Answered step by step

Verified Expert Solution

Question

1 Approved Answer

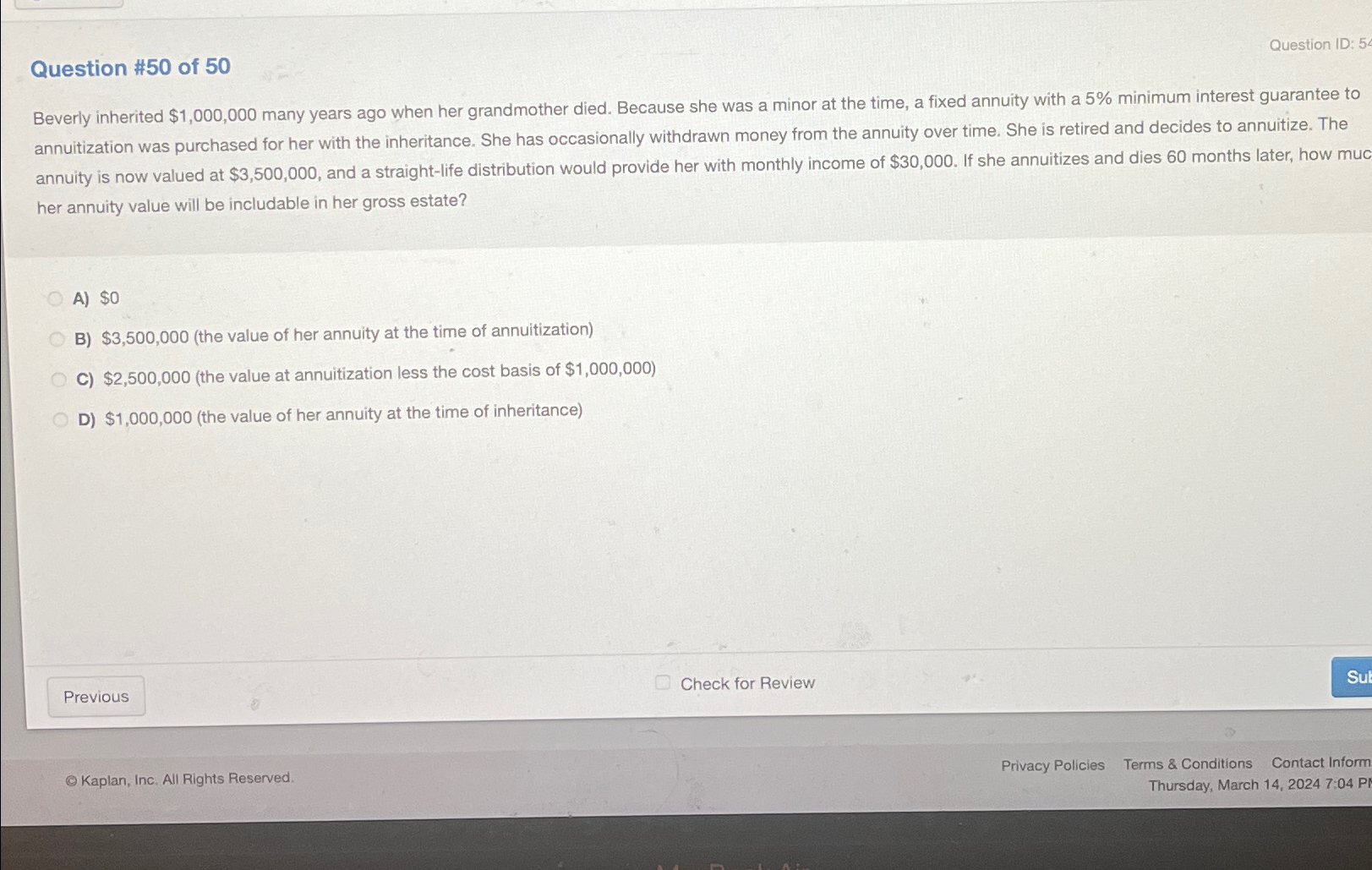

Question # 5 0 of 5 0 Question ID: 5 Beverly inherited $ 1 , 0 0 0 , 0 0 0 many years ago

Question # of

Question ID:

Beverly inherited $ many years ago when her grandmother died. Because she was a minor at the time, a fixed annuity with a minimum interest guarantee to annuitization was purchased for her with the inheritance. She has occasionally withdrawn money from the annuity over time. She is retired and decides to annuitize. The annuity is now valued at $ and a straightlife distribution would provide her with monthly income of $ If she annuitizes and dies months later, how muc her annuity value will be includable in her gross estate?

A $

B $the value of her annuity at the time of annuitization

C $the value at annuitization less the cost basis of $

D $the value of her annuity at the time of inheritance

Check for Review

Kaplan, Inc. All Rights Reserved.

Privacy Policies

Terms & Conditions

Contact Inform

Thursday, March : PI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started