Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (18 marks) (a) The credit risk on a 4-year $100 par value 5% annual coupon payment corporate bond can be expressed by an

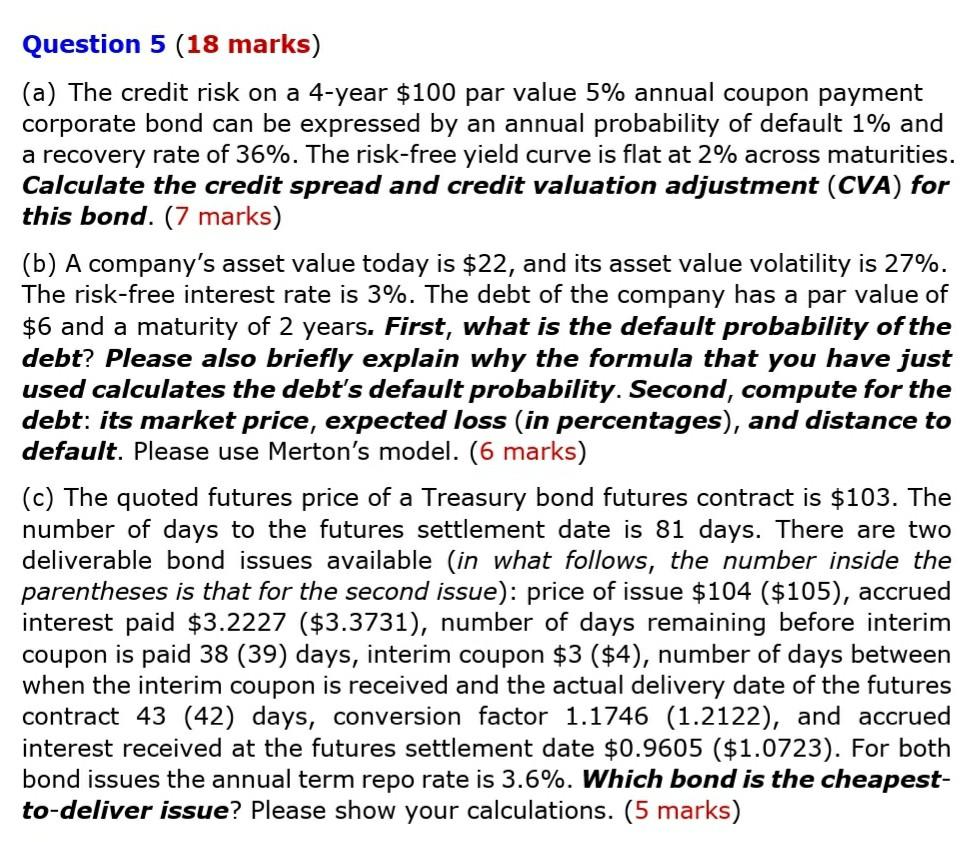

Question 5 (18 marks) (a) The credit risk on a 4-year $100 par value 5% annual coupon payment corporate bond can be expressed by an annual probability of default 1% and a recovery rate of 36%. The risk-free yield curve is flat at 2% across maturities. Calculate the credit spread and credit valuation adjustment (CVA) for this bond. (7 marks) (b) A company's asset value today is $22, and its asset value volatility is 27%. The risk-free interest rate is 3%. The debt of the company has a par value of $6 and a maturity of 2 years. First, what is the default probability of the debt? Please also briefly explain why the formula that you have just used calculates the debt's default probability. Second, compute for the debt: its market price, expected loss (in percentages), and distance to default. Please use Merton's model. (6 marks) (c) The quoted futures price of a Treasury bond futures contract is $103. The number of days to the futures settlement date is 81 days. There are two deliverable bond issues available in what follows, the number inside the parentheses is that for the second issue): price of issue $104 ($105), accrued interest paid $3.2227 ($3.3731), number of days remaining before interim coupon is paid 38 (39) days, interim coupon $3 ($4), number of days between when the interim coupon is received and the actual delivery date of the futures contract 43 (42) days, conversion factor 1.1746 (1.2122), and accrued interest received at the futures settlement date $0.9605 ($1.0723). For both bond issues the annual term repo rate is 3.6%. Which bond is the cheapest- to-deliver issue? Please show your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started