Answered step by step

Verified Expert Solution

Question

1 Approved Answer

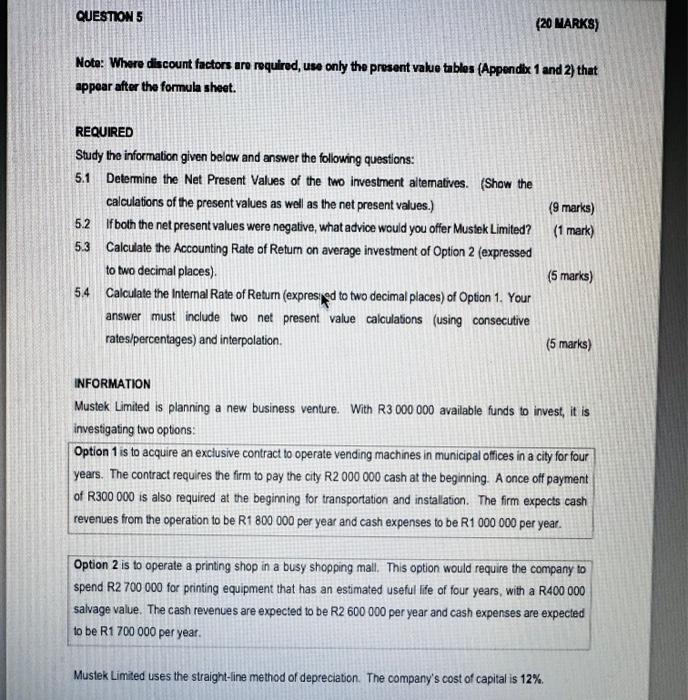

QUESTION 5 (20 MARKS) Note: Where discount factors are required, use only the present value tables (Appendix 1 and 2) that appear after the

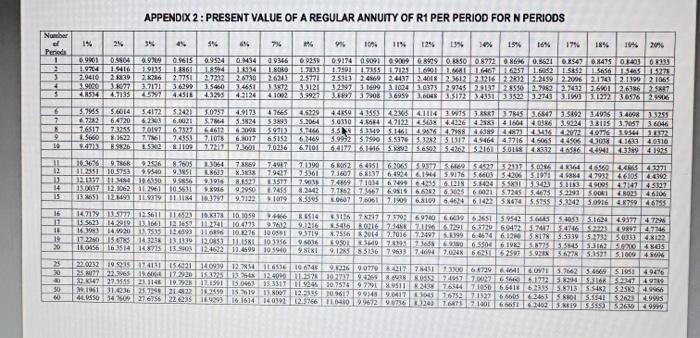

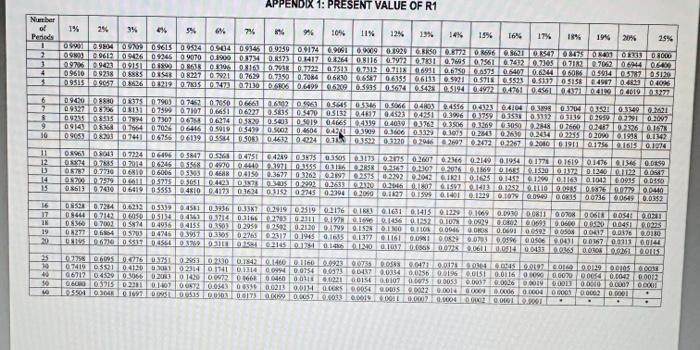

QUESTION 5 (20 MARKS) Note: Where discount factors are required, use only the present value tables (Appendix 1 and 2) that appear after the formula sheet. REQUIRED Study the information given below and answer the following questions: 5.1 Determine the Net Present Values of the two investment alternatives. (Show the calculations of the present values as well as the net present values.) (9 marks) 5.2 If both the net present values were negative, what advice would you offer Mustek Limited? 5.3 Calculate the Accounting Rate of Return on average investment of Option 2 (expressed (1 mark) to two decimal places). (5 marks) 5.4 Calculate the Internal Rate of Return (expresied to two decimal places) of Option 1. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION (5 marks) Mustek Limited is planning a new business venture. With R3 000 000 available funds to invest, it is investigating two options: Option 1 is to acquire an exclusive contract to operate vending machines in municipal offices in a city for four years. The contract requires the firm to pay the city R2 000 000 cash at the beginning. A once off payment of R300 000 is also required at the beginning for transportation and installation. The firm expects cash revenues from the operation to be R1 800 000 per year and cash expenses to be R1 000 000 per year. Option 2 is to operate a printing shop in a busy shopping mall. This option would require the company to spend R2 700 000 for printing equipment that has an estimated useful life of four years, with a R400 000 salvage value. The cash revenues are expected to be R2 600 000 per year and cash expenses are expected to be R1 700 000 per year. Mustek Limited uses the straight-line method of depreciation. The company's cost of capital is 12%. APPENDIX 2: PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS 43295 Number 1% 2% 3% 4% 5% Periods 3 S 48534 4.7135 45797 6.9901 0.5804 0.9700 0.9615 1.9704 1.5416 1.9135 13861 2.9410 28839 2.8286 2.7751 2.7232 1.9000 38077 3.7171 3.6299 3.5460 4.451 0.9524 6% 7%6 0.9434 0.9346 6.9259 1.3334 1.800 1.7833 26730 26243 2.5771 3.4651 33872 3.3121 4.2124 4.1002 3.9927 1% 6 5.7955 54014 5.4172 5.2421 7 6.7282 6.4720 62303 6.0021 5.0757 57864 7.6517 7.3255 20197 6.7327 4612 9 5660 8.1622 7.7861 7.4353 7.1078 94713 8.9826 8.5302 1109 7.7217 4.9173 47665 4.6229 5.3824 $3893 5.2064 62008 59713 5.7466 6.3017 65152 6.2469 73601 7.0236 67101 16.36% 9.7868 92536 8.7605 3.3064 12 11.2551 10.5753 9.9540 9.3851 8.8633 15 12.1337 11 M4 196550 9.5856 14 13.0037 12.1062 11 2961 10.5631 1916 5806 9.2950 15 13.8651 1249 119379 E 1184 183791 9.7122 73869 74987 8.3838 79427 8.8527 3577 7455 1079 7.1390 75361 7.9038 8.2442 8.5505 16 18 14.7179 11.5777 12.5611 11.4523 10.8378 15.5623 14.2919 13.1661 12.1657 11.2741 16.3983 14 9920 117535 12 4593 19 17.2260 15.4785 14 3238 13.1339 20 16.0456 16.3514 148725 139903 10.3059 4466 10.4773 97632 116896 10.8276 100591 12.0853 11.1581 10.3356 124622 11.4699 10 5940 84514 9.1216 93719 0.6036 9.8181 25 30 30 60 22.0232 19.5215174131 154121 25 77 22.3965 11.6004 17.2920 32.K347 27.3555 211146 19.7928 1961 31436 25.7298 21 422 44.9550 34 2609 27 6756 14.0979 12 7854 15 3725 13.264 17.1591 15 0463 12559 15.619 22 6235 189293 10 6746 10% 20% 9%6 10% 11% 12% 13% 14%6 19% 16% 1796 18% 0.9174 09091 0900908929 08850 08772 8696 0.5621 0.8547 68475 08403 08339 1.7591 1.7355 1.71251.6901 1.6681 1.6467 16257 1.6052 1544352 155 15405 1.5278 2.5313 2.4869 2.4437 2.4018 2.3612 2.3216 2.2832 2.2459 2.2096 2.1743 2.1399 21065 32197 3 1699 3.1024 30373 2.9745 2.9137 2.8550 2.7982 2.7412 26901 2.6386 2.5887 3.8897 37908 6959 3.6048 3.5172 3.4331 33522 3.2743 3.1993 11222 3.0576 2.9906 44859 435535 4265 41114 39975 3.8587 37845 3.6847 35492 3.4976 3.4098 3.3255 5.0330 4.5684 471225638 4.4226 4.2583 4 1604 4.0386 3.9224 33115 3.7057 36046 5.59 $31495.1461 49676 4.7988 46389 44873 43416 4.2072 4.976 3.9544 38372 5.9952 57590 5.5376 5.3282 5 1317 4.5464 4.7716 4.6065 4.4506 43018 4.1633 4.0310 64177 61446 58892 5.6502 54262 52161 50148 48332 4.6586 44941 43349 4.1925 68062 64951 6.2065 5.9377 56869 54527 52337 5.0286 4.8364 46560 4465 4.3271 7.1607 68137 64924 1944 5.9176 56605 54206 5.1971 4.9884 4.7932 46105 4.4392 7.4869 71034 7499 42556.1218 5.1424 5.5831 3.3423 5.1183 49095 4.7147 4.5327 7.7862 7.3467 69819 6.6282 6.3025 6 0021 5.7245 5.4675 5.2293 5008148025 4.6106 80607 76061 71909 6.8109 64624 6.1422 58474 5.5755 5.3242 5.0916 4.8759 4.6755 3126 7 K717 7.3792 69740 66039 63651 59542 56645 5.4053 5.1624 49377 4.726 5416 80216 7.5488 7.11% 7291 63729 69472 5.7447 34746 $2223 49897 47346 8.7556 2014 2.7016 7.2497 4999 6.4674 6.1260 58178 5.5339 5.2732 5.0333 4.8122 69501 3640 78393 73658 9380 6.5504 61982 8775 5.5645 53162 5070048435 9.1285 8.5136 7.9633 7.4694 7.0048 66231 62591 5.928 5.6278 53527 51009 45006 116536 98226 90770 4217 78451 73300 6472964041 60971 5.7662 54669 5.1951 49476 12.400 11.257 10.2737 9.426980552 74957 7.0027 65660 6.1772 58294 5.3168 52347 49749 33.3317 11.9246 30.7574 9.791 8.95112438 7.6544 7.1050 6.6418 62315 5.8713 55482 5.2582 49966 13.8007 12.2335 109617 99145 9.0417 3045 16752 7.1527 66605 6.2465 58801 5.5541 16.1614 140392 12.5766 11.048099672 98736 3243 76875 71401 66651 2402 5.8819 5.5553 52630 9999 $2623 4.9995 Number APPENDIX 1: PRESENT VALUE OF R1 of 1% 36 2% 3% 24% 5% 0% 7% 8% 2 Periods 1 2 3 4 $ 6 2 9 10 11 08961 0043 07224 06406 05847 12 13 08874 0.788507014 06246 5568 08787 07710 06810 06006 14 15 05368 0 49270 0.4440 05303 04688 0.4150 08709 0.757906611 05775 05051 0.4423 03878 08613 07430 06419 05553 04810 04173 0.3624 04751 25% 09804 0909 09615 09524 09034 0.9346 0.9259 09174 69061 09009 0.3929 6.8K50 0.8772 0.8656 8621 08547 8475 08407 0 0 8000 098039612 09426 09246 09070 0.000 0.3734 0.8573 0.3417 08264 0.8116 0.7972 0.7831 0.7605 0.7561 07432 0.7305 0.7182 07062 06944 06400 09706 09423 09151 04890 0.8638 08106 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6951 0.6750 0.6575 06407 0.6244 9.6086 09610 09238 08885 08548 08227 0.7921 0.5914 0.5787 05120 0.7629 0.7350 0.7084 06830 06587 0.6355 06111 05921 0.5718 0.5523 0.5337 0.5158 4987 0.4823 0.4096 0.9515 09057 08626 08219 0.7815 0.7473 07130 0.6806 06499 0629 0.3935 0.5674 0.5428 0.5194 0.4972 0.4761 0.4561 0.437104199 G4019 03277 09420 08880 08375 0.7903 07462 0.7050 0666106102 0.5963 0.5645 0.5346 0.5066 0.4803 4556 04123 04104 0.3898 09327 08706 08131 07599 07307 0.6651 06227 0.5835 05470 05132 03704 03521 0.3149 0.2621 04817 04523 04251 0.396 0.3759 0.3538 0.3112 03139 02959 0.2791 0.2007 09215 08535 07894 07307 06758 06274 0.5829 0.5403 0.5019 04665 04339 04039 03762 93506 0.3269 03050 0.2848 02660 0.2487 0.2326 0.1678 09143 08368 07664 0.7026 06446 0.5919 05499 0.5602 0.4604 0424 0.3909 03606 03329 0.3075 0.2843 0.2630 0.2434 0.2255 02090 0.1938 0.1342 09053 08203 07441 06756 06139 0.5584 0508) 0.4612 04224 0.38 0.3522 0.3220 02946 2607 0.2472 02267 02080 01911 01756 91615 0.1974 04249 0.3975 03505 03173 0.2875 0.2607 0.2366 0.2149 0.1954 01778 01619 01476 9.3971 0.3555 03186 0.2858 92147 0.230702076 1569 0.1685 1520 0.1372 0.1240 0112200647 01346 0.0859 0.3677 0.3262 02897 2575 0.2292 02042 1121 0.1625 01452 1299 0.1163 01042 60915 0.0550 0.3405 0.2992 0.2633 92120 0.2946 0.1807 0.1597 0.1413 0.1252 0.1110 0.0985 0.5876 90779 0.0440 0.3152 02745 0.2304 02060 0.1827 01599 0.1401 01229 0.1079 00949 0.0835 00736 00649 0.0352 996 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 16 17 18 19 20 08528 0.7284 0.6212 0.5339 04581 0.3936 0.3387 08444 0.7142 0.6050 05134 0463 0.3714 03166 083607002 05874 0.4956 04155 0.350) 0.2959 08277 064 05703 04746 0.3957 03305 02760 08195 06710 0.5517 0.4564 0.3769 0311 025 0.2919 02519 02176 01883 0.1631 0.1415 01229 01069 0.0930 00811 0070800618 00541 02703 02111 01978 0.1696 9.1456 0.1252 0.1070929 0.0802 0695 0.0600 0.0520 0.0451 0.0225 2592 0.2120 91799 0.1528 010 0110 2317 0.1945 0.0046 0.0808 0.0691 0.0592 0050 01615 0.1377 1161 0.0981 0.0629 0.0703 0.0596 00506 0431 02145 0.1744 0.1486 0.1240 01057 0.0065 0.0728 0611 0.0514 0.0433 0.0365 9.0281 0.0417 0.0376 0.0180 0.0367 0.031300144 0.008 0.0261 00115 25 30 40 10 60 0779 06095 0.4776 0.3751 0.2953 02330 0.1842 0.1460 1160 0.0923 0.07 0.0549 0.04719.01789.030460045 0.0197 0049 07419 05521 04120 0301 02314 01741 0.3314 00994 0.0754 0.0573 60437 0.0334 0.0256 0.0196 0.0151 0.0116 0000000070 06717 04529 0.3066 0203 01420 00972 04668 00460 00118 0221 00154 00107 0.0075 0.0053 0.600 03715 0.2281 01407 00872 0.0543 00559 0.0213 0.0114 0.0085 00054 0.0005 0.0022 0.0014 0.0009 0.0007 0.0026 00019 00013 0.0000 0.0007 0.000 05504 03048 01697 0095 00535 0.003 0.0175 0.099 0.0057 0.0033 0.0019 001 0.0007 0.0004 0.0006 0.0004 0.0005 0.0002 0.0001 0.0002 0.000199001 0.0129 0.0105 0008 00054 0.0042 0.0012 . .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started