Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (1 point) Listen Jack received an award for plant safety from Coca-Cola consisting of a watch and a cash award. Using IRS

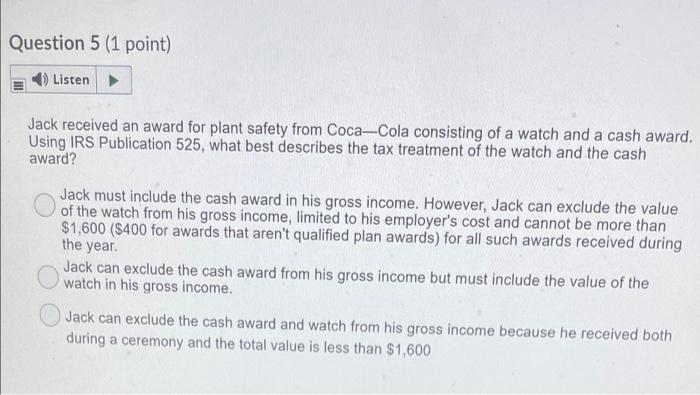

Question 5 (1 point) Listen Jack received an award for plant safety from Coca-Cola consisting of a watch and a cash award. Using IRS Publication 525, what best describes the tax treatment of the watch and the cash award? Jack must include the cash award in his gross income. However, Jack can exclude the value of the watch from his gross income, limited to his employer's cost and cannot be more than $1,600 ($400 for awards that aren't qualified plan awards) for all such awards received during the year. Jack can exclude the cash award from his gross income but must include the value of the watch in his gross income. Jack can exclude the cash award and watch from his gross income because he received both during a ceremony and the total value is less than $1,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started