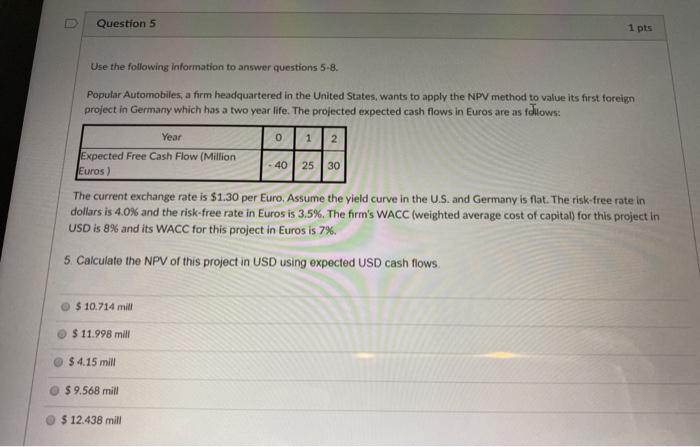

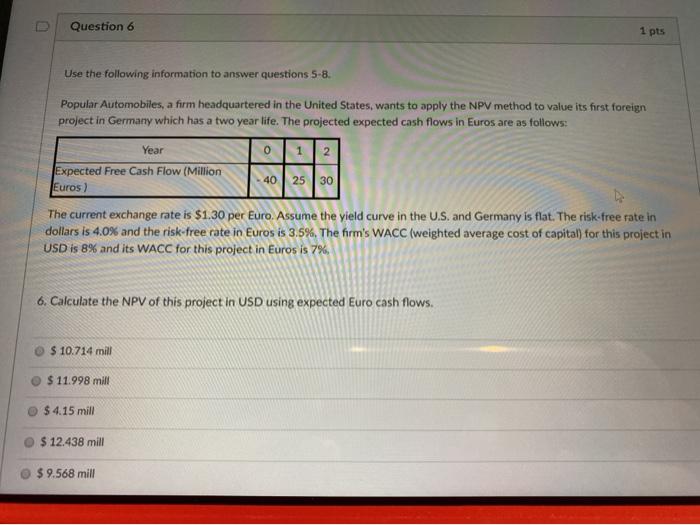

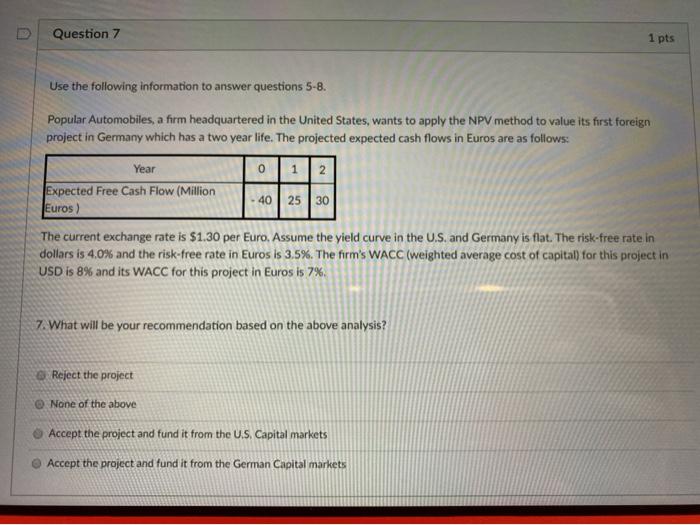

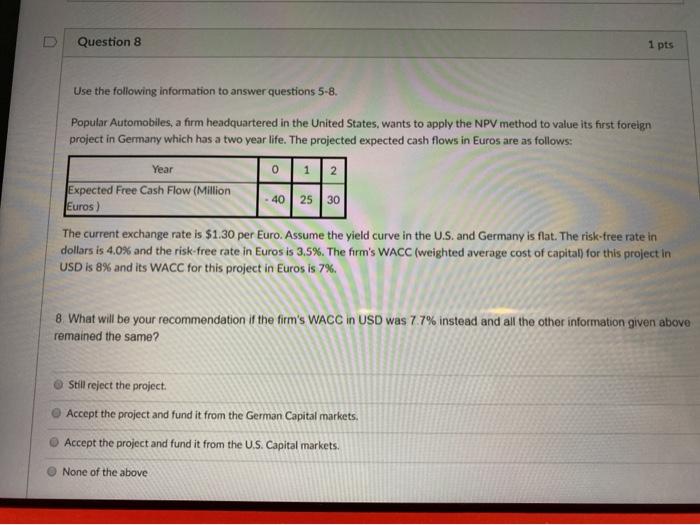

Question 5 1 pts Year Use the following information to answer questions 5-8. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 0 12 Expected Free Cash Flow (Million Euros) 25 30 The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is 8% and its WACC for this project in Euros is 7%. 5. Calculate the NPV of this project in USD using expected USD cash flows. 40 $ 10.714 mill $11.998 mill $ 4.15 mill $ 9.568 mill $ 12.438 mill Question 6 1 pts Use the following information to answer questions 5-8. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 0 1 2 40 30 Year Expected Free Cash Flow (Million 25 Euros) The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is 8% and its WACC for this project in Euros is 7% 6. Calculate the NPV of this project in USD using expected Euro cash flows. $ 10.714 mill $11.998 mill $4.15 mill $ 12.438 mill $ 9.568 mill Question 7 1 pts Use the following information to answer questions 5-8. Year Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 0 1 | 2 Expected Free Cash Flow (Million 25 30 Euros) The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is 8% and its WACC for this project in Euros is 7% 40 7. What will be your recommendation based on the above analysis? Reject the project None of the above Accept the project and fund it from the U.S. Capital markets Accept the project and fund it from the German Capital markets Question 8 1 pts Year Use the following information to answer questions 5-8. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 0 1 2 Expected Free Cash Flow (Million 40 25 30 Euros) The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is 8% and its WACC for this project in Euros is 7% 8 What will be your recommendation if the firm's WACC in USD was 7 7% instead and all the other information given above remained the same? Still reject the project Accept the project and fund it from the German Capital markets, Accept the project and fund it from the U.S. Capital markets. None of the above