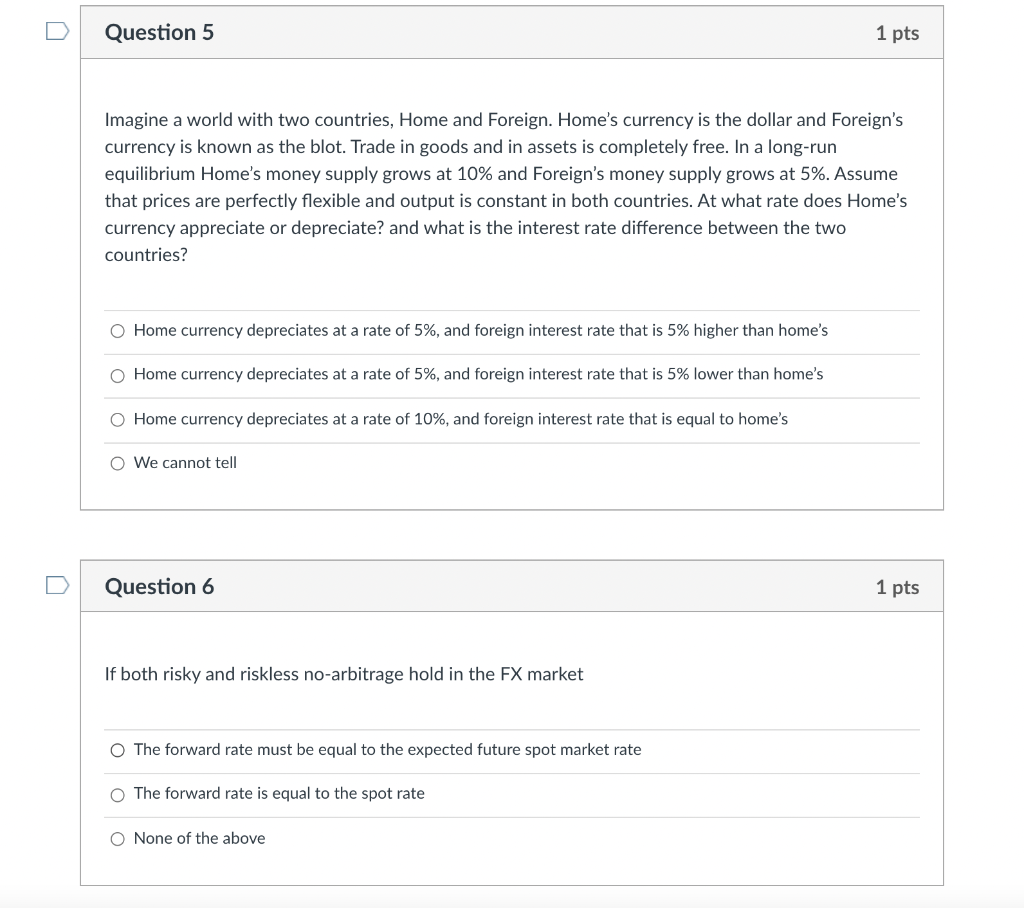

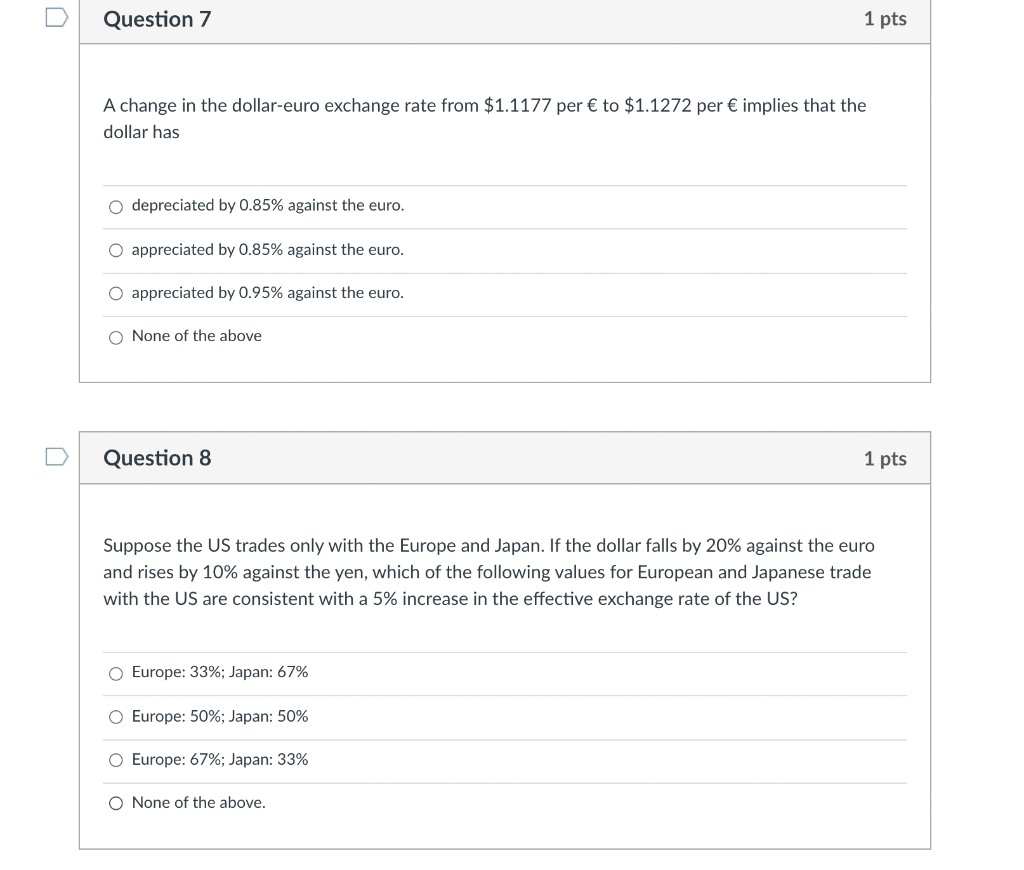

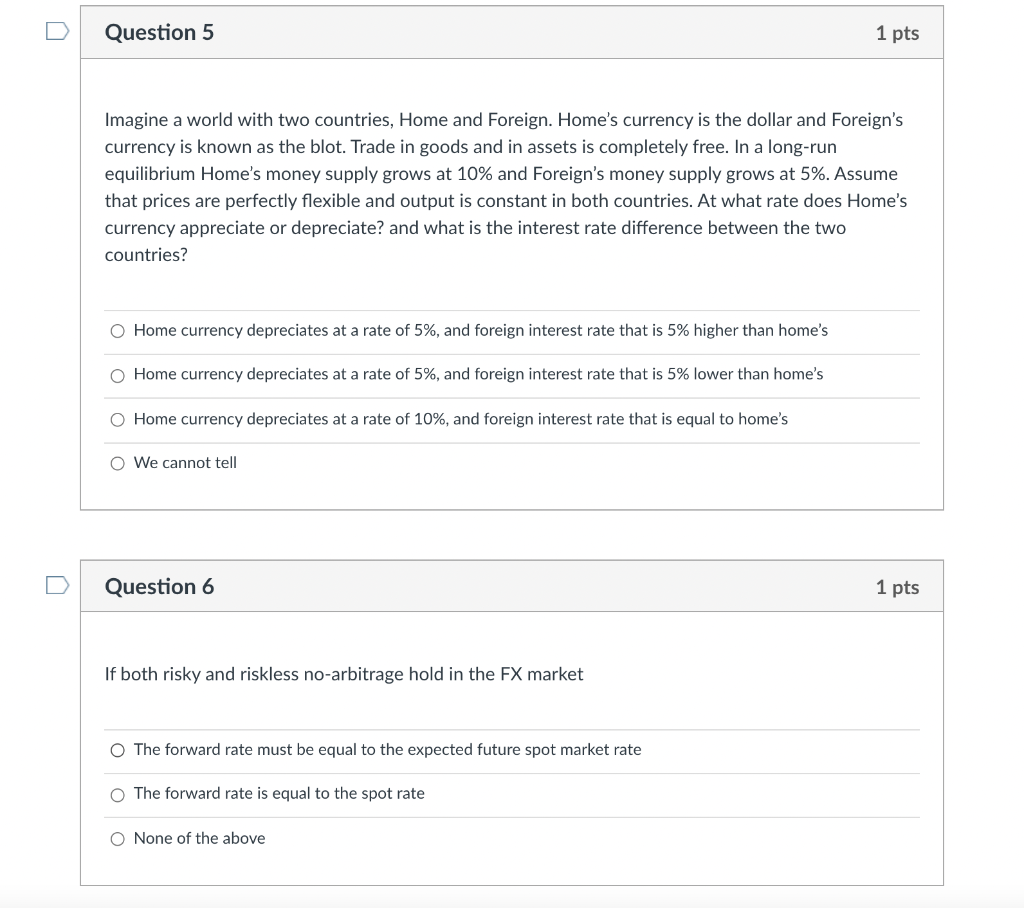

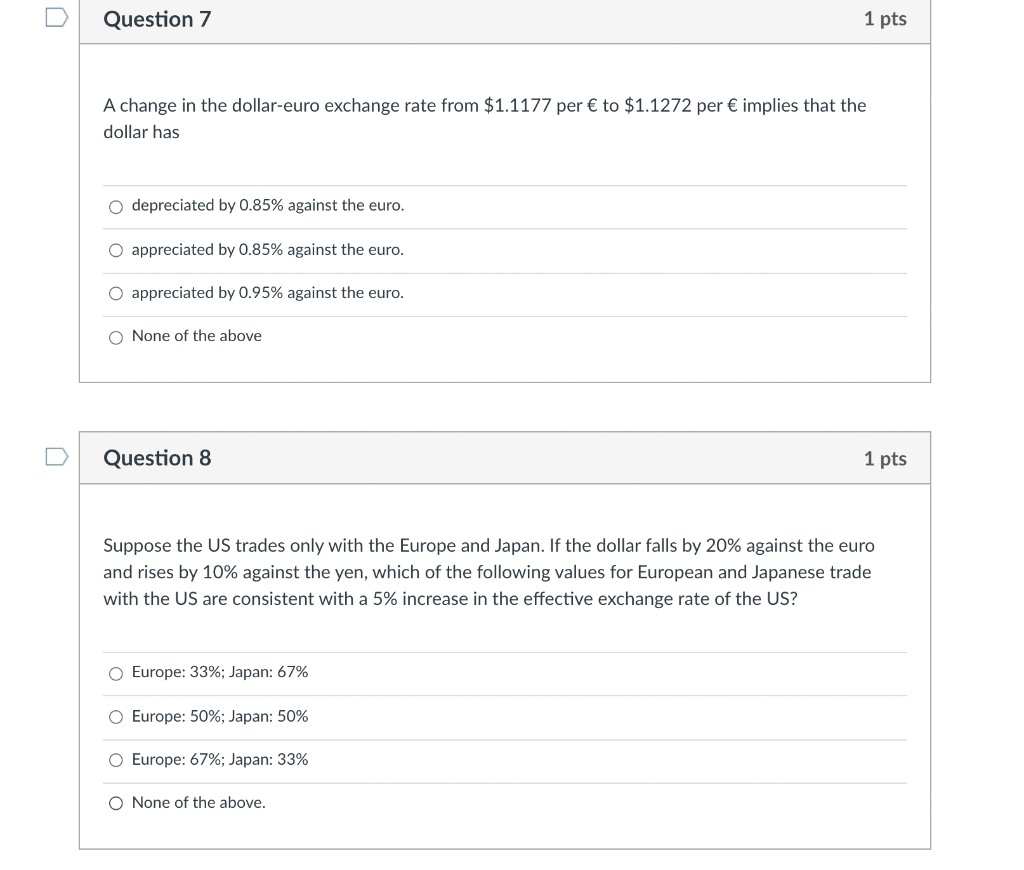

Question 5 1 pts Imagine a world with two countries, Home and Foreign. Home's currency is the dollar and Foreign's currency is known as the blot. Trade in goods and in assets is completely free. In a long-run equilibrium Home's money supply grows at 10% and Foreign's money supply grows at 5%. Assume that prices are perfectly flexible and output is constant in both countries. At what rate does Home's currency appreciate or depreciate? and what is the interest rate difference between the two countries? O Home currency depreciates at a rate of 5%, and foreign interest rate that is 5% higher than home's O Home currency depreciates at a rate of 5%, and foreign interest rate that is 5% lower than home's Home currency depreciates at a rate of 10%, and foreign interest rate that is equal to home's O We cannot tell D Question 6 1 pts If both risky and riskless no-arbitrage hold in the FX market The forward rate must be equal to the expected future spot market rate The forward rate is equal to the spot rate O None of the above Question 7 1 pts A change in the dollar-euro exchange rate from $1.1177 per to $1.1272 per implies that the dollar has depreciated by 0.85% against the euro. O appreciated by 0.85% against the euro. O appreciated by 0.95% against the euro. O None of the above U Question 8 1 pts Suppose the US trades only with the Europe and Japan. If the dollar falls by 20% against the euro and rises by 10% against the yen, which of the following values for European and Japanese trade with the US are consistent with a 5% increase in the effective exchange rate of the US? Europe: 33%; Japan: 67% O Europe: 50%; Japan: 50% O Europe: 67%; Japan: 33% O None of the above. Question 5 1 pts Imagine a world with two countries, Home and Foreign. Home's currency is the dollar and Foreign's currency is known as the blot. Trade in goods and in assets is completely free. In a long-run equilibrium Home's money supply grows at 10% and Foreign's money supply grows at 5%. Assume that prices are perfectly flexible and output is constant in both countries. At what rate does Home's currency appreciate or depreciate? and what is the interest rate difference between the two countries? O Home currency depreciates at a rate of 5%, and foreign interest rate that is 5% higher than home's O Home currency depreciates at a rate of 5%, and foreign interest rate that is 5% lower than home's Home currency depreciates at a rate of 10%, and foreign interest rate that is equal to home's O We cannot tell D Question 6 1 pts If both risky and riskless no-arbitrage hold in the FX market The forward rate must be equal to the expected future spot market rate The forward rate is equal to the spot rate O None of the above Question 7 1 pts A change in the dollar-euro exchange rate from $1.1177 per to $1.1272 per implies that the dollar has depreciated by 0.85% against the euro. O appreciated by 0.85% against the euro. O appreciated by 0.95% against the euro. O None of the above U Question 8 1 pts Suppose the US trades only with the Europe and Japan. If the dollar falls by 20% against the euro and rises by 10% against the yen, which of the following values for European and Japanese trade with the US are consistent with a 5% increase in the effective exchange rate of the US? Europe: 33%; Japan: 67% O Europe: 50%; Japan: 50% O Europe: 67%; Japan: 33% O None of the above