question 4b-9

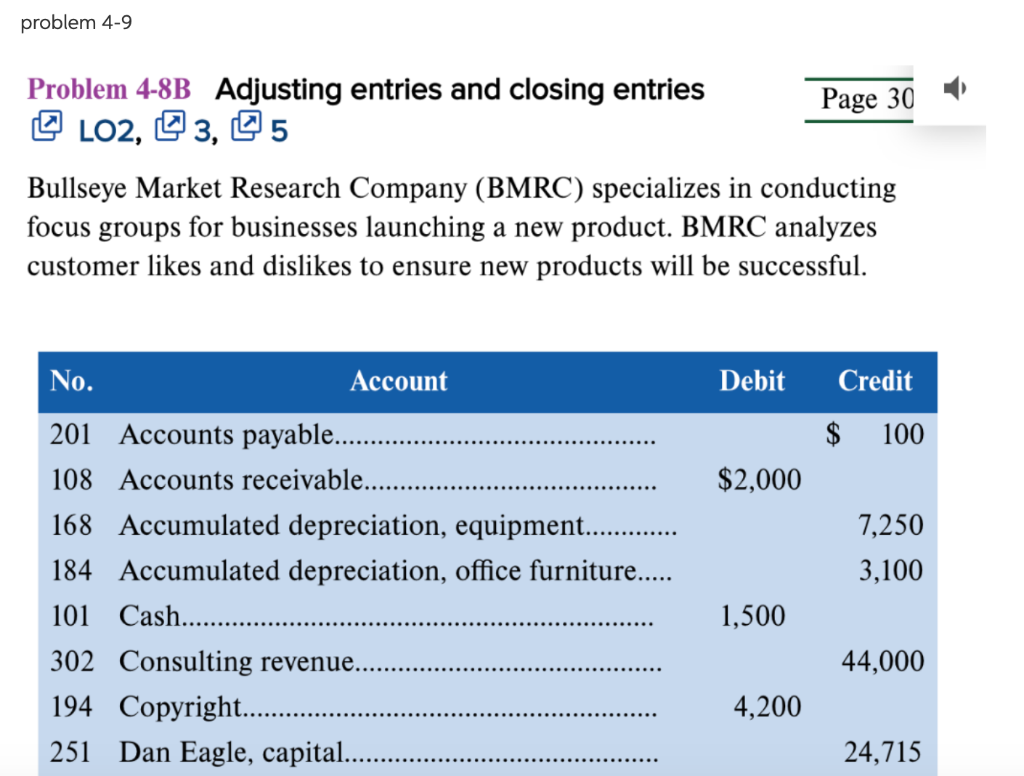

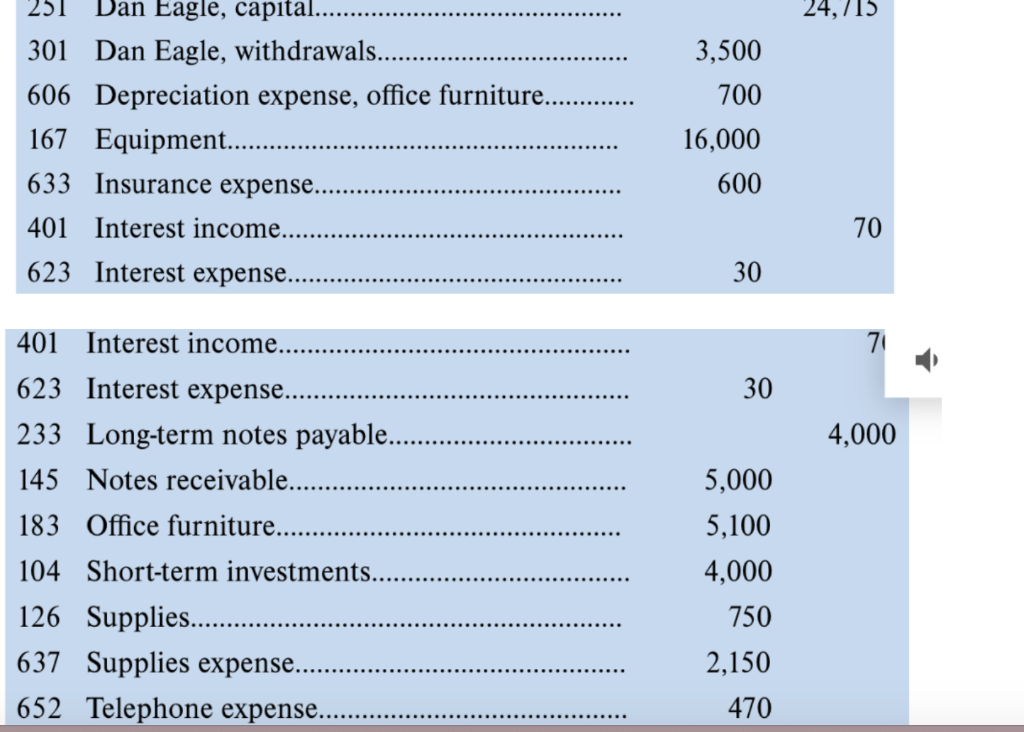

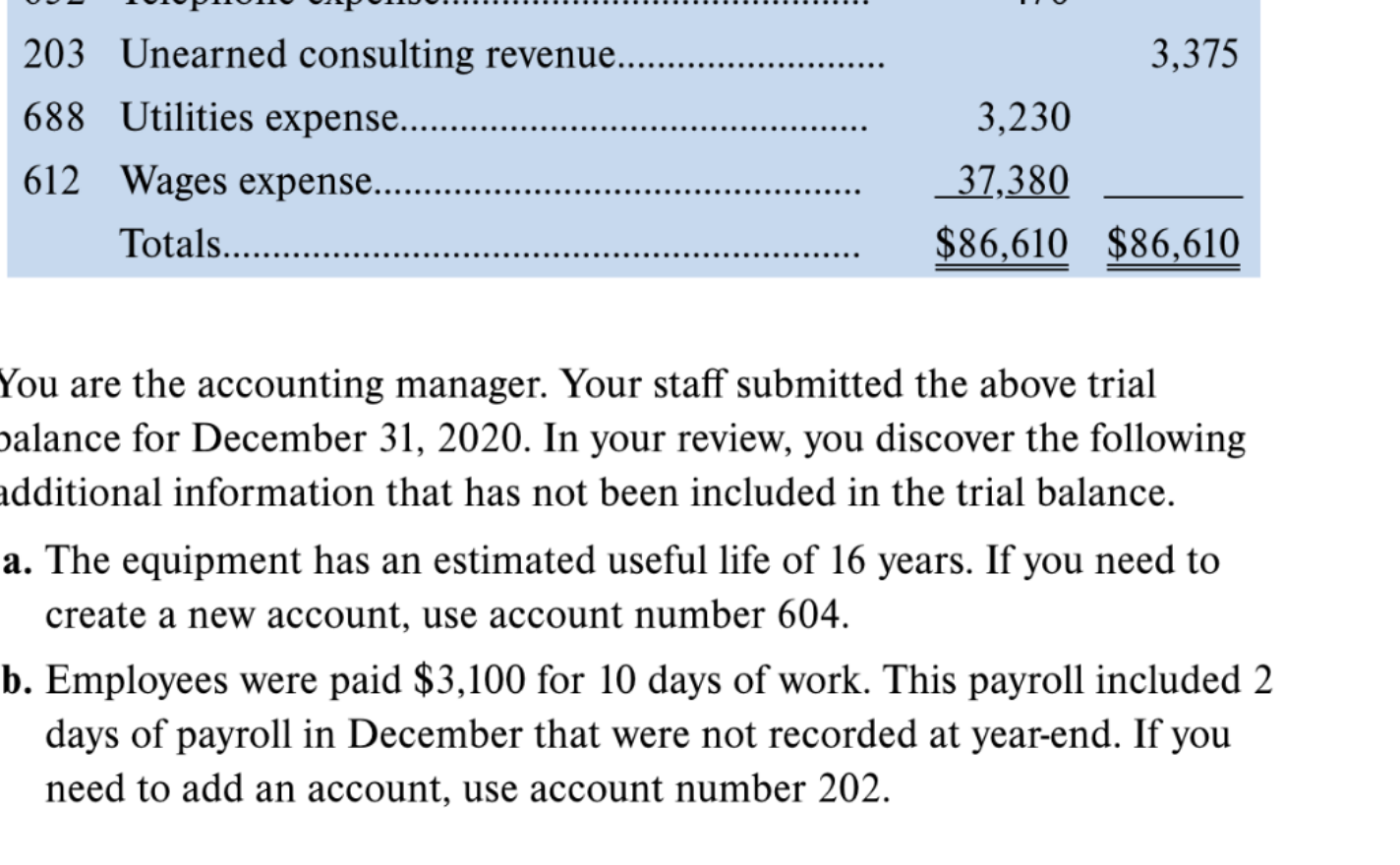

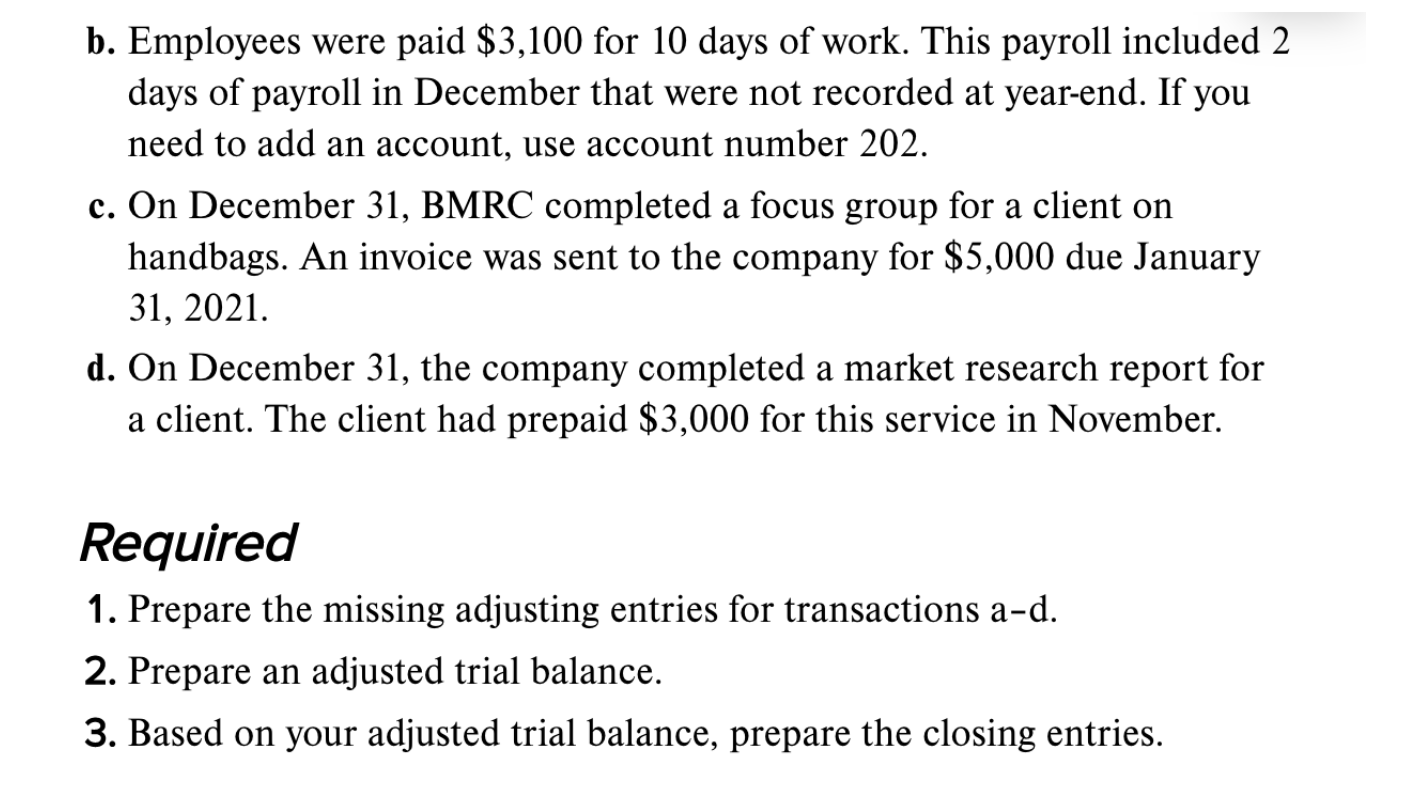

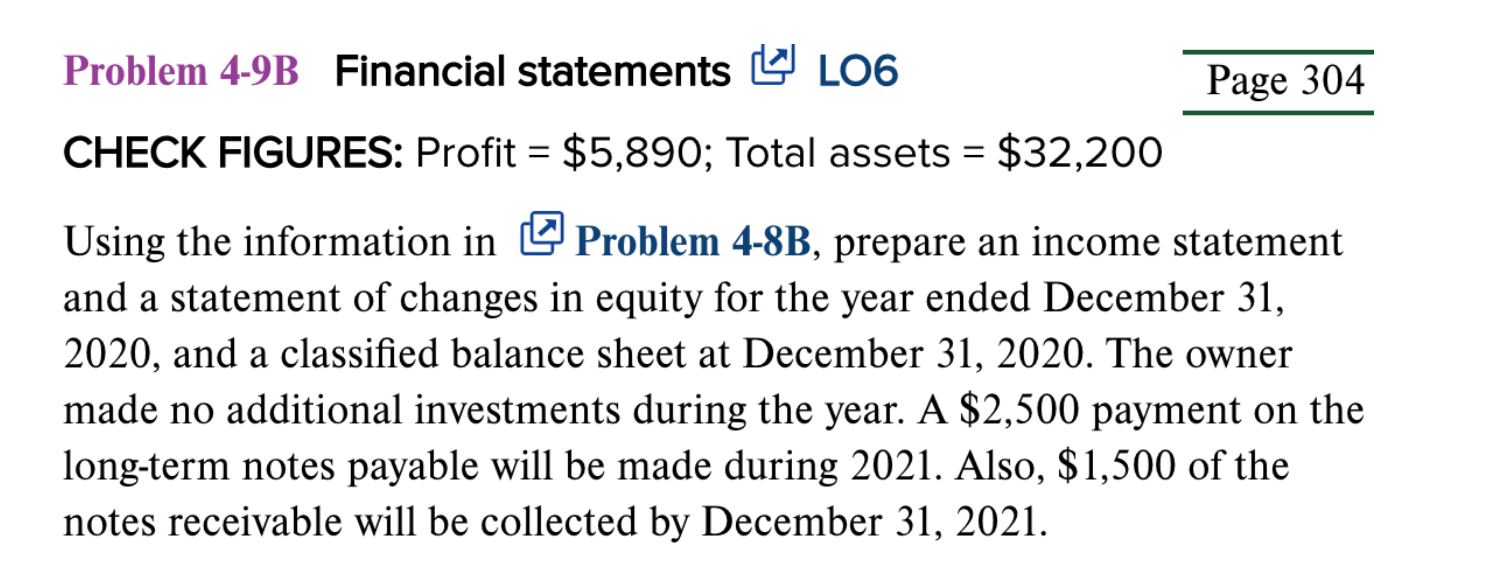

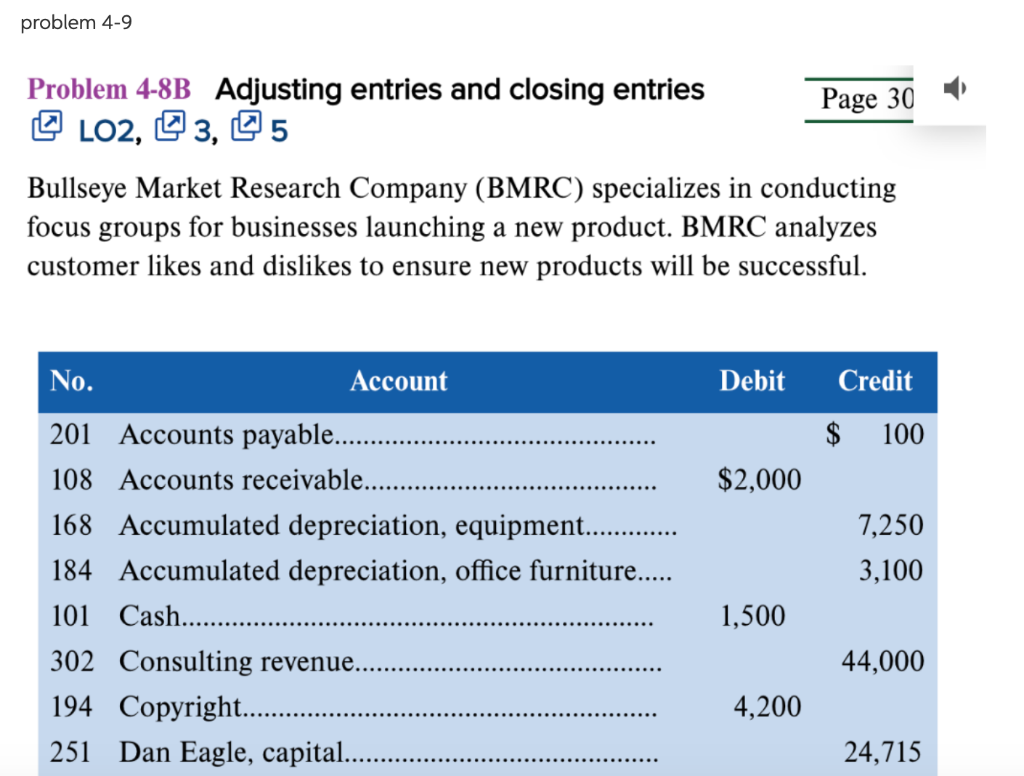

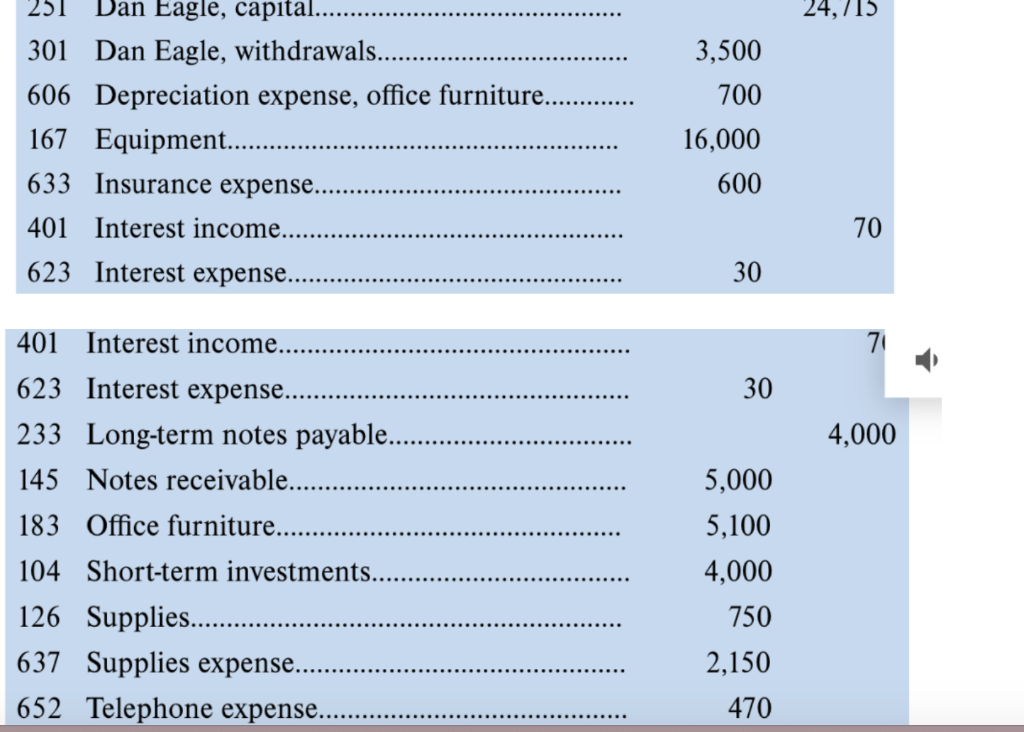

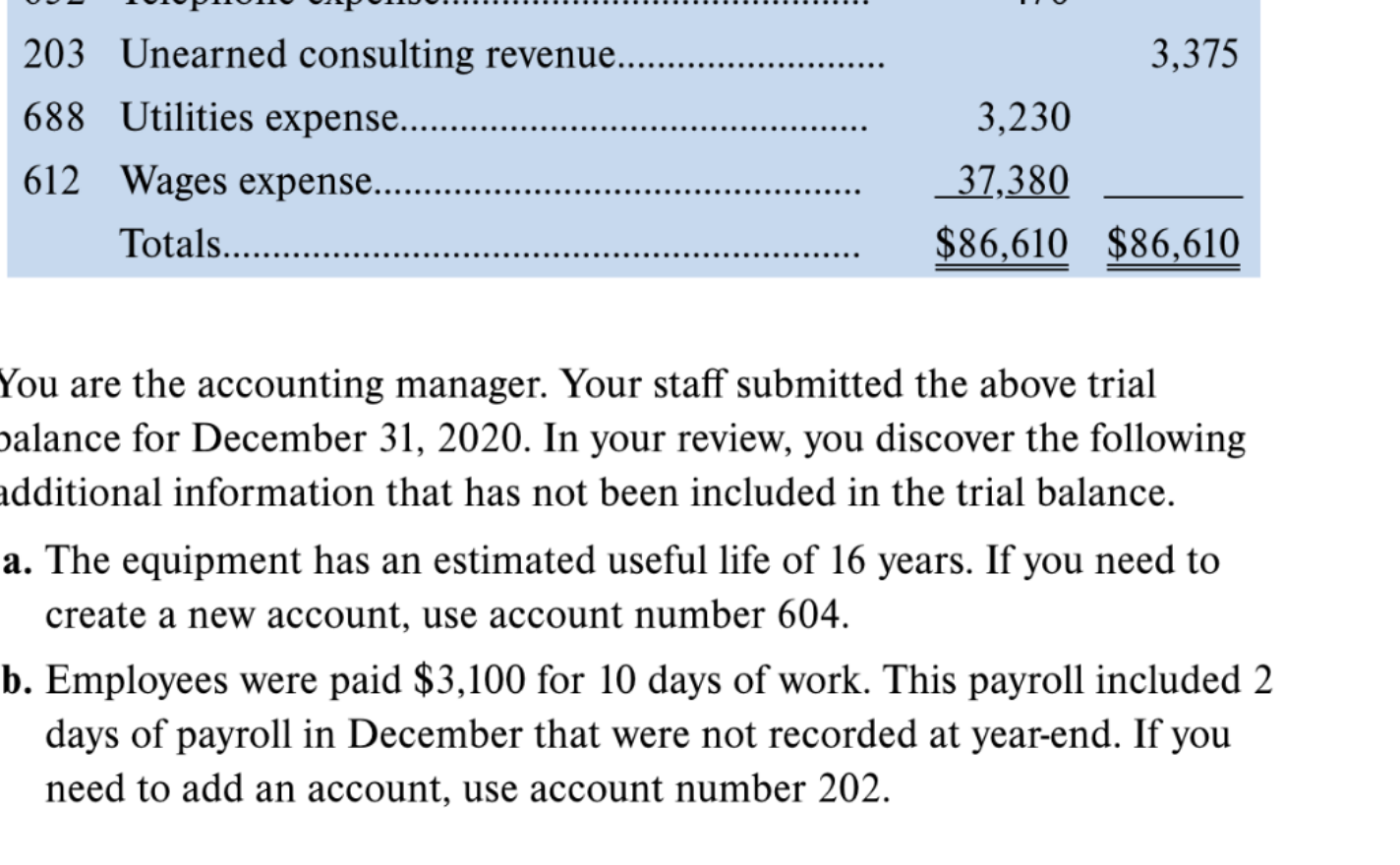

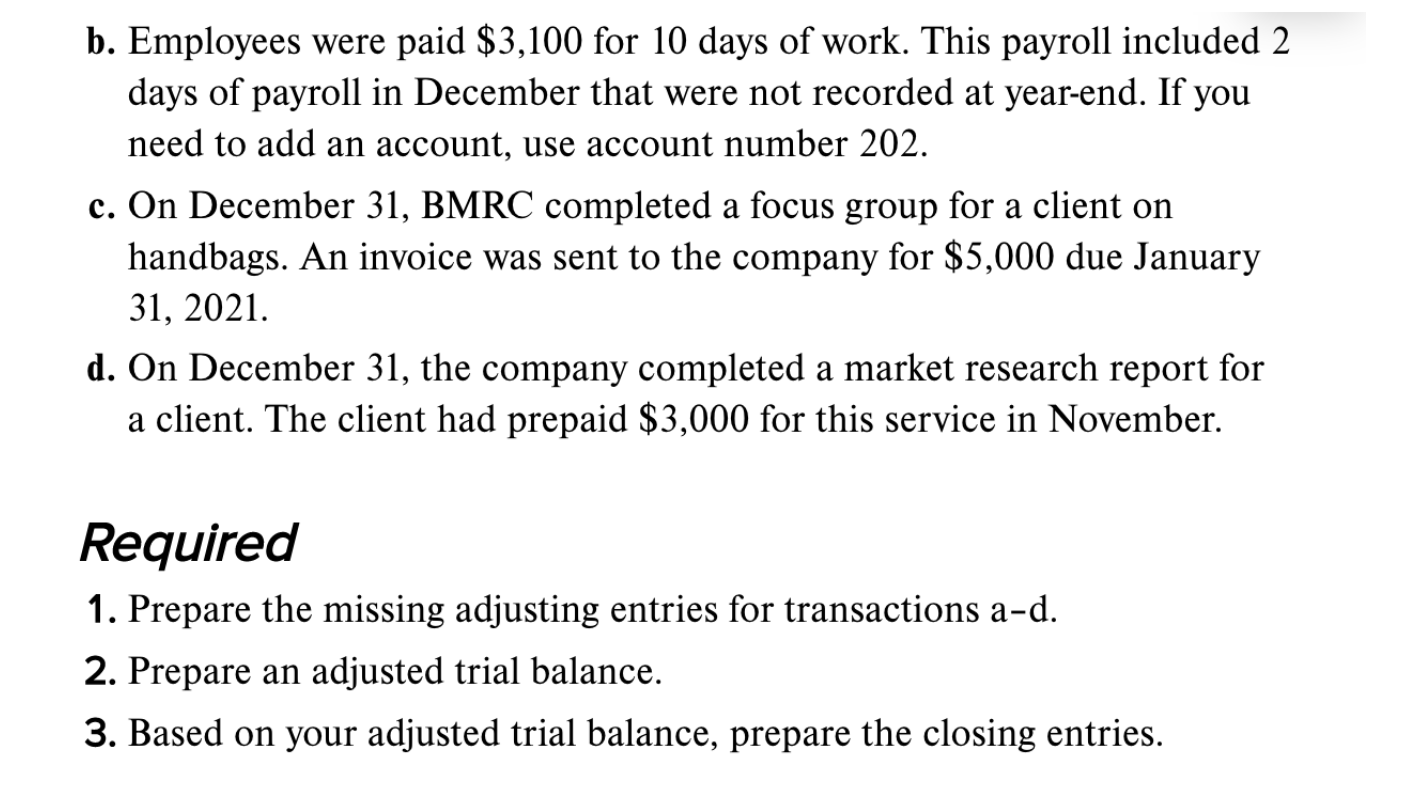

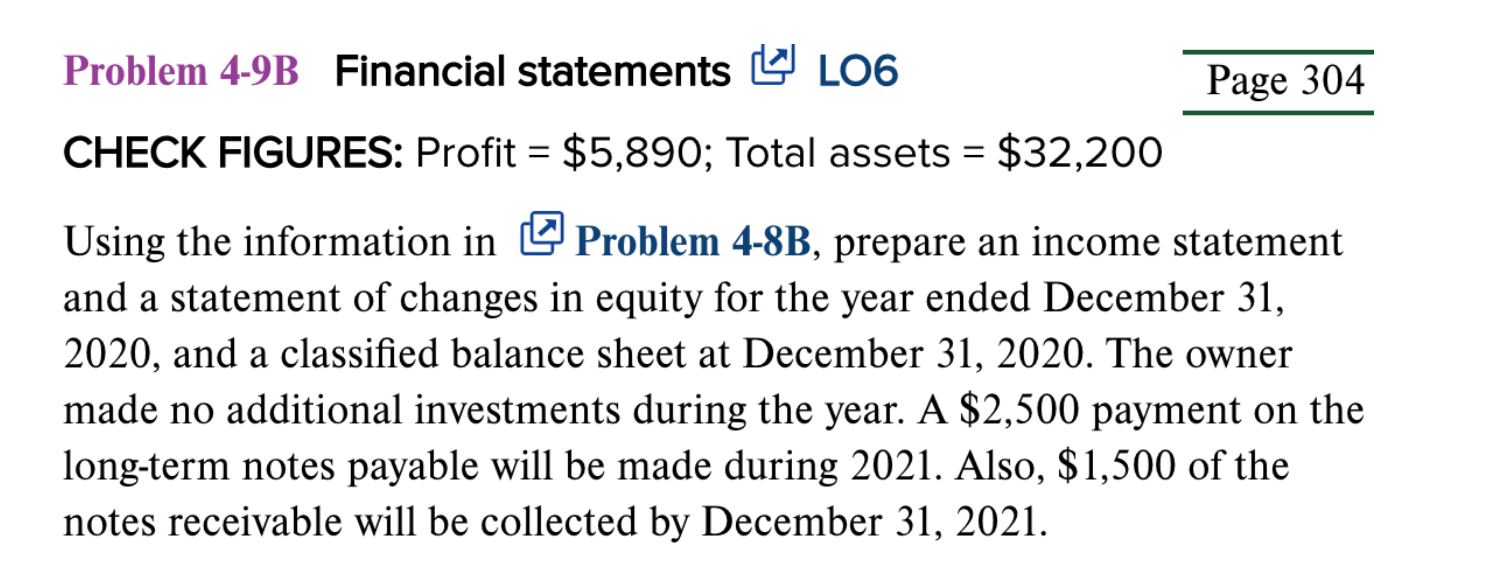

problem 4-9 Problem 4-8B Adjusting entries and closing entries @ LO2, Q3, Q5 Page 30 Bullseye Market Research Company (BMRC) specializes in conducting focus groups for businesses launching a new product. BMRC analyzes customer likes and dislikes to ensure new products will be successful. No. Account Debit Credit $ 100 $2,000 7,250 3,100 201 Accounts payable......... 108 Accounts receivable.. 168 Accumulated depreciation, equipment............ 184 Accumulated depreciation, office furniture..... 101 Cash............... 302 Consulting revenue.... 194 Copyright.... 251 Dan Eagle, capital..... 1,500 44,000 4,200 24,715 24,715 Dan Eagle, capital. 301 Dan Eagle, withdrawals. 606 Depreciation expense, office furniture.. 167 Equipment.......... 633 Insurance expense... 401 Interest income.. 623 Interest expense.. 3,500 700 16,000 600 70 30 71 30 4,000 401 Interest income. 623 Interest expense.. 233 Long-term notes payable... 145 Notes receivable........... 183 Office furniture.. 104 Short-term investments.. 126 Supplies............ 637 Supplies expense... 652 Telephone expense.. 5,000 5,100 4,000 750 2,150 470 3,375 3,230 203 Unearned consulting revenue. 688 Utilities expense... 612 Wages expense.......... Totals..... 37,380 $86,610 $86,610 You are the accounting manager. Your staff submitted the above trial palance for December 31, 2020. In your review, you discover the following additional information that has not been included in the trial balance. a. The equipment has an estimated useful life of 16 years. If you need to create a new account, use account number 604. b. Employees were paid $3,100 for 10 days of work. This payroll included 2 days of payroll in December that were not recorded at year-end. If you need to add an account, use account number 202. b. Employees were paid $3,100 for 10 days of work. This payroll included 2 days of payroll in December that were not recorded at year-end. If you need to add an account, use account number 202. c. On December 31, BMRC completed a focus group for a client on handbags. An invoice was sent to the company for $5,000 due January 31, 2021. d. On December 31, the company completed a market research report for a client. The client had prepaid $3,000 for this service in November. Required 1. Prepare the missing adjusting entries for transactions a-d. 2. Prepare an adjusted trial balance. 3. Based on your adjusted trial balance, prepare the closing entries. Problem 4-9B Financial statements LL06 Page 304 CHECK FIGURES: Profit = $5,890; Total assets = $32,200 Using the information in Problem 4-8B, prepare an income statement and a statement of changes in equity for the year ended December 31, 2020, and a classified balance sheet at December 31, 2020. The owner made no additional investments during the year. A $2,500 payment on the long-term notes payable will be made during 2021. Also, $1,500 of the notes receivable will be collected by December 31, 2021