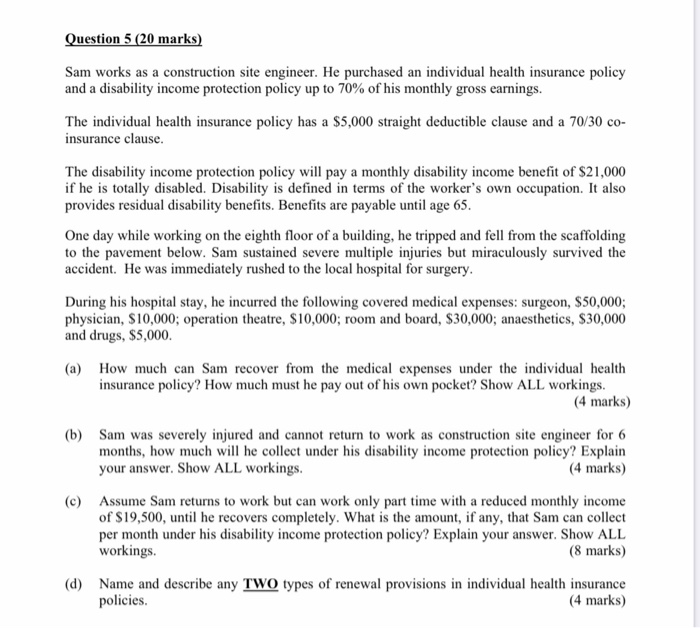

Question 5 (20 marks) Sam works as a construction site engineer. He purchased an individual health insurance policy and a disability income protection policy up to 70% of his monthly gross earnings. The individual health insurance policy has a $5,000 straight deductible clause and a 70/30 co- insurance clause. The disability income protection policy will pay a monthly disability income benefit of $21,000 if he is totally disabled. Disability is defined in terms of the worker's own occupation. It also provides residual disability benefits. Benefits are payable until age 65. One day while working on the eighth floor of a building, he tripped and fell from the scaffolding to the pavement below. Sam sustained severe multiple injuries but miraculously survived the accident. He was immediately rushed to the local hospital for surgery. During his hospital stay, he incurred the following covered medical expenses: surgeon, $50,000; physician, $10,000; operation theatre, $10,000; room and board, $30,000; anaesthetics, $30,000 and drugs, $5,000. (a) How much can Sam recover from the medical expenses under the individual health insurance policy? How much must he pay out of his own pocket? Show ALL workings. (4 marks) (b) Sam was severely injured and cannot return to work as construction site engineer for 6 months, how much will he collect under his disability income protection policy? Explain your answer. Show ALL workings. (4 marks) (c) Assume Sam returns to work but can work only part time with a reduced monthly income of $19,500, until he recovers completely. What is the amount, if any, that Sam can collect per month under his disability income protection policy? Explain your answer. Show ALL workings (8 marks) (d) Name and describe any TWO types of renewal provisions in individual health insurance policies. (4 marks) Question 5 (20 marks) Sam works as a construction site engineer. He purchased an individual health insurance policy and a disability income protection policy up to 70% of his monthly gross earnings. The individual health insurance policy has a $5,000 straight deductible clause and a 70/30 co- insurance clause. The disability income protection policy will pay a monthly disability income benefit of $21,000 if he is totally disabled. Disability is defined in terms of the worker's own occupation. It also provides residual disability benefits. Benefits are payable until age 65. One day while working on the eighth floor of a building, he tripped and fell from the scaffolding to the pavement below. Sam sustained severe multiple injuries but miraculously survived the accident. He was immediately rushed to the local hospital for surgery. During his hospital stay, he incurred the following covered medical expenses: surgeon, $50,000; physician, $10,000; operation theatre, $10,000; room and board, $30,000; anaesthetics, $30,000 and drugs, $5,000. (a) How much can Sam recover from the medical expenses under the individual health insurance policy? How much must he pay out of his own pocket? Show ALL workings. (4 marks) (b) Sam was severely injured and cannot return to work as construction site engineer for 6 months, how much will he collect under his disability income protection policy? Explain your answer. Show ALL workings. (4 marks) (c) Assume Sam returns to work but can work only part time with a reduced monthly income of $19,500, until he recovers completely. What is the amount, if any, that Sam can collect per month under his disability income protection policy? Explain your answer. Show ALL workings (8 marks) (d) Name and describe any TWO types of renewal provisions in individual health insurance policies. (4 marks)