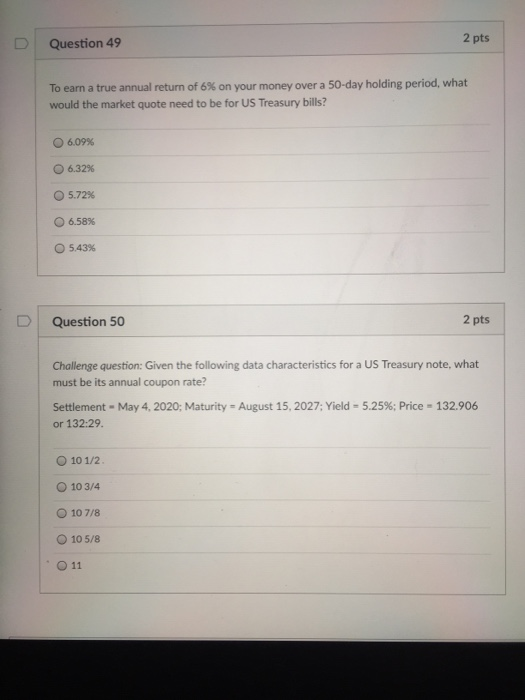

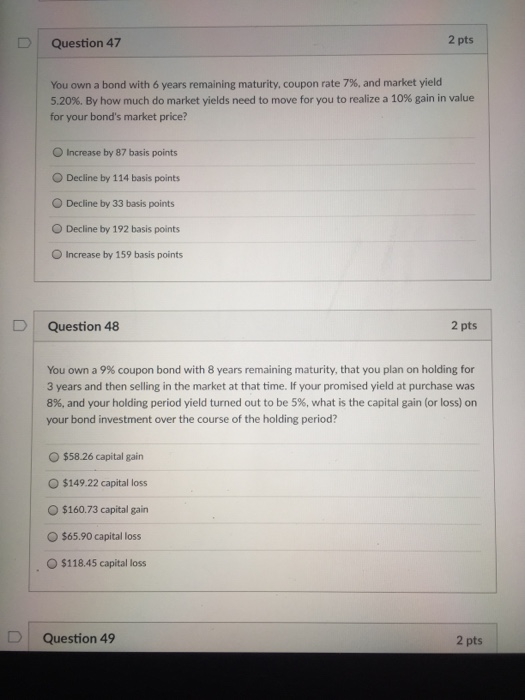

Question 49 2 pts To earn a true annual return of 6% on your money over a 50-day holding period, what would the market quote need to be for US Treasury bills? 06.09% 6.32% 5.72% 6.5896 O 5.43% Question 50 2 pts Challenge question: Given the following data characteristics for a US Treasury note, what must be its annual coupon rate? Settlement - May 4, 2020; Maturity - August 15, 2027; Yield - 5.25%; Price = 132.906 or 132:29. O 10 1/2 010 3/4 O 10 7/8 10 5/8 O 11 Question 47 2 pts You own a bond with 6 years remaining maturity.coupon rate 7%, and market yield 5.20%. By how much do market yields need to move for you to realize a 10% gain in value for your bond's market price? Increase by 87 basis points Decline by 114 basis points Decline by 33 basis points Decline by 192 basis points Increase by 159 basis points Question 48 2 pts You own a 9% coupon bond with 8 years remaining maturity, that you plan on holding for 3 years and then selling in the market at that time. If your promised yield at purchase was 8%, and your holding period yield turned out to be 5%, what is the capital gain (or loss) on your bond investment over the course of the holding period? $58.26 capital gain $149.22 capital loss $160.73 capital gain $65.90 capital loss $118.45 capital loss Question 49 2 pts Question 49 2 pts To earn a true annual return of 6% on your money over a 50-day holding period, what would the market quote need to be for US Treasury bills? 06.09% 6.32% 5.72% 6.5896 O 5.43% Question 50 2 pts Challenge question: Given the following data characteristics for a US Treasury note, what must be its annual coupon rate? Settlement - May 4, 2020; Maturity - August 15, 2027; Yield - 5.25%; Price = 132.906 or 132:29. O 10 1/2 010 3/4 O 10 7/8 10 5/8 O 11 Question 47 2 pts You own a bond with 6 years remaining maturity.coupon rate 7%, and market yield 5.20%. By how much do market yields need to move for you to realize a 10% gain in value for your bond's market price? Increase by 87 basis points Decline by 114 basis points Decline by 33 basis points Decline by 192 basis points Increase by 159 basis points Question 48 2 pts You own a 9% coupon bond with 8 years remaining maturity, that you plan on holding for 3 years and then selling in the market at that time. If your promised yield at purchase was 8%, and your holding period yield turned out to be 5%, what is the capital gain (or loss) on your bond investment over the course of the holding period? $58.26 capital gain $149.22 capital loss $160.73 capital gain $65.90 capital loss $118.45 capital loss Question 49 2 pts