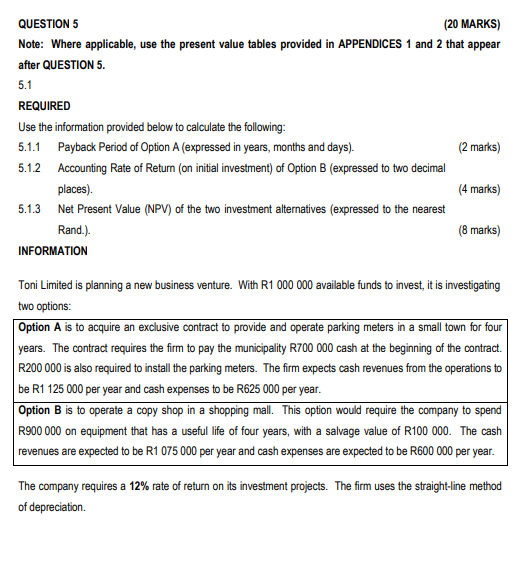

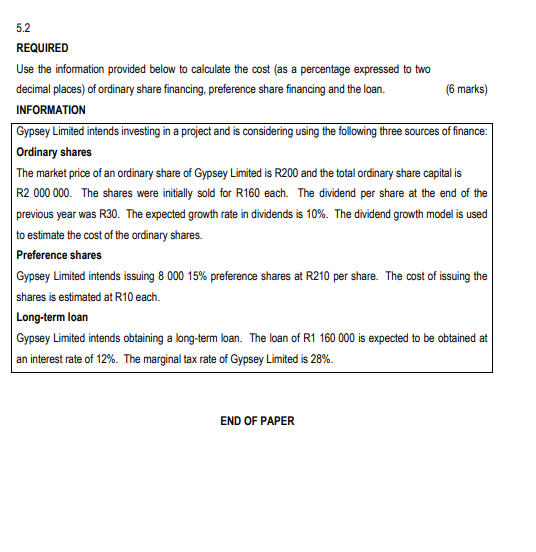

QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. 5.1 REQUIRED Use the information provided below to calculate the following: 5.1.1 Payback Period of Option A (expressed in years, months and days). (2 marks) 5.1.2 Accounting Rate of Return (on initial investment) of Option B (expressed to two decimal places). (4 marks) 5.1.3 Net Present Value (NPV) of the two investment alternatives (expressed to the nearest Rand.). ( 8 marks) INFORMATION Toni Limited is planning a new business venture. With R1000000 available funds to invest, it is investigating two options: Option A is to acquire an exclusive contract to provide and operate parking meters in a small town for four years. The contract requires the firm to pay the municipality R700 000 cash at the beginning of the contract. R200 000 is also required to install the parking meters. The firm expects cash revenues from the operations to be R1 125000 per year and cash expenses to be R625 000 per year. Option B is to operate a copy shop in a shopping mall. This option would require the company to spend R900 000 on equipment that has a useful life of four years, with a salvage value of R100 000 . The cash revenues are expected to be R1 075000 per year and cash expenses are expected to be R600 000 per year. The company requires a 12% rate of return on its investment projects. The firm uses the straight-line method of depreciation. 5.2 REQUIRED Use the information provided below to calculate the cost (as a percentage expressed to two decimal places) of ordinary share financing, preference share financing and the loan. (6 marks) INFORMATION Gypsey Limited intends investing in a project and is considering using the following three sources of finance: Ordinary shares The market price of an ordinary share of Gypsey Limited is R200 and the total ordinary share capital is R2 000000 . The shares were initially sold for R160 each. The dividend per share at the end of the previous year was R30. The expected growth rate in dividends is 10%. The dividend growth model is used to estimate the cost of the ordinary shares. Preference shares Gypsey Limited intends issuing 800015% preference shares at R210 per share. The cost of issuing the shares is estimated at R10 each. Long-term loan Gypsey Limited intends obtaining a long-term loan. The loan of R1 160000 is expected to be obtained at an interest rate of 12%. The marginal tax rate of Gypsey Limited is 28%