Question: Question 5 (1 point) If Sally puts $ 10,000.00 into an investment, and expects to have $16,430.00 at the end of 3 years, what is

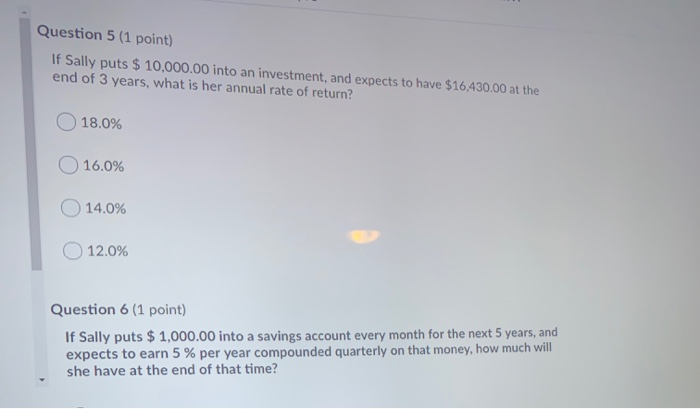

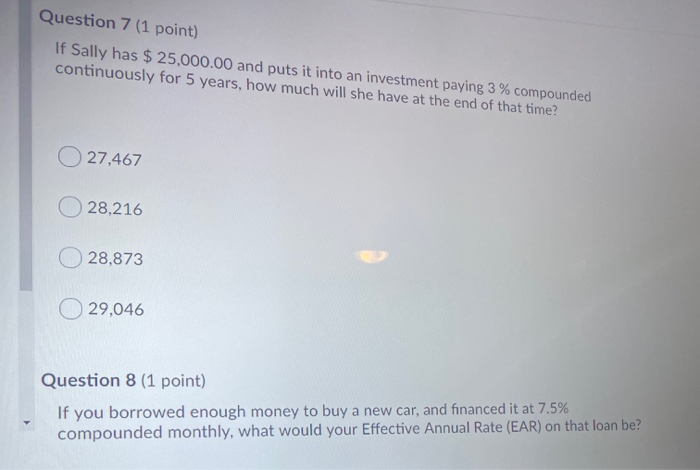

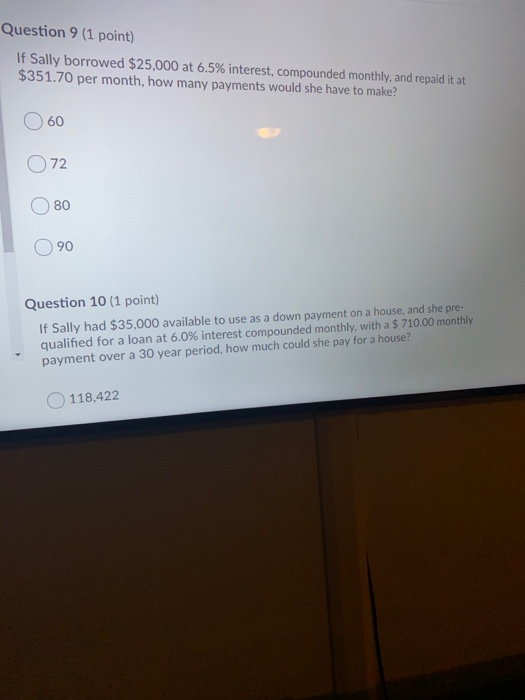

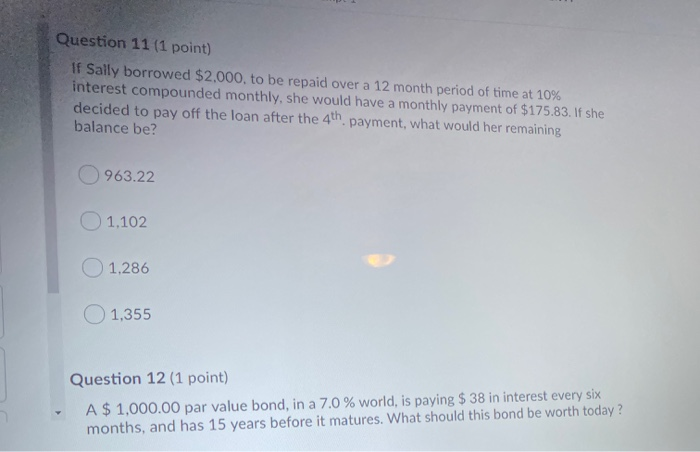

Question 5 (1 point) If Sally puts $ 10,000.00 into an investment, and expects to have $16,430.00 at the end of 3 years, what is her annual rate of return? 18.0% 16.0% 14.0% 12.0% Question 6 (1 point) If Sally puts $ 1,000.00 into a savings account every month for the next 5 years, and expects to earn 5 % per year compounded quarterly on that money, how much will she have at the end of that time? Question 7 (1 point) If Sally has $ 25,000.00 and puts it into an investment paying 3% compounded continuously for 5 years, how much will she have at the end of that time? 27,467 28,216 28,873 29,046 Question 8 (1 point) If you borrowed enough money to buy a new car, and financed it at 7.5% compounded monthly, what would your Effective Annual Rate (EAR) on that loan be? Question 9 (1 point) If Sally borrowed $25,000 at 6.5% interest, compounded monthly, and repaid it at $351.70 per month, how many payments would she have to make? 60 72 80 90 Question 10 (1 point) If Sally had $35,000 available to use as a down payment on a house, and she pre- qualified for a loan at 6.0% interest compounded monthly, with a$ 710.00 monthly payment over a 30 year period, how much could she pay for a house? 118.422 Question 11 (1 point) If Sally borrowed $2,000, to be repaid over a 12 month period of time at 10 % interest compounded monthly, she would have a monthly payment of $175.83. If she decided to pay off the loan after the 4th. payment, what would her remaining balance be? 963.22 1.102 O1.286 1,355 Question 12 (1 point) A$ 1,000.00 par value bond, in a 7.0 % world, is paying $ 38 in interest every six months, and has 15 years before it matures. What should this bond be worth today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts