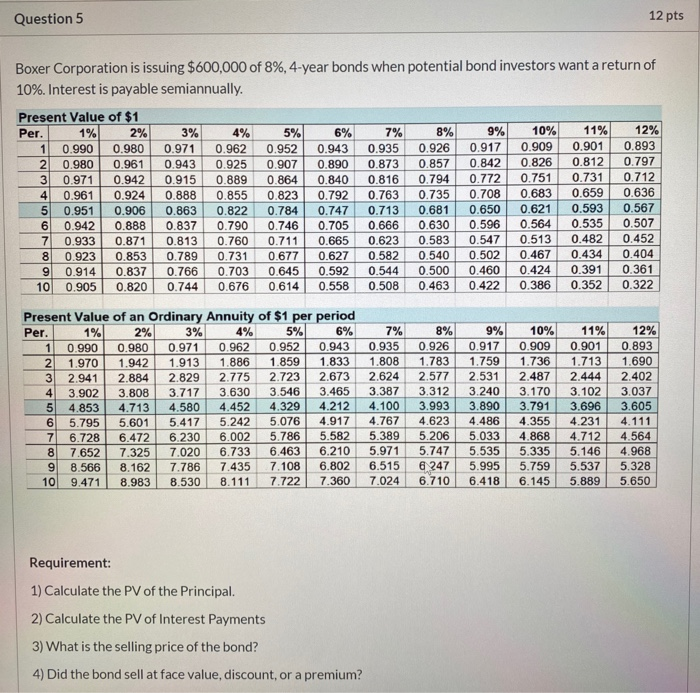

Question 5 12 pts 1 Boxer Corporation is issuing $600,000 of 8%, 4-year bonds when potential bond investors want a return of 10%. Interest is payable semiannually. Present Value of $1 Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 1 Present Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 0.990 0.980 0.971 0.962 0.952 0.943 2 1.970 1.942 1.913 1.886 1.859 1.833 3 2.941 2.884 2.829 2.775 2.723 2.673 4 3.902 3.808 3.717 3.630 3.546 3.465 5 4.853 4.713 4.580 4.452 4.329 4.212 6 5.795 5.601 5.417 5.242 5.076 4.917 6.728 6.472 6.002 5.786 5.582 8 7.652 7.325 7.020 6.733 6.463 6.210 9 8.566 8.162 7.786 7.435 7.108 6.802 10 9.471 8.983 8.530 8.111 7.722 7.360 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 8% 0.926 1.783 2.577 3.312 3.993 4.623 5 206 5.747 6 247 6.710 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 7 Requirement: 1) Calculate the PV of the Principal. 2) Calculate the PV of Interest Payments 3) What is the selling price of the bond? 4) Did the bond sell at face value, discount, or a premium