Question: QUESTION 5 10 points Save Answer Select all of the following that are true regarding hedging: Hedging is like arbitrage in that it operates across

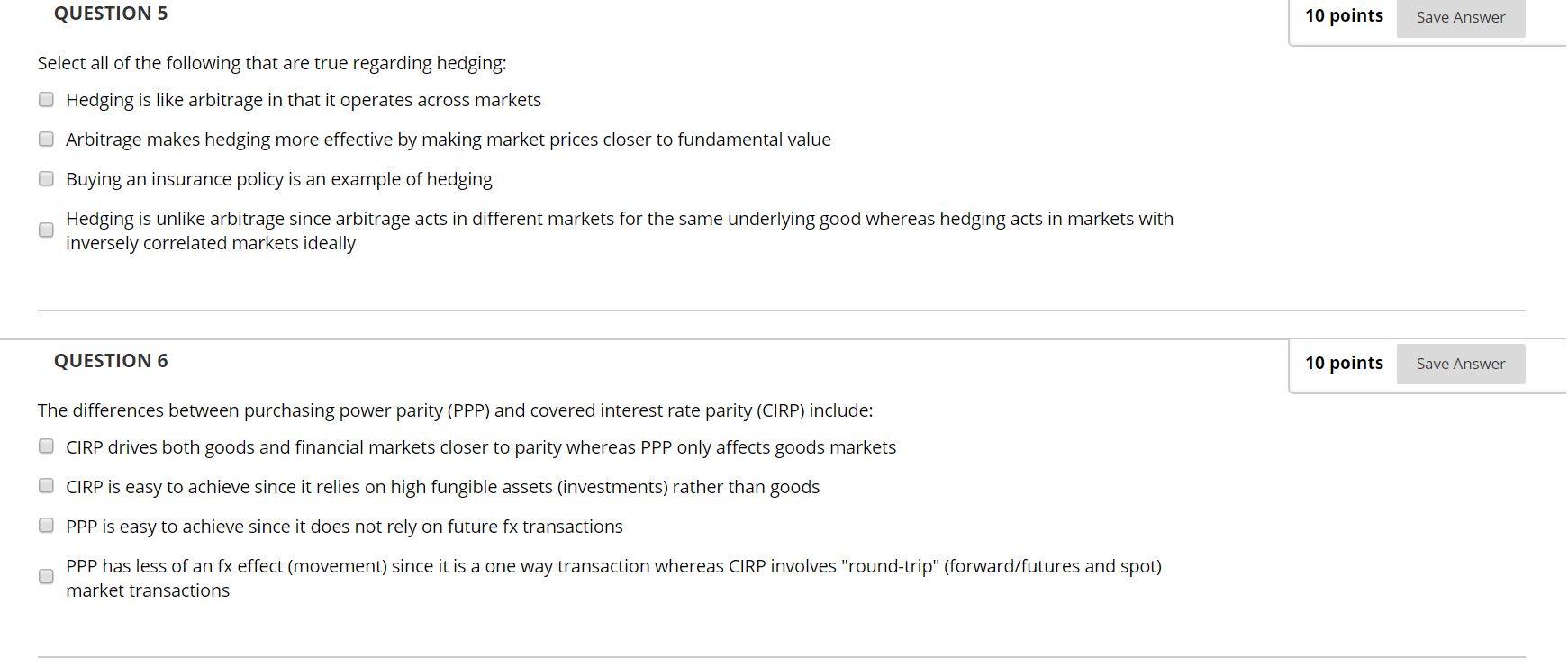

QUESTION 5 10 points Save Answer Select all of the following that are true regarding hedging: Hedging is like arbitrage in that it operates across markets Arbitrage makes hedging more effective by making market prices closer to fundamental value Buying an insurance policy is an example of hedging Hedging is unlike arbitrage since arbitrage acts in different markets for the same underlying good whereas hedging acts in markets with inversely correlated markets ideally QUESTION 6 10 points Save Answer The differences between purchasing power parity (PPP) and covered interest rate parity (CIRP) include: CIRP drives both goods and financial markets closer to parity whereas PPP only affects goods markets CIRP is easy to achieve since it relies on high fungible assets (investments) rather than goods PPP is easy to achieve since it does not rely on future fx transactions PPP has less of an fx effect (movement) since it is a one way transaction whereas CIRP involves "round-trip" (forward/futures and spot) market transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts