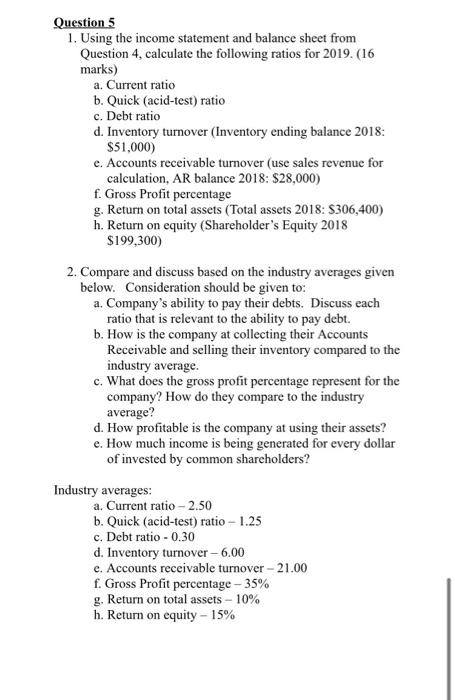

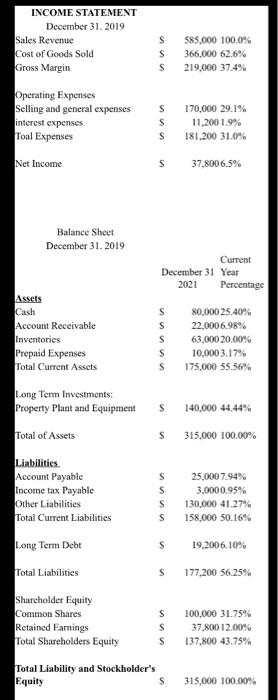

Question 5 1. Using the income statement and balance sheet from Question 4, calculate the following ratios for 2019. (16 marks) a. Current ratio b. Quick (acid-test) ratio c. Debt ratio d. Inventory turnover (Inventory ending balance 2018: $51.000) e. Accounts receivable turnover (use sales revenue for calculation, AR balance 2018: $28,000) f. Gross Profit percentage g. Return on total assets (Total assets 2018: S306,400) h. Return on equity (Shareholder's Equity 2018 $199,300) 2. Compare and discuss based on the industry averages given below. Consideration should be given to: a. Company's ability to pay their debts. Discuss each ratio that is relevant to the ability to pay debt. b. How is the company at collecting their Accounts Receivable and selling their inventory compared to the industry average. c. What does the gross profit percentage represent for the company? How do they compare to the industry average? d. How profitable is the company at using their assets? e. How much income is being generated for every dollar of invested by common shareholders? Industry averages: a. Current ratio - 2.50 b. Quick (acid-test) ratio - 1.25 c. Debt ratio - 0.30 d. Inventory turnover - 6.00 e. Accounts receivable turnover - 21.00 f. Gross Profit percentage - 35% g. Return on total assets - 10% h. Return on equity - 15% INCOME STATEMENT December 31, 2019 Sales Revenue Cost of Goods Sold Gross Margin S S s 585,000 100.0% 366,000 62.6% 219.000 37.4% Operating Expenses Selling and general expenses interest expenses Toal Expenses s s s 170,000 29.1% 11,2001.9% 181,200 31.0% Net Income s 37,8006,5% Balance Sheet December 31, 2019 Current December 31 Year 2021 Percentage Assets Cash Account Receivable Inventories Prepaid Expenses Total Current Assets s s S S s 80,000 25.40% 22.000 6.98% 63,000 20.00% 10,000 3.17% 175,000 55.56% Long Term Investments: Property Plant and Equipment S 140.000 44.44% Total of Assets S 315.000 100.00% Liabilities Account Payable Income tax Payable Other Liabilities Total Current Liabilities S s S s 25,000 7.94% 3,000 0.95% 130.000 41.27% 158,000 50.16% Long Term Debt s 19.2006.10% Total Liabilities s 177,200 56.25% Shareholder Equity Common Shares Retained Earnings Total Shareholders Equity S S S 100.000 31.75% 37,800 12.00% 137.800 43.75% Total Liability and Stockholder's Equity S 315,000 100.00%