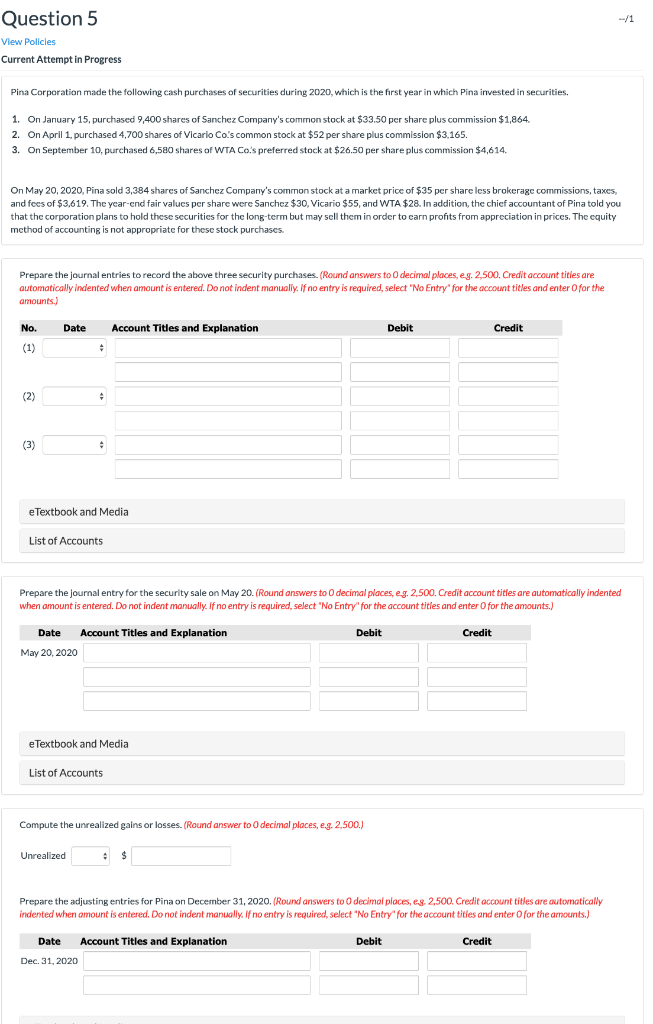

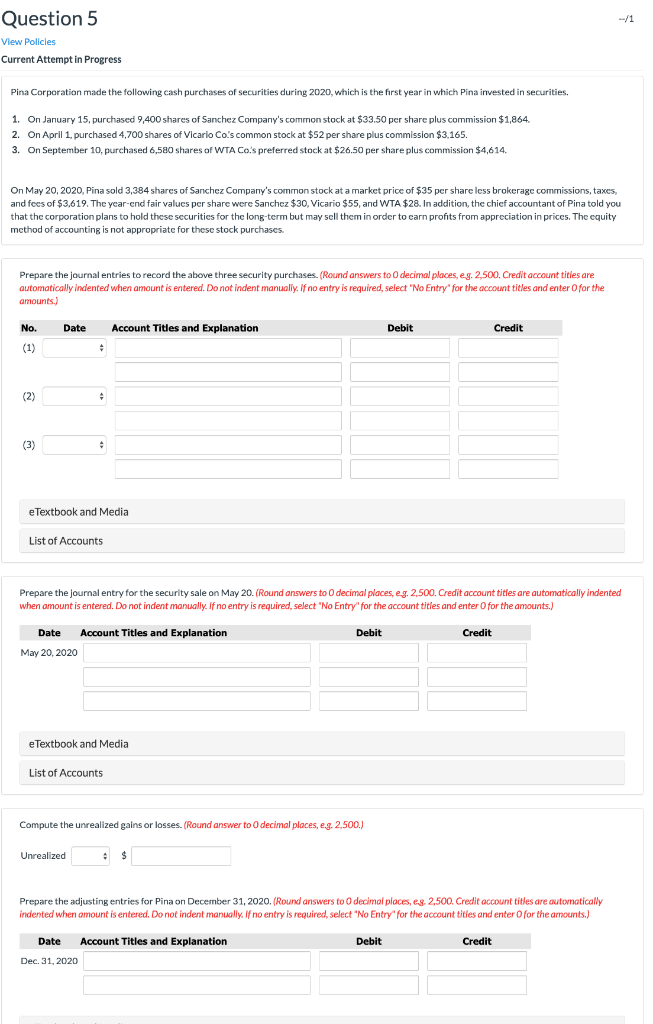

Question 5 /1 View Policles Current Attempt in Progress Pina Corporation made the following cash purchases of securities during 2020, which is the first year in which Pina invested in securities 1. On January 15, purchased 9,400 shares of Sanchez Company's common stock at $33.50 per share plus commission $1,864 On April 1, purchased 4,700 shares of Vicario Co.'s common stock at $52 per share plus commission $3,165. 2. 3. On September 10, purchased 6,580 shares of WTA Cos preferred stack at $26.50 per share plus commission $4,614 On May 20, 2020, Pina sold 3,384 shares of Sanchez Company's common stock at a market price of $35 per share less brokerage commissions, taxes, and fees of $3,619. The year-end fair values per share were Sanchez $30, Vicario $55, and WTA $28. In addition, the chief accountant of Pina told you that the corporation plans to hold these securities for the long-term but may sell them in order to carn profits from appreciation in prices. The cquity method of accounting is not appropriate for these stock purchases Prepare the journal entries to record the above three security purchases. (Round answers to O decimal places, eg. 2,500. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry amounts.) for the account titles and enter 0for the Account Titles and Explanation Credit No. Date Debit (1) (2) (3) eTextbook and Media List of Accounts Prepare the journal entry for the security sale on May 20. (Round answers to 0 decimal places, eg. 2,500. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry' for the account titles and enter 0for the amounts.) Date Account Titles and Explanation Debit Credit May 20, 2020 eTextbook and Media List of Accounts Compute the unrealized gains or losses. (Round answer to 0 decimal places, e.g. 2,500. Unrealized Prepare the adjusting entries for Pina on December 31, 2020. (Round answers to 0 decimal places, eg. 2,500. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0for the amounts.) Account Titles and Explanation Debit Credit Date Dec. 31, 2020