Answered step by step

Verified Expert Solution

Question

1 Approved Answer

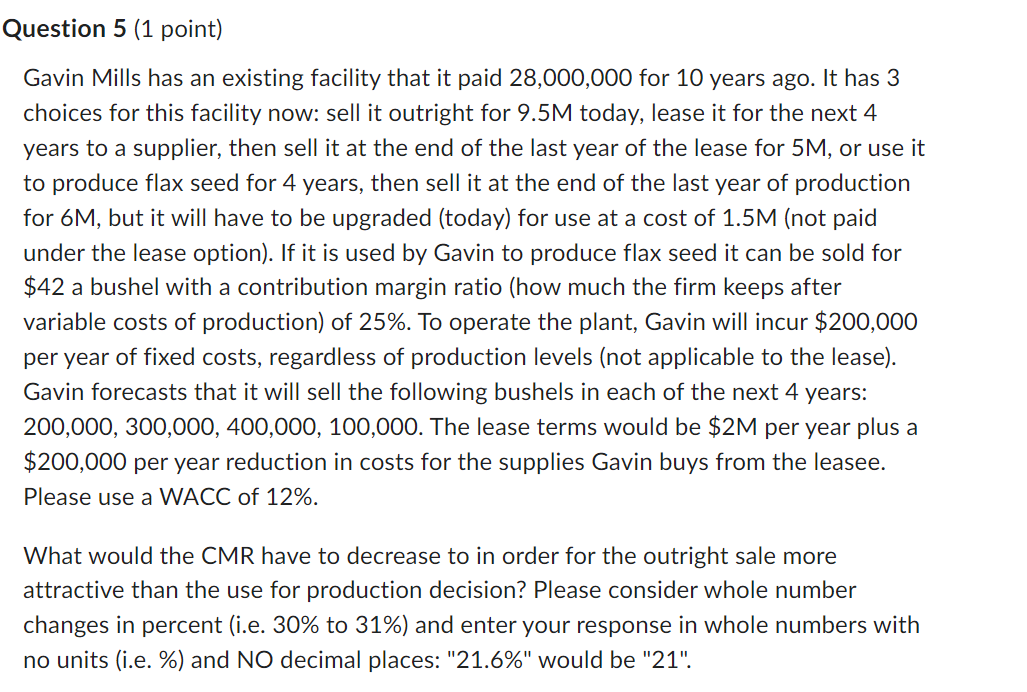

Question 5 ( 1 point ) Gavin Mills has an existing facility that it paid 2 8 , 0 0 0 , 0 0 0

Question point

Gavin Mills has an existing facility that it paid for years ago. It has

choices for this facility now: sell it outright for today, lease it for the next

years to a supplier, then sell it at the end of the last year of the lease for or use it

to produce flax seed for years, then sell it at the end of the last year of production

for M but it will have to be upgraded today for use at a cost of M not paid

under the lease option If it is used by Gavin to produce flax seed it can be sold for

$ a bushel with a contribution margin ratio how much the firm keeps after

variable costs of production of To operate the plant, Gavin will incur $

per year of fixed costs, regardless of production levels not applicable to the lease

Gavin forecasts that it will sell the following bushels in each of the next years:

The lease terms would be $ per year plus a

$ per year reduction in costs for the supplies Gavin buys from the leasee.

Please use a WACC of

What would the CMR have to decrease to in order for the outright sale more

attractive than the use for production decision? Please consider whole number

changes in percent ie to and enter your response in whole numbers with

no units ie and NO decimal places: would be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started