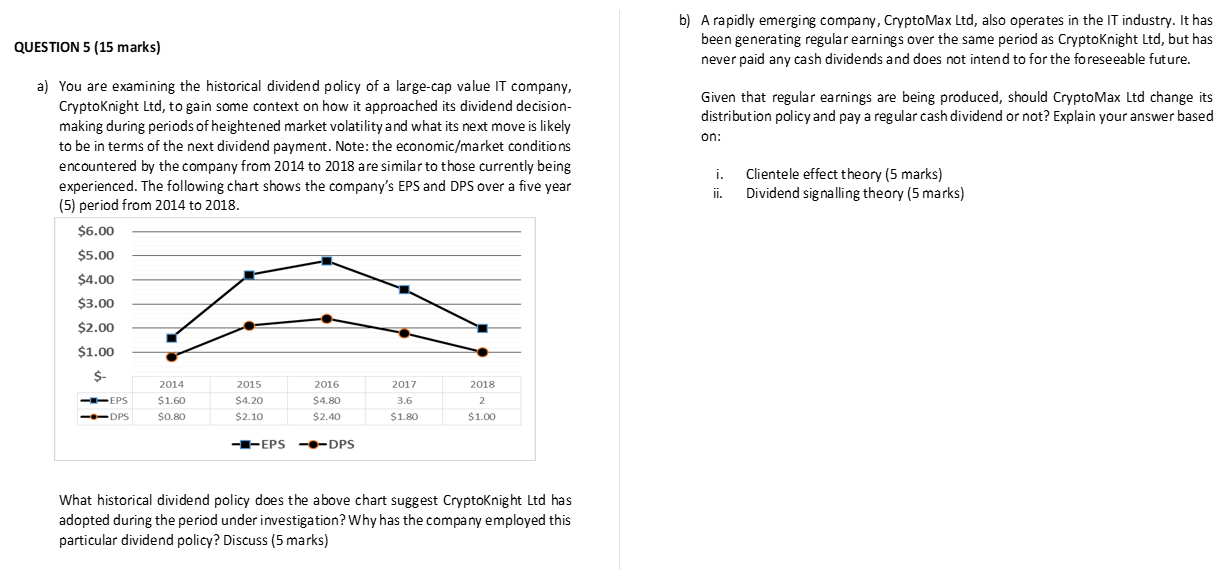

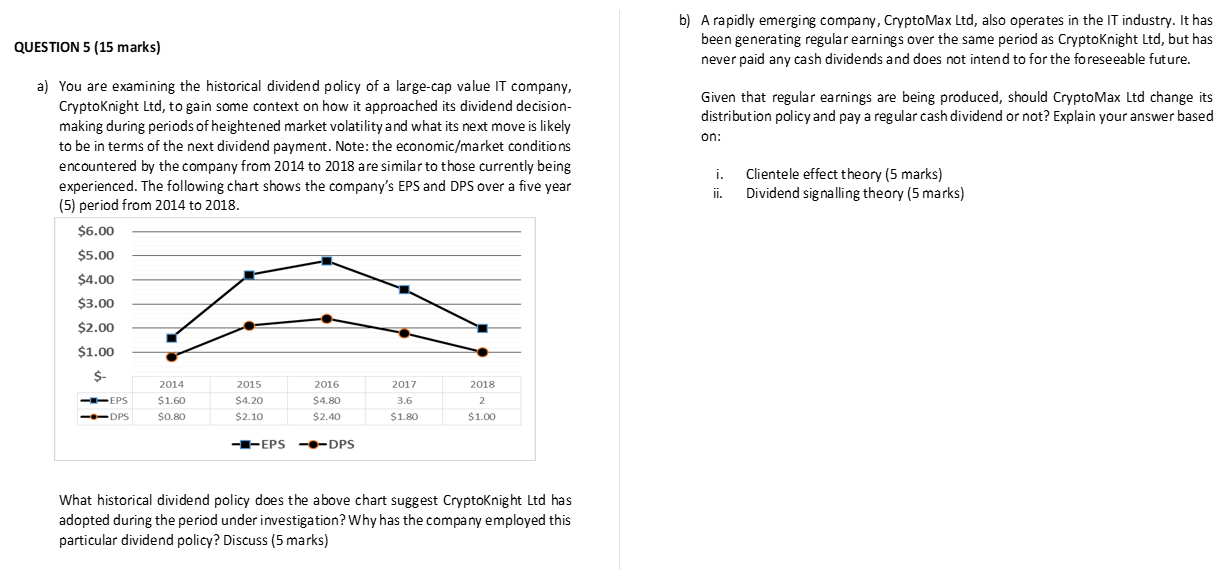

QUESTION 5 (15 marks) b) A rapidly emerging company, Crypto Max Ltd, also operates in the IT industry. It has been generating regular earnings over the same period as CryptoKnight Ltd, but has never paid any cash dividends and does not intend to for the foreseeable future. Given that regular earnings are being produced, should Crypto Max Ltd change its distribution policy and pay a regular cash dividend or not? Explain your answer based on: a) You are examining the historical dividend policy of a large-cap value IT company, CryptoKnight Ltd, to gain some context on how it approached its dividend decision- making during periods of heightened market volatility and what its next move is likely to be in terms of the next dividend payment. Note: the economic/market conditions encountered by the company from 2014 to 2018 are similar to those currently being experienced. The following chart shows the company's EPS and DPS over a five year (5) period from 2014 to 2018. i. Clientele effect theory (5 marks) ii. Dividend signalling theory (5 marks) $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $- 2014 2018 --EPS 2015 $4.20 $2.10 $1.60 $0.80 2016 $4.80 $2.40 2017 3.6 $ 1.80 2 --DPS $1.00 --EPS -O-DPS What historical dividend policy does the above chart suggest CryptoKnight Ltd has adopted during the period under investigation? Why has the company employed this particular dividend policy? Discuss (5 marks) QUESTION 5 (15 marks) b) A rapidly emerging company, Crypto Max Ltd, also operates in the IT industry. It has been generating regular earnings over the same period as CryptoKnight Ltd, but has never paid any cash dividends and does not intend to for the foreseeable future. Given that regular earnings are being produced, should Crypto Max Ltd change its distribution policy and pay a regular cash dividend or not? Explain your answer based on: a) You are examining the historical dividend policy of a large-cap value IT company, CryptoKnight Ltd, to gain some context on how it approached its dividend decision- making during periods of heightened market volatility and what its next move is likely to be in terms of the next dividend payment. Note: the economic/market conditions encountered by the company from 2014 to 2018 are similar to those currently being experienced. The following chart shows the company's EPS and DPS over a five year (5) period from 2014 to 2018. i. Clientele effect theory (5 marks) ii. Dividend signalling theory (5 marks) $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $- 2014 2018 --EPS 2015 $4.20 $2.10 $1.60 $0.80 2016 $4.80 $2.40 2017 3.6 $ 1.80 2 --DPS $1.00 --EPS -O-DPS What historical dividend policy does the above chart suggest CryptoKnight Ltd has adopted during the period under investigation? Why has the company employed this particular dividend policy? Discuss