Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 . 1 6 ( 3 2 Marks ) Brewing Ltd ( ' Brewing ' ) is a South African company that specialises in

QUESTION

Marks

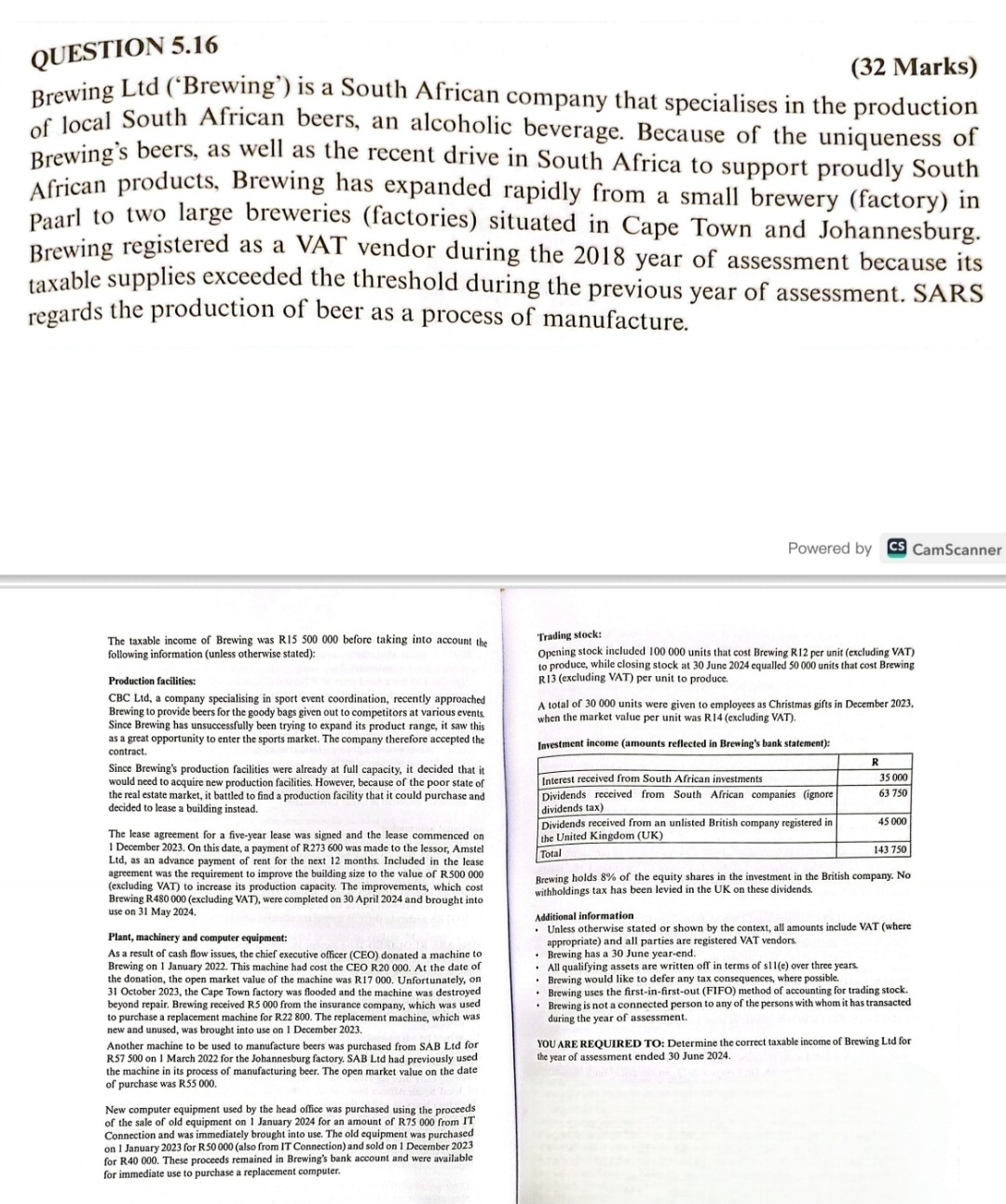

Brewing Ltd Brewing is a South African company that specialises in the production of local South African beers, an alcoholic beverage. Because of the uniqueness of Brewing's beers, as well as the recent drive in South Africa to support proudly South African products, Brewing has expanded rapidly from a small brewery factory in Paarl to two large breweries factories situated in Cape Town and Johannesburg. Brewing registered as a VAT vendor during the year of assessment because its taxable supplies exceeded the threshold during the previous year of assessment. SARS regards the production of beer as a process of manufacture.

Powered by CS CamScanner

The taxable income of Brewing was R before taking into account the following information unless otherwise stated:

Production facilities:

CBC Ltd a company specialising in sport event coordination, recently approached Brewing to provide beers for the goody bags given out to competitors at various events Since Brewing has unsuccessfully been trying to expand its product range, it saw this as a great opportunity to enter the sports market. The company therefore accepted the contract.

Since Brewing's production facilities were already at full capacity, it decided that it would need to acquire new production facilities. However, because of the poor state of the real estate market, it battled to find a production facility that it could purchase and decided to lease a building instead.

The lease agreement for a fiveyear lease was signed and the lease commenced on December On this date, a payment of R was made to the lessor, Amstel Ltd as an advance payment of rent for the next months. Included in the lease agreement was the requirement to improve the building size to the value of Rexcluding VAT to increase its production capacity. The improvements, which cost Brewing R excluding VAT were completed on April and brought into use on May

Plant, machinery and computer equipment:

As a result of cash flow issues, the chief executive officer CEO donated a machine to Brewing on January This machine had cost the CEO R At the date of the donation, the open market value of the machine was R Unfortunately, on October the Cape Town factory was flooded and the machine was destroyed beyond repair. Brewing received R from the insurance company, which was used to purchase a replacement machine for R The replacement machine, which was new and unused, was brought into use on December

Another machine to be used to manufacture beers was purchased from SAB Ltd for R on March for the Johannesburg factory. SAB Ltd had previously used the machine in its process of manufacturing beer. The open market value on the date of purchase was R

New computer equipment used by the head office was purchased using the proceeds of the sale of old equipment on January for an amount of R from IT Connection and was immediately brought into use. The old equipment was purchased on January for R also from IT Connection and sold on December for R These proceeds remained in Brewing's bank account and were available for immediate use to purchase a replacement computer.

Trading stock:

Opening stock included units that cost Brewing R per unit excluding VAT to produce, while closing stock at June equalled units that cost Brewing RIexcluding VAT per unit to produce.

A total of units were given to employees as Christmas gifts in December when the market value per unit was Rexcluding VAT

Investment income amounts reflected in Brewing's bank statement:

tableRInterest received from South African investments,tableDividends received from South African companies ignoredividends taxtableDividends received from an unlisted British company registered inthe United Kingdom UKTotal

Brewing holds of the equity shares in the investment in the British company. No withholdings tax has been levied in the UK on these dividends.

Additional information

Unless otherwise stated or shown by the context, all amounts include VAT where appropriate and all parties are registered VAT vendors.

Brewing has a June yearend.

All qualifying assets are written off in terms of se over three years

Brewing would like to defer any tax consequences, where possible.

Brewing uses the firstinfirstout FIFO method of accounting for trading stock.

Brewing is not a connected person to any of the persons with whom it has transacted during the year of assessment.

YOU ARE REQUIRED TO: Determine the correct taxable income of Brewing Ltd for the year of assessment ended June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started