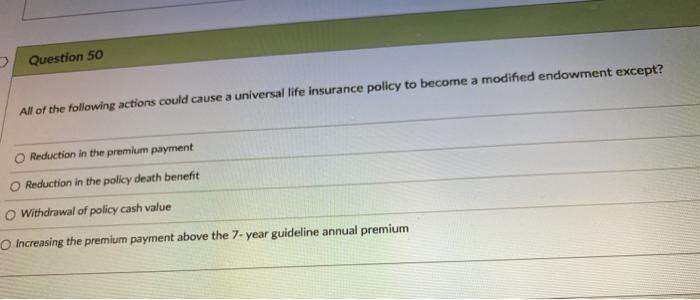

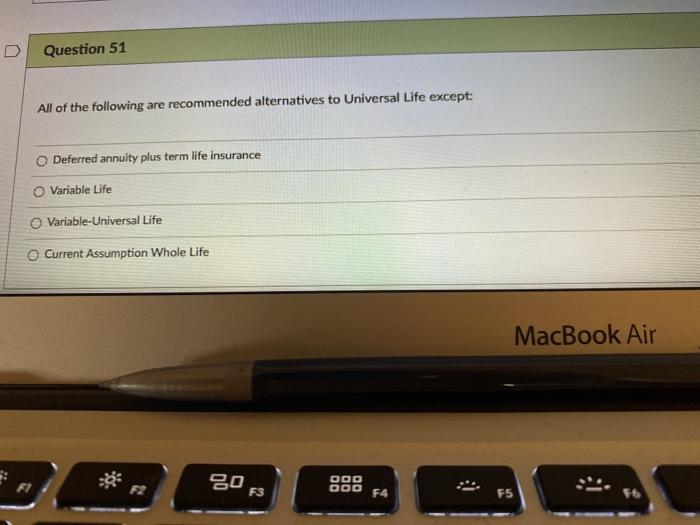

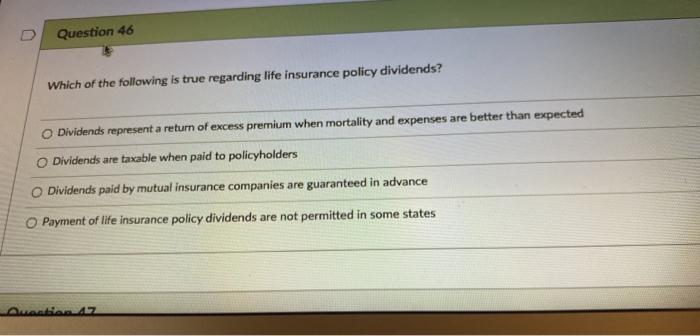

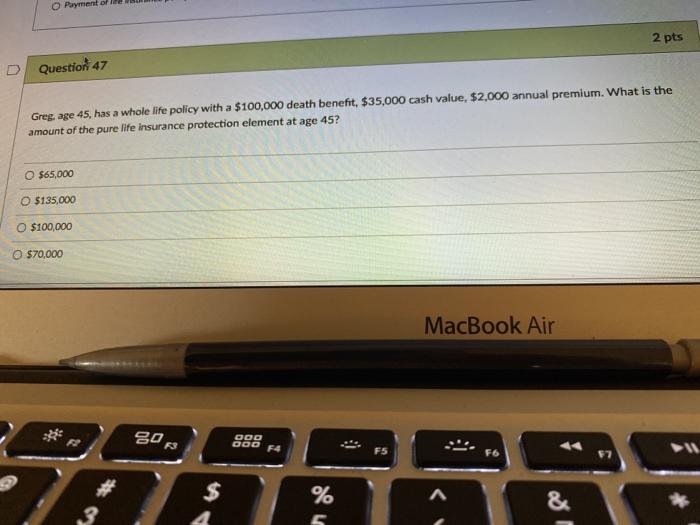

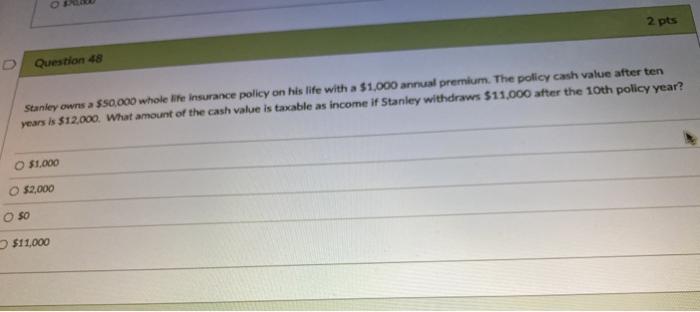

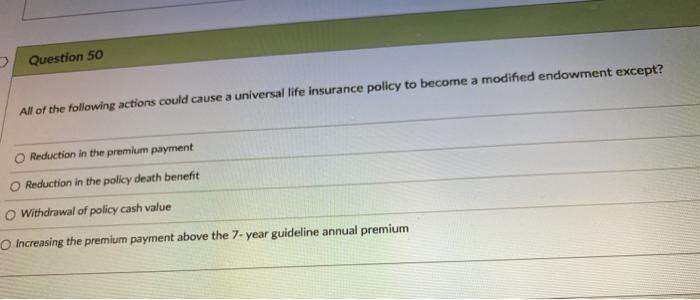

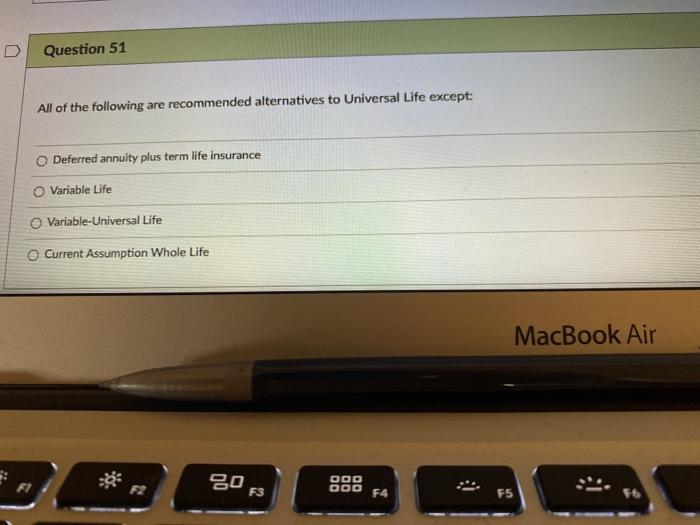

Question 46 Which of the following is true regarding life insurance policy dividends? Dividends represent a return of excess premium when mortality and expenses are better than expected Dividends are taxable when paid to policyholders Dividends paid by mutual insurance companies are guaranteed in advance Payment of life insurance policy dividends are not permitted in some states Questio. 47 O Payment of le 2 pts Question 47 Greg, age 45, has a whole life policy with a $100,000 death benefit, $35,000 cash value, $2,000 annual premium. What is the amount of the pure life insurance protection element at age 45? $65,000 O $135,000 $100,000 $70,000 MacBook Air gos ODD F4 F5 F6 % 5 & 3 2 pts D Question 48 Stanley owns a $50,000 whole life insurance policy on his life with a $1.000 annual premium. The policy cash value after ten years is $12,000. What amount of the cash value is taxable as income if Stanley withdraws $11,000 after the 10th policy year? $1.000 O $2,000 SO $11,000 Question 50 All of the following actions could cause a universal life insurance policy to become a modified endowment except? Reckction in the premium payment Reduction in the policy death benefit Withdrawal of policy cash value Increasing the premium payment above the 7-year guideline annual premium Question 51 All of the following are recommended alternatives to Universal Life except: Deferred annuity plus term life insurance O Variable Life Variable-Universal Life Current Assumption Whole Life MacBook Air 20 F3 OOO OOO F4 F5

Question 46 Which of the following is true regarding life insurance policy dividends? Dividends represent a return of excess premium when mortality and expenses are better than expected Dividends are taxable when paid to policyholders Dividends paid by mutual insurance companies are guaranteed in advance Payment of life insurance policy dividends are not permitted in some states Questio. 47 O Payment of le 2 pts Question 47 Greg, age 45, has a whole life policy with a $100,000 death benefit, $35,000 cash value, $2,000 annual premium. What is the amount of the pure life insurance protection element at age 45? $65,000 O $135,000 $100,000 $70,000 MacBook Air gos ODD F4 F5 F6 % 5 & 3 2 pts D Question 48 Stanley owns a $50,000 whole life insurance policy on his life with a $1.000 annual premium. The policy cash value after ten years is $12,000. What amount of the cash value is taxable as income if Stanley withdraws $11,000 after the 10th policy year? $1.000 O $2,000 SO $11,000 Question 50 All of the following actions could cause a universal life insurance policy to become a modified endowment except? Reckction in the premium payment Reduction in the policy death benefit Withdrawal of policy cash value Increasing the premium payment above the 7-year guideline annual premium Question 51 All of the following are recommended alternatives to Universal Life except: Deferred annuity plus term life insurance O Variable Life Variable-Universal Life Current Assumption Whole Life MacBook Air 20 F3 OOO OOO F4 F5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started