Answered step by step

Verified Expert Solution

Question

1 Approved Answer

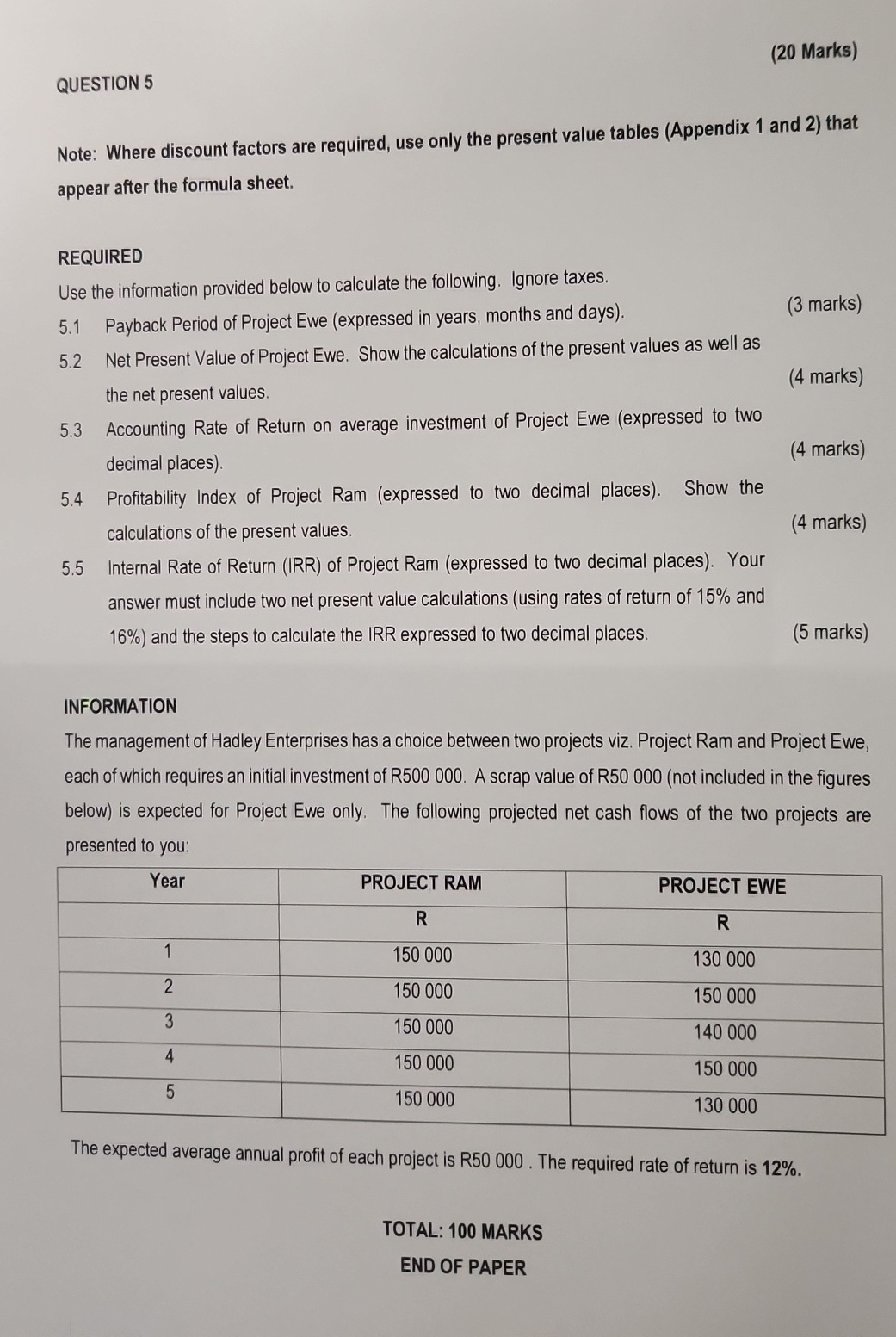

QUESTION 5 ( 2 0 Marks ) Note: Where discount factors are required, use only the present value tables ( Appendix 1 and 2 )

QUESTION

Marks

Note: Where discount factors are required, use only the present value tables Appendix and that appear after the formula sheet.

REQUIRED

Use the information provided below to calculate the following. Ignore taxes.

Payback Period of Project Ewe expressed in years, months and days

marks

Net Present Value of Project Ewe. Show the calculations of the present values as well as the net present values.

marks

Accounting Rate of Return on average investment of Project Ewe expressed to two decimal places

marks

Profitability Index of Project Ram expressed to two decimal places Show the calculations of the present values.

marks

Internal Rate of Return IRR of Project Ram expressed to two decimal places Your answer must include two net present value calculations using rates of return of and and the steps to calculate the IRR expressed to two decimal places.

marks

INFORMATION

The management of Hadley Enterprises has a choice between two projects viz. Project Ram and Project Ewe, each of which requires an initial investment of A scrap value of not included in the figures below is expected for Project Ewe only. The following projected net cash flows of the two projects are presented to you:

tableYearPROJECT RAM,PROJECT EWER

The expected average annual profit of each project is The required rate of return is

TOTAL: MARKS

END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started