Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use

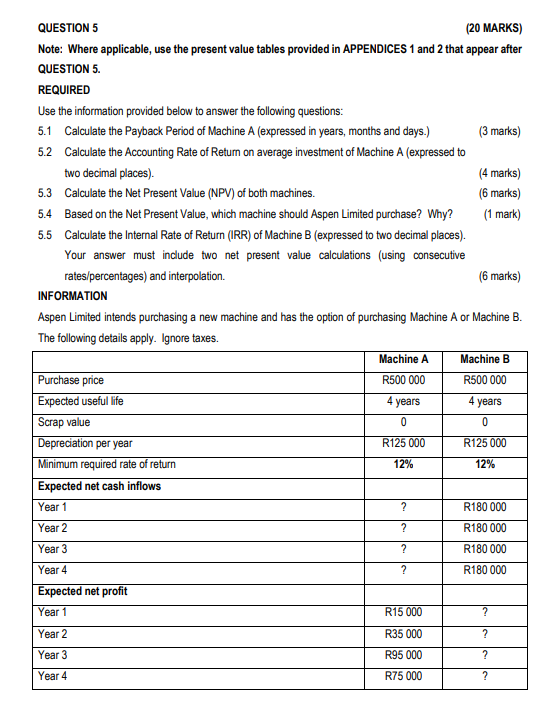

QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use the information provided below to answer the following questions: 5.1 Calculate the Payback Period of Machine A (expressed in years, months and days.) ( 3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Machine A (expressed to two decimal places). (4 marks) 5.3 Calculate the Net Present Value (NPV) of both machines. ( 6 marks) 5.4 Based on the Net Present Value, which machine should Aspen Limited purchase? Why? (1 mark) 5.5 Calculate the Internal Rate of Return (IRR) of Machine B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. ( 6 marks) INFORMATION Aspen Limited intends purchasing a new machine and has the option of purchasing Machine A or Machine B. The following details apply. Ignore taxes

QUESTION 5 (20 MARKS) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Use the information provided below to answer the following questions: 5.1 Calculate the Payback Period of Machine A (expressed in years, months and days.) ( 3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Machine A (expressed to two decimal places). (4 marks) 5.3 Calculate the Net Present Value (NPV) of both machines. ( 6 marks) 5.4 Based on the Net Present Value, which machine should Aspen Limited purchase? Why? (1 mark) 5.5 Calculate the Internal Rate of Return (IRR) of Machine B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. ( 6 marks) INFORMATION Aspen Limited intends purchasing a new machine and has the option of purchasing Machine A or Machine B. The following details apply. Ignore taxes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started