Answered step by step

Verified Expert Solution

Question

1 Approved Answer

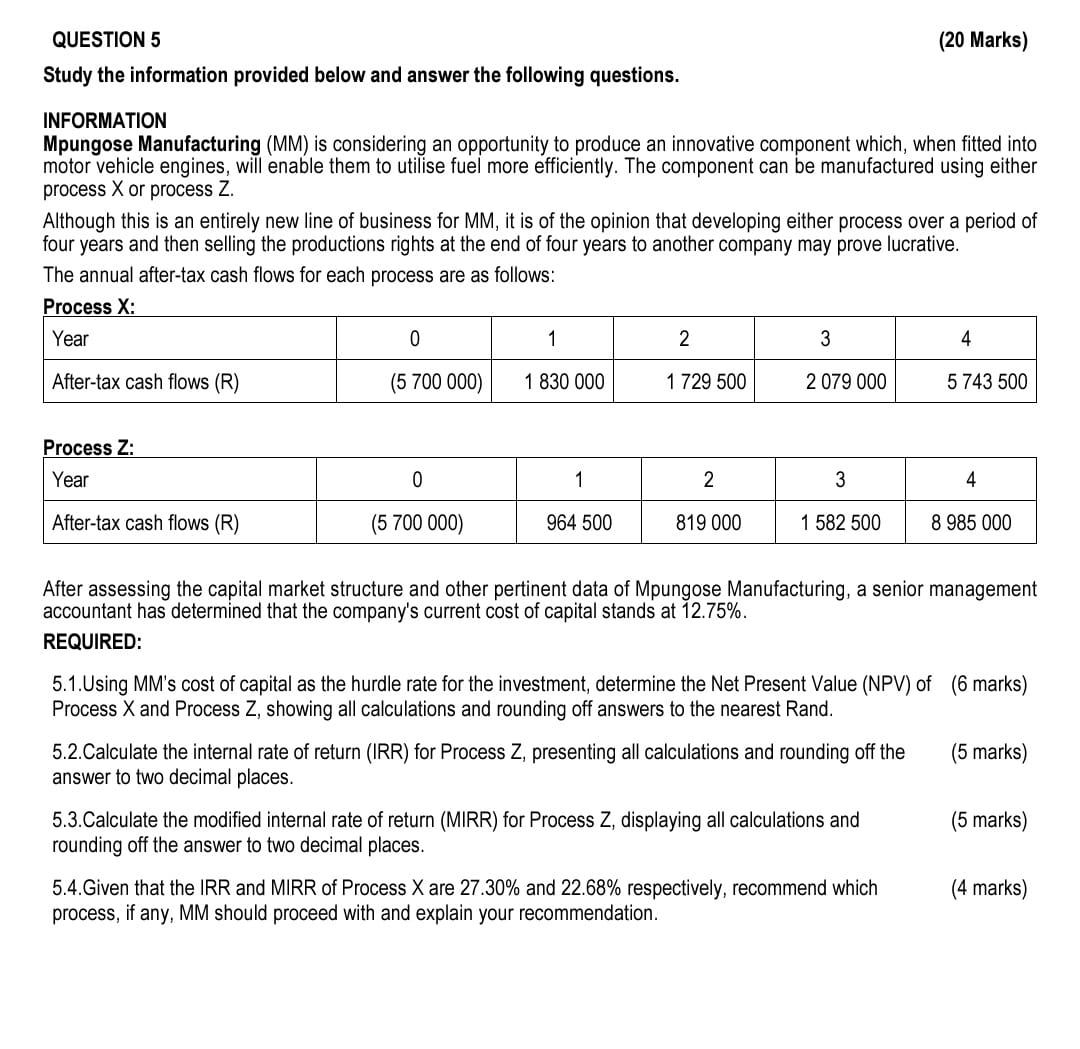

QUESTION 5 ( 2 0 Marks ) Study the information provided below and answer the following questions. INFORMATION Mpungose Manufacturing ( MM ) is considering

QUESTION

Marks

Study the information provided below and answer the following questions.

INFORMATION

Mpungose Manufacturing MM is considering an opportunity to produce an innovative component which, when fitted into

motor vehicle engines, will enable them to utilise fuel more efficiently. The component can be manufactured using either

process or process

Although this is an entirely new line of business for MM it is of the opinion that developing either process over a period of

four years and then selling the productions rights at the end of four years to another company may prove lucrative.

The annual aftertax cash flows for each process are as follows:

Process X:

Process Z:

After assessing the capital market structure and other pertinent data of Mpungose Manufacturing, a senior management

accountant has determined that the company's current cost of capital stands at

REQUIRED:

Using MMs cost of capital as the hurdle rate for the investment, determine the Net Present Value NPV of

marks

Process and Process Z showing all calculations and rounding off answers to the nearest Rand.

Calculate the internal rate of return IRR for Process Z presenting all calculations and rounding off the

marks

answer to two decimal places.

Calculate the modified internal rate of return MIRR for Process Z displaying all calculations and

marks

rounding off the answer to two decimal places.

Given that the IRR and MIRR of Process are and respectively, recommend which

marks

process, if any, MM should proceed with and explain your recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started