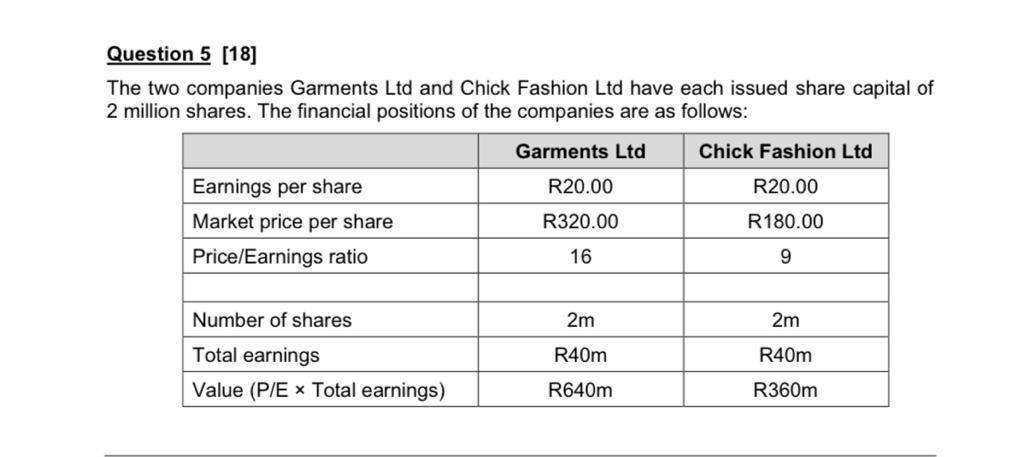

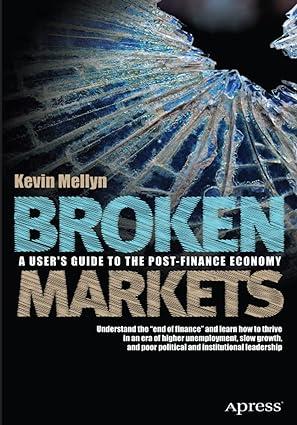

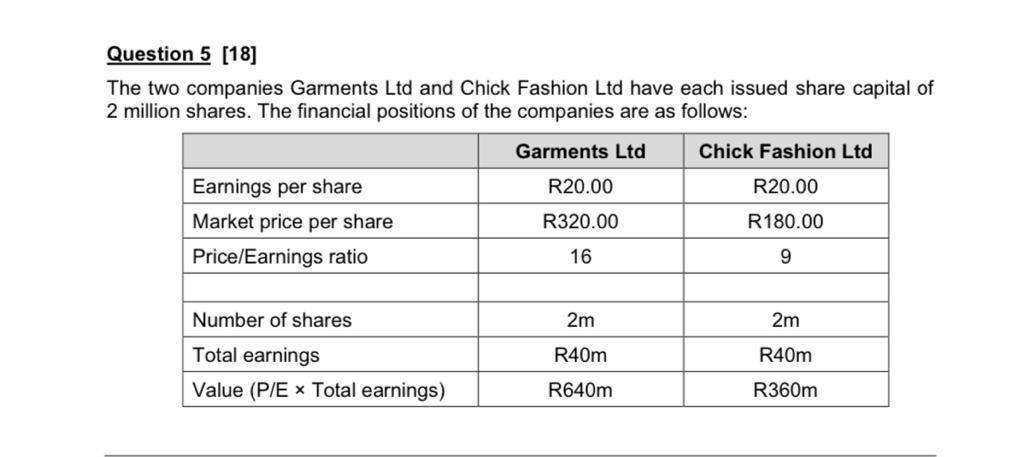

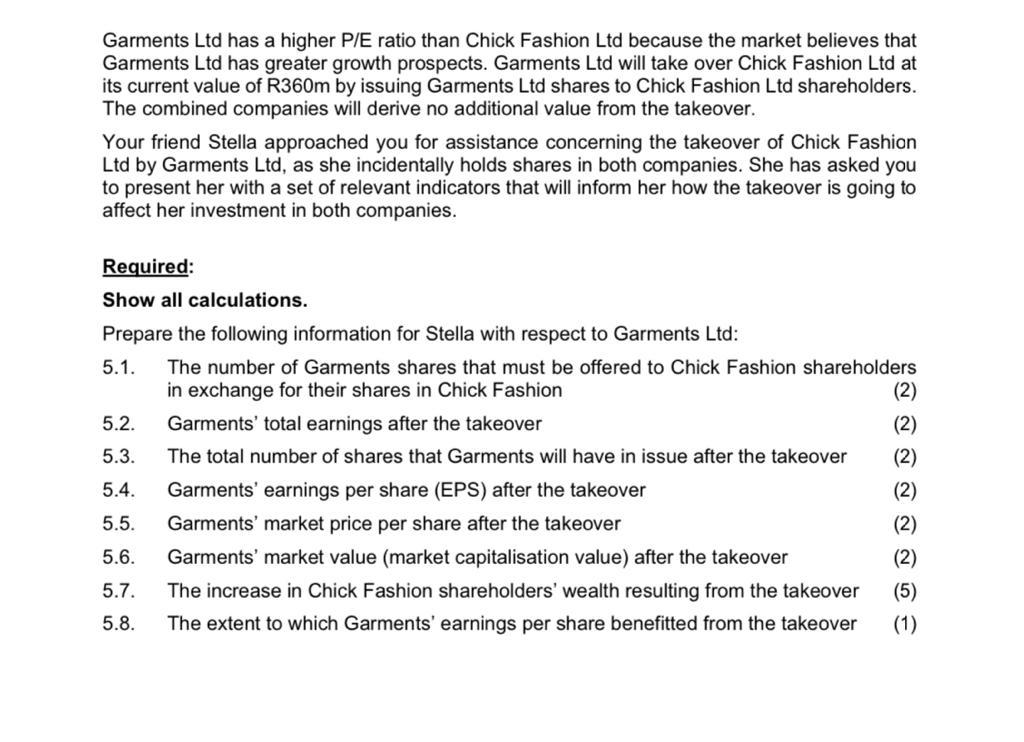

Question 5 [18] The two companies Garments Ltd and Chick Fashion Ltd have each issued share capital of 2 million shares. The financial positions of the companies are as follows: Garments Ltd Chick Fashion Ltd R20.00 R20.00 Earnings per share Market price per share Price/Earnings ratio R320.00 R180.00 16 9 Number of shares 2m 2m Total earnings R40m R40m Value (P/E x Total earnings) R640m R360m Garments Ltd has a higher P/E ratio than Chick Fashion Ltd because the market believes that Garments Ltd has greater growth prospects. Garments Ltd will take over Chick Fashion Ltd at its current value of R360m by issuing Garments Ltd shares to Chick Fashion Ltd shareholders. The combined companies will derive no additional value from the takeover. Your friend Stella approached you for assistance concerning the takeover of Chick Fashion Ltd by Garments Ltd, as she incidentally holds shares in both companies. She has asked you to present her with a set of relevant indicators that will inform her how the takeover is going to affect her investment in both companies. Required: Show all calculations. Prepare the following information for Stella with respect to Garments Ltd: 5.1. The number of Garments shares that must be offered to Chick Fashion shareholders in exchange for their shares in Chick Fashion (2) 5.2. Garments' total earnings after the takeover (2) 5.3. The total number of shares that Garments will have in issue after the takeover (2) 5.4. Garments' earnings per share (EPS) after the takeover (2) 5.5. Garments' market price per share after the takeover (2) 5.6. Garments' market value (market capitalisation value) after the takeover (2) 5.7. (5) The increase in Chick Fashion shareholders' wealth resulting from the takeover The extent to which Garments' earnings per share benefitted from the takeover 5.8. (1) Question 5 [18] The two companies Garments Ltd and Chick Fashion Ltd have each issued share capital of 2 million shares. The financial positions of the companies are as follows: Garments Ltd Chick Fashion Ltd R20.00 R20.00 Earnings per share Market price per share Price/Earnings ratio R320.00 R180.00 16 9 Number of shares 2m 2m Total earnings R40m R40m Value (P/E x Total earnings) R640m R360m Garments Ltd has a higher P/E ratio than Chick Fashion Ltd because the market believes that Garments Ltd has greater growth prospects. Garments Ltd will take over Chick Fashion Ltd at its current value of R360m by issuing Garments Ltd shares to Chick Fashion Ltd shareholders. The combined companies will derive no additional value from the takeover. Your friend Stella approached you for assistance concerning the takeover of Chick Fashion Ltd by Garments Ltd, as she incidentally holds shares in both companies. She has asked you to present her with a set of relevant indicators that will inform her how the takeover is going to affect her investment in both companies. Required: Show all calculations. Prepare the following information for Stella with respect to Garments Ltd: 5.1. The number of Garments shares that must be offered to Chick Fashion shareholders in exchange for their shares in Chick Fashion (2) 5.2. Garments' total earnings after the takeover (2) 5.3. The total number of shares that Garments will have in issue after the takeover (2) 5.4. Garments' earnings per share (EPS) after the takeover (2) 5.5. Garments' market price per share after the takeover (2) 5.6. Garments' market value (market capitalisation value) after the takeover (2) 5.7. (5) The increase in Chick Fashion shareholders' wealth resulting from the takeover The extent to which Garments' earnings per share benefitted from the takeover 5.8. (1)