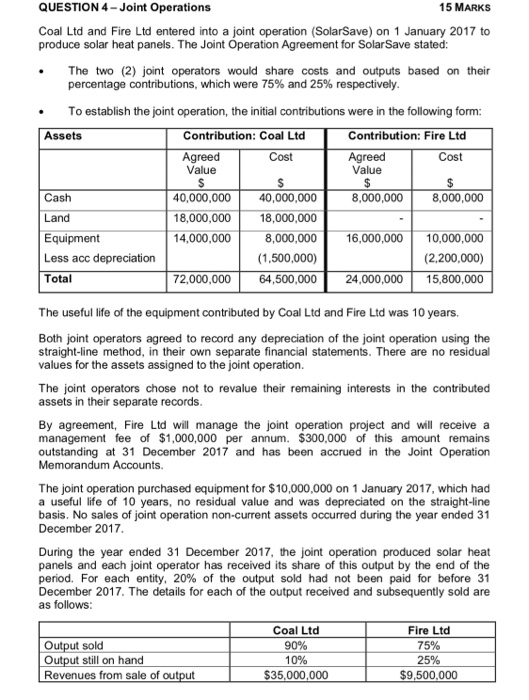

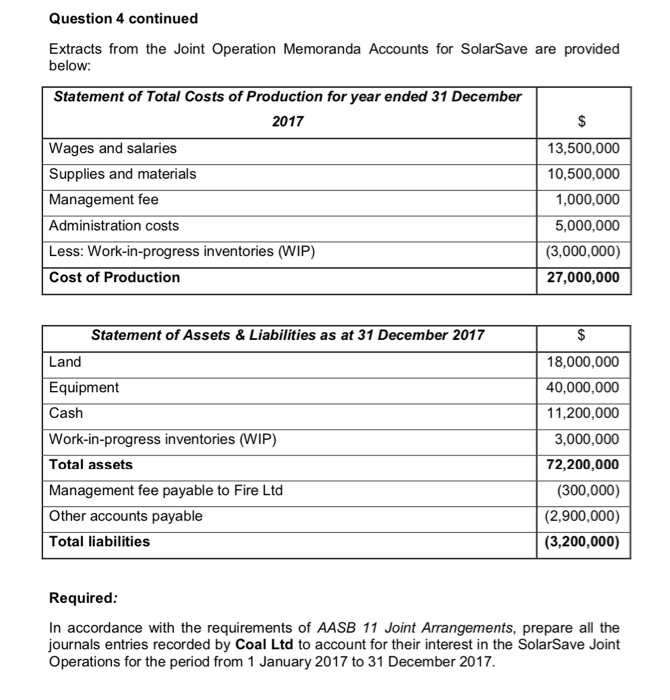

QUESTION 4-Joint Operations 15 MARKS Coal Ltd and Fire Ltd entered into a joint operation (SolarSave) on 1 January 2017 to produce solar heat panels. The Joint Operation Agreement for SolarSave stated: The two (2) joint operators would share costs and outputs based on their percentage contributions, which were 75% and 25% respectively To establish the joint operation, the initial contributions were in the following form: Contribution: Coal Ltd Agreed Contribution: Fire Ltd Agreed Assets Cost Cost Value Value $ 8,000,000 40,000,000 40,000,000 8,000,000 Cash 18,000,000 18,000,000 Land Equipment 14,000,000 8,000,000 16,000,000 10,000,000 Less acc depreciation (1,500,000) (2,200,000) 24,000,000 Total 64,500,000 15,800,000 72,000,000 The useful life of the equipment contributed by Coal Ltd and Fire Ltd was 10 years. Both joint operators agreed to record any depreciation of the joint operation using the straight-line method, in their own separate financial statements. There are no residual values for the assets assigned to the joint operation. The joint operators chose not to revalue their remaining interests in the contributed assets in their separate records By agreement, Fire Ltd will manage the joint operation project and will receive a management fee of $1,000,000 per annum. $300,000 of this amount remains outstanding at 31 December 2017 and has been accrued in the Joint Operation Memorandum Accounts The joint operation purchased equipment for $10,000,000 on 1 January 2017, which had a useful life of 10 years, no residual value and was depreciated on the straight-line basis. No sales of joint operation non-current assets occurred during the year ended 31 December 2017. During the year ended 31 December 2017, the joint operation produced solar heat panels and each joint operator has received its share of this output by the end of the period. For each entity, 20 % of the output sold had not been paid for before 31 December 2017. The details for each of the output received and subsequently sold are as follows: Coal Ltd Fire Ltd Output sold Output still on hand 90% 75% 10% 25% Revenues from sale of output $35,000,000 $9,500,000 Question 4 continued Extracts from the Joint Operation Memoranda Accounts for SolarSave are provided below Statement of Total Costs of Production for year ended 31 December $ 2017 Wages and salaries Supplies and materials Management fee 13,500,000 10,500,000 1,000,000 5,000,000 Administration costs Less: Work-in-progress inventories (WIP) Cost of Production (3,000,000) 27,000,000 Statement of Assets & Liabilities as at 31 December 2017 Land 18,000,000 40,000,000 Equipment Cash 11,200,000 3,000,000 Work-in-progress inventories (WIP) 72,200,000 Total assets Management fee payable to Fire Ltd Other accounts payable Total liabilities (300,000) (2,900,000) (3,200,000) Required: In accordance with the requirements of AASB 11 Joint Arrangements, prepare all the journals entries recorded by Coal Ltd to account for their interest in the SolarSave Joint Operations for the period from 1 January 2017 to 31 December 2017 QUESTION 4-Joint Operations 15 MARKS Coal Ltd and Fire Ltd entered into a joint operation (SolarSave) on 1 January 2017 to produce solar heat panels. The Joint Operation Agreement for SolarSave stated: The two (2) joint operators would share costs and outputs based on their percentage contributions, which were 75% and 25% respectively To establish the joint operation, the initial contributions were in the following form: Contribution: Coal Ltd Agreed Contribution: Fire Ltd Agreed Assets Cost Cost Value Value $ 8,000,000 40,000,000 40,000,000 8,000,000 Cash 18,000,000 18,000,000 Land Equipment 14,000,000 8,000,000 16,000,000 10,000,000 Less acc depreciation (1,500,000) (2,200,000) 24,000,000 Total 64,500,000 15,800,000 72,000,000 The useful life of the equipment contributed by Coal Ltd and Fire Ltd was 10 years. Both joint operators agreed to record any depreciation of the joint operation using the straight-line method, in their own separate financial statements. There are no residual values for the assets assigned to the joint operation. The joint operators chose not to revalue their remaining interests in the contributed assets in their separate records By agreement, Fire Ltd will manage the joint operation project and will receive a management fee of $1,000,000 per annum. $300,000 of this amount remains outstanding at 31 December 2017 and has been accrued in the Joint Operation Memorandum Accounts The joint operation purchased equipment for $10,000,000 on 1 January 2017, which had a useful life of 10 years, no residual value and was depreciated on the straight-line basis. No sales of joint operation non-current assets occurred during the year ended 31 December 2017. During the year ended 31 December 2017, the joint operation produced solar heat panels and each joint operator has received its share of this output by the end of the period. For each entity, 20 % of the output sold had not been paid for before 31 December 2017. The details for each of the output received and subsequently sold are as follows: Coal Ltd Fire Ltd Output sold Output still on hand 90% 75% 10% 25% Revenues from sale of output $35,000,000 $9,500,000 Question 4 continued Extracts from the Joint Operation Memoranda Accounts for SolarSave are provided below Statement of Total Costs of Production for year ended 31 December $ 2017 Wages and salaries Supplies and materials Management fee 13,500,000 10,500,000 1,000,000 5,000,000 Administration costs Less: Work-in-progress inventories (WIP) Cost of Production (3,000,000) 27,000,000 Statement of Assets & Liabilities as at 31 December 2017 Land 18,000,000 40,000,000 Equipment Cash 11,200,000 3,000,000 Work-in-progress inventories (WIP) 72,200,000 Total assets Management fee payable to Fire Ltd Other accounts payable Total liabilities (300,000) (2,900,000) (3,200,000) Required: In accordance with the requirements of AASB 11 Joint Arrangements, prepare all the journals entries recorded by Coal Ltd to account for their interest in the SolarSave Joint Operations for the period from 1 January 2017 to 31 December 2017