Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (16 marks) Stacey Morrows decided to start a business that manufactures a medical device, which required the purchase of assets at a

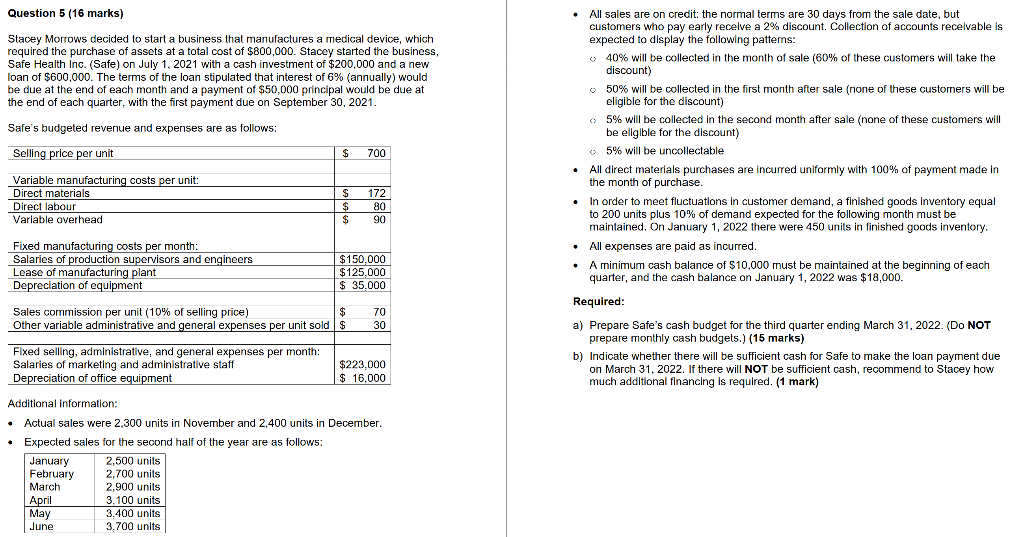

Question 5 (16 marks) Stacey Morrows decided to start a business that manufactures a medical device, which required the purchase of assets at a total cost of $800,000. Stacey started the business, Safe Health Inc. (Safe) on July 1, 2021 with a cash investment of $200,000 and a new loan of $600,000. The terms of the loan stipulated that interest of 6% (annually) would be due at the end of each month and a payment of $50,000 principal would be due at the end of each quarter, with the first payment due on September 30, 2021. Safe's budgeted revenue and expenses are as follows: Selling price per unit $ 700 Variable manufacturing costs per unit: Direct materials Direct labour Variable overhead Fixed manufacturing costs per month: $ 172 $ 80 $ 90 Salaries of production supervisors and engineers Lease of manufacturing plant Depreciation of equipment $150,000 $125,000 $ 35,000 Sales commission per unit (10% of selling price) $ 70 Other variable administrative and general expenses per unit sold $ 30 Fixed selling, administrative, and general expenses per month: Salaries of marketing and administrative staff Depreciation of office equipment Additional information: $223,000 $ 16,000 Actual sales were 2,300 units in November and 2,400 units in December. Expected sales for the second half of the year are as follows: January 2,500 units February 2,700 units March 2,900 units April 3,100 units May 3,400 units June 3,700 units All sales are on credit: the normal terms are 30 days from the sale date, but customers who pay early receive a 2% discount. Collection of accounts receivable is expected to display the following patterns: 40% will be collected in the month of sale (60% of these customers will take the discount) 50% will be collected in the first month after sale (none of these customers will be eligible for the discount) 5% will be collected in the second month after sale (none of these customers will be eligible for the discount) 5% will be uncollectable . All direct materials purchases are incurred uniformly with 100% of payment made in the month of purchase. In order to meet fluctuations in customer demand, a finished goods Inventory equal to 200 units plus 10% of demand expected for the following month must be maintained. On January 1, 2022 there were 450 units in finished goods inventory. All expenses are paid as incurred. A minimum cash balance of $10,000 must be maintained at the beginning of each quarter, and the cash balance on January 1, 2022 was $18,000. Required: a) Prepare Safe's cash budget for the third quarter ending March 31, 2022. (Do NOT prepare monthly cash budgets.) (15 marks) b) Indicate whether there will be sufficient cash for Safe to make the loan payment due on March 31, 2022. If there will NOT be sufficient cash, recommend to Stacey how much additional financing is required. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started