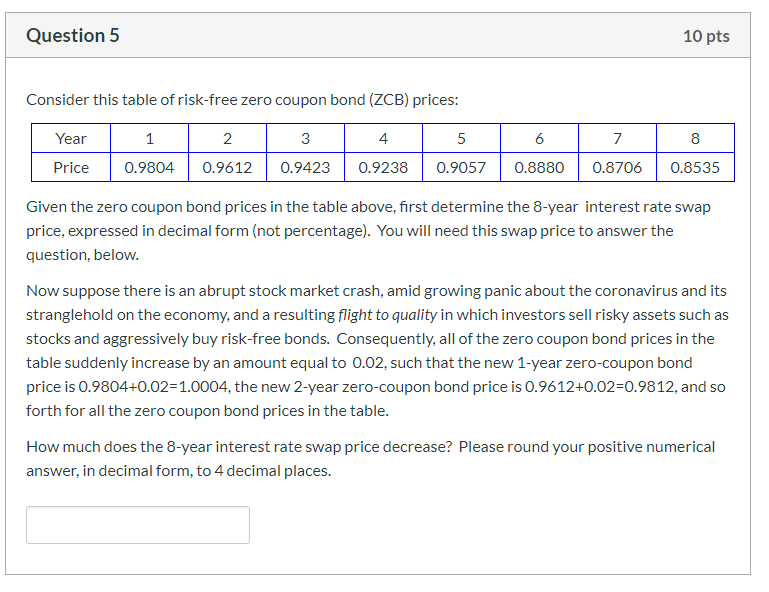

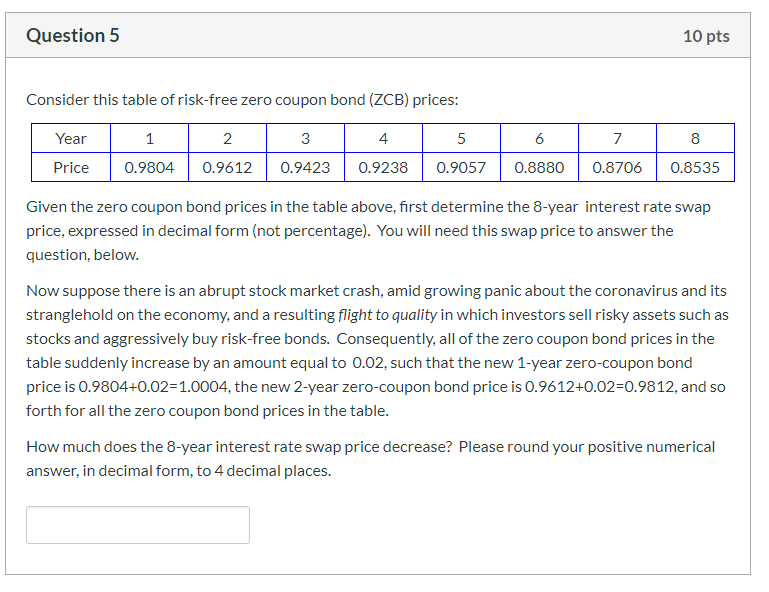

Question 5 10 pts Consider this table of risk-free zero coupon bond (ZCB) prices: Year 1 3 4 5 7 8 2 0.9612 6 0.8880 Price 0.9804 0.9423 0.9238 0.9057 0.8706 0.8535 Given the zero coupon bond prices in the table above, first determine the 8-year interest rate swap price, expressed in decimal form (not percentage). You will need this swap price to answer the question, below. Now suppose there is an abrupt stock market crash, amid growing panic about the coronavirus and its stranglehold on the economy, and a resulting flight to quality in which investors sell risky assets such as stocks and aggressively buy risk-free bonds. Consequently, all of the zero coupon bond prices in the table suddenly increase by an amount equal to 0.02, such that the new 1-year zero-coupon bond price is 0.9804+0.02=1.0004, the new 2-year zero-coupon bond price is 0.9612+0.02=0.9812, and so forth for all the zero coupon bond prices in the table. How much does the 8-year interest rate swap price decrease? Please round your positive numerical answer, in decimal form, to 4 decimal places. Question 5 10 pts Consider this table of risk-free zero coupon bond (ZCB) prices: Year 1 3 4 5 7 8 2 0.9612 6 0.8880 Price 0.9804 0.9423 0.9238 0.9057 0.8706 0.8535 Given the zero coupon bond prices in the table above, first determine the 8-year interest rate swap price, expressed in decimal form (not percentage). You will need this swap price to answer the question, below. Now suppose there is an abrupt stock market crash, amid growing panic about the coronavirus and its stranglehold on the economy, and a resulting flight to quality in which investors sell risky assets such as stocks and aggressively buy risk-free bonds. Consequently, all of the zero coupon bond prices in the table suddenly increase by an amount equal to 0.02, such that the new 1-year zero-coupon bond price is 0.9804+0.02=1.0004, the new 2-year zero-coupon bond price is 0.9612+0.02=0.9812, and so forth for all the zero coupon bond prices in the table. How much does the 8-year interest rate swap price decrease? Please round your positive numerical answer, in decimal form, to 4 decimal places